Apr

2024

FIRE in your eyes: How to achieve financial independence at any age

DIY Investor

13 April 2024

The FIRE movement – those wishing to achieve Financial Independence, Retired Early – is well established on the other side of the Pond; it comes in a range of guises from pretty brutal financial austerity to more benign, good old-fashioned common sense of the ‘mony a mickle maks a muckle’ variety by Hannah Barnaby

Now social media is fuelling FIRE’s spread through a generation of UK millennials facing the severe financial headwind of student debt and the stark reality that financial self-reliance will necessarily replace state support as our relationship with money more closely approximates that in the States.

Here we look at some lessons from the US, in the expectation that the 401k conversation will be coming to a dinner table near you and that you really are going to have to take more personal control of your finances.

‘UK millennials facing the severe financial headwind of student debt’

For many ‘retirement’ is achieving financial independence in the third stage of life – when you reach the prevailing qualifying age for state pension; which is only going one way.

The FIRE movement aims to achieve financial independence at a much younger age; multiple FIRE communities with tens of thousands of people online in the States are trying to achieve financial independence in 10-15 years vs a traditional career of 40 years; one of the most active is ChooseFI and there’s even a movie coming this year – ‘Playing with FIRE’.

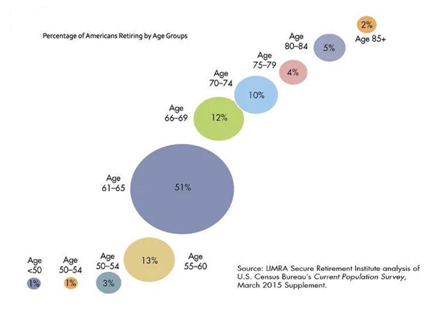

However, early retirement is still the exception with less than 1% of the US population retiring before aged 50.

What is Financial Independence?

‘the stark reality that financial self-reliance will necessarily replace state support’

JD Roth, one of the original personal finance bloggers, defines it thus: ‘Financial Independence occurs when you’ve saved enough to support your current spending habits for the rest of your life without the need to earn more money.

You might choose to work for other reasons – such as passion or purpose – but you no longer need a job to fund your lifestyle.’

His article on the six stages of financial independence – breaks down the problem and allows you to assess your own progress:

- Solvency: you can pay for yourself but use bad debt

- Stability: you don’t have bad debt like credit cards

- Agency: you’ve got enough savings to choose the work you prefer to do

- Security: your investment income covers basic needs

- Independence: your investment income maintains your standard of living

- Abundance: your income starts funding additional goals

FIRE away: How to achieve financial independence

The approach taken by the FIRE community in the US is significant because they may have a bigger challenge than traditional retirees due to student debt and easy credit, but can’t yet access social security and have to fund a longer time period.

So let’s look at the method used by FIRE and then we can explore some of the additional techniques that traditional retirement people can use.

The FIRE method is based upon a few core ideas – cut your expenses, save more than 50% of your income and invest efficiently; frugality is key.

The typical approach to achieving FIRE is:

- Track your expenses:Take the plunge – where is your money going? Charge everything, pay it off in full every month and then look at what your spending money on – try Mint.

- Cut your spending: Shift your mindset – celebrate how frugal you can be vs. comparing yourself to the Jones’; try a one month exercise to see how little you can spend.

- Calculate your financial independence number:The FIRE rule of thumb is 25 x your expenses, which is based on the 4% withdrawal rule. Want to be safer or potentially live larger – aim for 30/35 times your expenses, but this number can get very big, which is why keeping your expenses super-low is core to FIRE.

- Be tax efficient:Save and capture market returns as tax efficiently as you can both now and in the future.

- Invest aggressively and efficiently:FIRE people are younger and have more time to recover from downturns in markets if they need to – invest and capture market returns as efficiently as possible. Many FIRE people pursue a passive strategy where they invest in a very broad, well diversified portfolio with low fees; investing in real estate can provide long term reliable cash flows.

FIRE may be hard to achieve, but there are still lessons to be learned by those seeking a ‘traditional’ retirement and there are some basic steps to be adopted:

- Establish your goals & values:Write down what you want your future to look like; understanding your goals and values will help you make the important trade-off decisions during your journey to financial independence.

- Work out what you need and want to spend:Set a budget with minimum and desired levels based your spending habits.

- Document your resources:Include not just your retirement savings and investments, but also any pensions or annuities, state benefits, home and home equity, human capital (willingness to work part time) and any insurance benefits.

- Mind the gap:work out how to coordinate all of your assets; how you use one asset can often impact other parts of your plan eg the tax you may pay on any earnings vs your entitlement to state benefits.

- Action it:Once you have a working plan, implement your decisions; some can only be made once so it can be worth taking professional advice at this stage.

- Monitor & manage:retirement planning is not one and done; your life, taxes, markets and benefits will continue to change over time. Keeping expenses down can help people who are late in their savings years if they are off track or behind; the ability to cut expenses could make an unviable plan viable. Aim to monitor and review your plan at least annually – you could have thirty years in retirement.

We may not yet be as engaged with planning for retirement and beyond as our cousins Stateside, but the body of knowledge about how to plan and achieve a secure retirement is growing.

As more people enter retirement the market is getting more efficient with lower fees and more transparency across the board; why not start by trying out some of the tools and calculators that are available to help you on your journey.

Leave a Reply

You must be logged in to post a comment.