Oct

2015

Boost Your Returns, Limit Your Risk

DIY Investor

26 October 2015

It’s hard to deny the attraction of boosting your returns, but couple it with the threat of unlimited losses, and many investors will quickly turn the other way.

Ben Thompson

Societe Generale

However, trading on leverage does not have to be at the expense of unlimited losses, as it may be with CFDs or Spread Bets. It doesn’t even have to be used in pursuit of bumper returns. It can in fact be used defensively to reduce capital at risk, or to provide a degree of protection to a portfolio.

In this article Ben Thompson – Business Development Director Societe Generale Listed Products and Lyxor ETF -looks at what leverage is, and how you can harness it using regulated investment products that are listed on the London Stock Exchange and trade like a share in a regular stock broking account. Perhaps most importantly, we will also demonstrate that with these ‘Leveraged ETPs’ you will never lose more than you invest.

What is Leveraged Trading?

Leveraged trading means getting exposure to an underlying asset without paying the full cost. Anyone who has bought a house with a mortgage has done it. Consider an example where you buy a house worth £300,000 with a deposit of £50,000 and a mortgage of £250,000. For £50,000 you have exposure to an asset worth £300,000.

Theoretically, if your house increases in value by 10% to £330,000 you could sell it, pay back the bank and pocket the remaining £80,000. That’s £30,000 more than you invested, and a 60% profit from a 10% rise in the house price.

In investment terms we call this 6 times gearing as your profit is 6 times greater than the move in the underlying asset. Importantly, there is another lesson to learn. Gearing works against you too. If the house falls in value to £270,000, your equity would be slashed to £20,000 as you still owe the bank £250,000.

| INITIAL PURCHASE | SCENARIO 1: HOUSE VALUE INCREASES BY £30K | SCENARIO 2: HOUSE VALUE DECREASES BY £30K | |

| House price | £300,000 | £330,000 (+10%) | £270,000 (-10%) |

| Mortgage | £250,000 | £250,000 | £250,000 |

| Invested capital | £50,000 | £80,000 (+60%) | £20,000 (-60%) |

Beware of Unlimited Risk

Our mortgage example can also be used to demonstrate a bigger danger. What if your house fell in value to £225,000? If you sold now you would not only lose all your invested capital, but you would have to find an extra £25,000 to pay back your £250,000 mortgage. In the world of spread betting and CFDs this is a very real scenario, and your losses can far exceed your initial investment.

You might argue that a stop loss will protect you from this situation, and in most cases you would be right. However, a violent market move, or an overnight crash in the market can mean that the market gaps down and the next recorded price is below your stop loss automatic closing level. If this happens your loss will be greater than you planned.

Never get a Margin Call Again with Leverage ETPs

The good news is that leveraged returns do not have to be at the expense of unlimited risk. Leveraged Exchange Traded Products (ETPs) enable you to boost your potential returns in rising or falling markets without ever risking more than you invest. There are three main types to choose from. The right one for you will depend on how long you want to invest, what you want to trade and how much risk you want to take.

| Daily Leverage | Infinite Turbos | Covered Warrants | |

| Objective | Multiply the daily performance of the Underlying Asset by 5 | Boost returns from the rise or fall of the markets |

Boost returns from the rise or fall of the markets. |

| Market conditions | Rising or falling | Rising or falling | Rising or falling |

| Leverage | 5 times | 3 – 15 times | Up to 50 times |

| Current range | FTSE 100 TR | Variety of Indices | All asset classes |

| Typical term | Short / One day | Up to 6 months | Up to 12 months. |

| Risk profile | Losses can exceed a direct investment in the underlying but not initial capital | Losses can exceed a direct investment in the underlying but not initial capital | Losses can exceed a direct investment in the underlying but not initial capital |

Trading on exchange

Leveraged ETPs are fully regulated investment products created by an investment bank such as Societe Generale, and listed on the London Stock Exchange.

They are easy to trade with live buy and sell prices published on exchange throughout market hours, delivering absolute transparency over your investment. Everyone sees the same price whether they are a professional trader, or private investor.

Furthermore, Leveraged ETPs are not only governed by the rules of the Financial Conduct Authority, but the rules of the LSE, which are designed to ensure that prices are continuously available and fair.

There is no need to open an additional account, Leveraged ETPs can be traded in an existing stock broking account, just like a share (subject to an appropriateness test, much the same as you would with a CFD or spread bet).

Looking at an example; Infinite Turbos

Infinite Turbos are the latest edition to Societe Generale’s range of Leveraged ETPs. They can be linked to a single stock, an index, a commodity or a currency pair. However, instead of paying the full cost of buying it outright, an Infinite Turbo allows you to benefit from its full price movement with only a fraction of the capital invested – much like our mortgage example earlier. This creates a powerful leverage effect that can be used to enhance returns, reduce your capital at risk, or hedge an existing share holding.

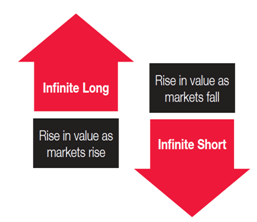

There are two types of Infinite Turbos. If your view is bullish, and you expect the market to rise, you could amplify your potential returns with an Infinite Long. If your outlook is bearish, and you expect markets to fall, you could look to the range of Infinite Shorts.

A key feature of all Infinite Turbos is the Knock Out Level which works as a built in stop loss mechanism, and ensures that you can never lose more than you invest.

An example trade: Infinite Long on the FTSE 100 Index

| EPIC | IT10 |

| Type | Infinite long |

| Underlying Asset | FTSE 100 Index |

| Underlying Asset price | 6,500.00 |

| Ask price | £0.8000 |

| Finance level | 5,700.00 |

| Knock out level | 5,800.00 |

| Parity | 1,000 |

| Gearing | 8.13 |

To demonstrate how Infinite Turbos work, suppose that the FTSE 100 Index is trading at 6,500.00, and you believe it is set to rise by at least 5%. Having looked at the range, you select IT10, an Infinite

Long on the FTSE 100 Index with a Finance Level of 5,700, a

Knock Out Level of 5,800.00 and gearing of 8.13 times.

What this all means is that the price of IT10 will rise or fall based on how far above 5,700 the FTSE 100 Index is trading. 8.13 times gearing means IT10 will move 8.13 times faster than the FTSE 100 Index before costs. Plus, the Knock Out level of 5,700.00 means that IT10 will expire if this level is ever touched.

The cost of IT10 is £0.8000 per unit, which is calculated by subtracting the Finance Level (5,700.00) from the FTSE 100 level (6,500.00). In this case we also have to apply a scaling factor of 1,000 to reduce the trading size. We call this Parity and without it IT10 would cost £800 per unit. But dividing everything by 1000 makes IT more palatable at £0.8000 per unit.

What happens next?

As the table below shows, there are three things that could happen next. If we’re right and the FTSE 100 Index rises 5% we would make a profit of £0.3250 per unit, a 40.63% return on the initial price of £0.8000.

If we’re wrong, and the FTSE 100 Index fell 5%, IT10 would fall 40.63% to £0.4750 per unit. The worst case scenario however is that the FTSE 100 Index hits the Knock Out Level of 5,800.00. If this was to occur IT10 would expire immediately and some or all of your capital would be lost. The amount repaid would depend on the level of the FTSE 100 Index over the next three trading hours.

| Performance of the FTSE 100 Index | |||

| Rises 5% | Falls 5% | Hits 5,800 | |

| New Index Level | 6,825.00 (+5%) | 6,175.00 (-5%) | Lowest level in the next 3 hours of trading |

| New price for IT10 | £1.1250

(6,825 – 5,700)/1,000 |

£0.4750

(6,175 – 5,700)/1,000 |

Dependent on recorded index level. |

| Profit per unit | £0.3250 (+40.63%) | -£0.3250 (-40.63%) | Up to 100% loss |

Taking a more conservative approach

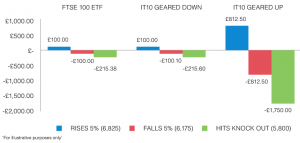

Leverage doesn’t have to be used aggressively; it can in fact be a tool for reducing risk. Assume you have £2,000 to invest, the FTSE 100 Index is trading at 6,500 and you think it will rise. If you wanted to simply track the FTSE 100 Index you may invest your money in an Exchange Traded Fund, which will rise or fall in line with the index.

If you wanted to ‘Gear up’ and boost your potential returns you could buy 2,500 units of our Infinite Turbo from earlier – IT10. At £0.8000 per unit it would cost a total of £2,000. With 8.13 times gearing, this would be the equivalent of investing £16,260 (£2,000 x 8.13 = £16,260) in the FTSE 100 Index ETF.

If however you are happy to replicate the same performance as the FTSE 100 Index (before costs), but want less capital at risk, you could ‘gear down’ your investment. This time you are trying to buy £2,000.00 worth of exposure with 8.13 times less capital (£2,000 / 8.13 = £246). We can’t buy £246 of IT10 precisely as £246 does not divide perfectly by £0.8000 (£246 / £0.8000 = 307.5). The closest we can get is to buy 308 units at £0.8000 for a total cost of £246.40. This gives us a FTSE 100 Exposure of £2,003.23 (£246.40 x 8.13), but we have £1,753.60 left.

Comparing our three investments

The chart above shows what would happen to our 3 investments under the same conditions that we tested IT10 earlier from a starting index level of 6,500. We can see that if the Index rose 5% to 6,825 our FTSE 100 Index and our Geared Down investment return approximately the same. Our Geared up position however rises more than 8 times further.

However, look at the situation where the FTSE 100 Index falls 5% to 6,175.00. Again, the Geared Down exposure all but matches the ETF. The Geared up position though multiplies the loss more than 8 times. The big difference happens if the FTSE 100 hits 5,800.00. Here our ETF is down £215.38 but you still own it, and it could recover, whereas both IT10 positions are knocked out, the Geared Up position losing £1,750 of our initial £2,000.

Choosing an Infinite Turbo

In this article we have kept it simple and only used one example product, IT10. In reality there would be a lot more choice. Firstly you can trade more than just the FTSE 100 Index, and you can go short in expectation of a fall, as well as the long examples we have seen. But, for each underlying asset there will be a number of different products with different Finance Levels, different Knock Out Levels and therefore different levels of gearing, typically between 3 and 15 times. This means that you can find a product to suit your view.

What costs and fees are involved?

Like our mortgage example at the start, an interest rate equivalent to approximately 1.5% to 2.6% per year is pro-rated and deducted from the price of an Infinite Turbo each day.

What risks should I be aware of?

The key thing to understand is that your losses can exceed a direct investment in the underlying asset, and as we have seen, the value of the product can go down as well as up. Importantly, the underlying assets can be volatile which can lead to large movements in price; either for you, or against you. The Knock Out Level will protect you from unlimited losses, but if it is touched the product will expire, and you could lose all of your investment. The last important point is that Infinite Turbos are issued by a Societe Generale company, as such any failure by Societe Generale to make payments due may result in the loss of all or part of your investment.

THIS COMMUNICATION IS FOR SOPHISTICATED RETAIL CLIENTS IN THE UK

This communication issued in the U.K. by the London Branch of Societe Generale. Societe Generale is a French credit institution (bank) authorised by the Autorite de Contrôle Prudentiel et de Resolution (the French Prudential Control Authority) and the Prudential Regulation Authority and subject to limited regulation by the Financial Conduct Authority and Prudential Regulation Authority. Details about the extent of our authorisation and regulation by the Prudential Regulation Authority, and regulation by the Financial Conduct Authority are available from us on request.

Alternative investments Commentary » Alternative investments Latest » Commentary » Exchange traded products Commentary » Exchange traded products Latest » Latest » Structured products Commentary » Structured products Latest » Uncategorized

Leave a Reply

You must be logged in to post a comment.