Oct

2020

Investing in health care post COVID-19

DIY Investor

16 October 2020

Key takeaways

- The COVID-19 pandemic is helping showcase innovation in biotech and may fine-tune our understanding of new drug platforms, leading to potential applications in other disease categories.

- The global need for a COVID-19 cure could improve sentiment toward the biopharma industry and lead policy makers to take a more moderate approach to future health care reform.

- Demand for telemedicine has climbed sharply, a trend that we think could persist after the pandemic. Likewise, China’s biotech industry could emerge stronger as the country competes to develop COVID-19 treatments.

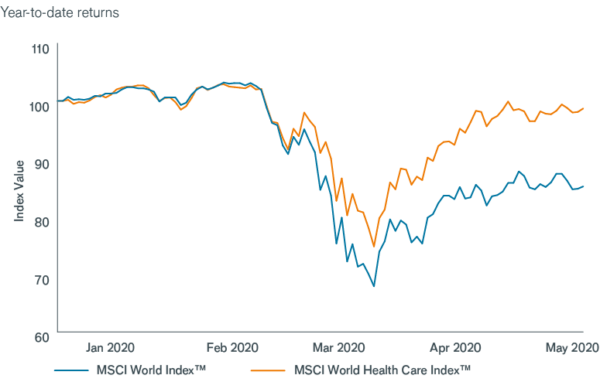

The health care sector has taken a leading role during the COVID-19 pandemic, with many investors rewarding firms working to develop treatments for the novel coronavirus or providing remote care. Thus, in March, while equities globally collapsed, the sector – though not spared from losses – outperformed most other areas of the market.

We believe this momentum could continue, especially as the outbreak helps accelerate growth trends in health care and, long term, potentially improves sentiment toward the sector.

Biotech innovation shines

With millions of people worldwide now diagnosed with COVID-19, the need for a treatment or vaccine has become paramount. In the past, drug discovery and development could take years, but amid the current outbreak some vaccine candidates have been able to enter clinical trials in a matter of months.

This accelerated timeline is made possible by advances over the past decade in genetic sequencing, structure-based drug design and molecular research tools.

What’s more, the intense focus on finding a COVID-19 cure is helping fine-tune some of the science.

Messenger ribonucleic acid (mRNA) technology, which directs the body to produce specific disease-fighting proteins, has been studied for several years, with potential applications in oncology, genetic disorders and infectious disease.

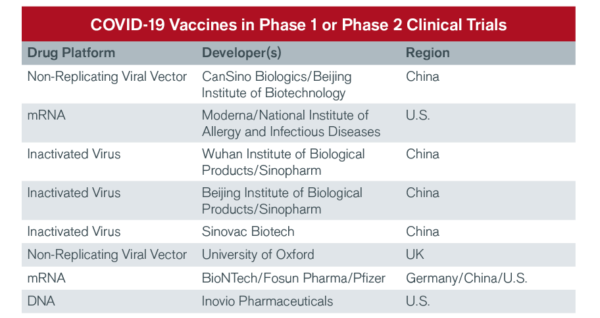

No mRNA therapy has been approved for commercial use yet, but now at least two mRNA vaccines are in clinical trials for COVID-19. Large studies still need to be conducted to prove the drugs’ safety and efficacy against the novel coronavirus, but longer term, the crisis could help fast track the scientific understanding and application of this technology.

HEALTH CARE STOCKS OUTPERFORM

Source: Bloomberg, as of 15 May 2020. Data rebased to 100 as of 31 December 2019.

Biopharma: sentiment may improve

The intense effort to address COVID-19 could also improve public perception of the biopharma industry, which in recent years has drawn scrutiny because of rising drug prices and out-of-pocket costs.

In April, a Harris Poll found that 40% of Americans reported having a more positive view of the industry than before the pandemic began.[1] That’s not to say criticism has evaporated.

When the U.S. Food and Drug Administration (FDA) granted Gilead Sciences orphan drug status for remdesivir, which has shown efficacy in treating severe cases of COVID-19, the news led to a public outcry (orphan status would give Gilead seven years of market exclusivity). Gilead quickly asked the FDA to withdraw the designation and subsequently donated 1.5 million vials of remdesivir worldwide.

We think drug makers are likely to price COVID-19 treatments to ensure access. (Gilead, for example, has signed licensing deals with five generic drug manufacturers for remdesivir and allowed each company to set its own pricing.)

And going forward, policy makers could have a greater appreciation for the research and development performed by the biotech industry and try to strike a balance between affordability and the need to safeguard innovation. The net result would be more manageable health care reform – and less uncertainty for the sector.

Collaboration is also rising. Several innovative small-cap biotech firms have partnered with large biopharmaceuticals as they seek to develop COVID-19 treatments.

The partnerships pair the cutting-edge technology of small caps with the manufacturing and distribution prowess of biopharma, all in the hope of bringing global relief faster. For example, German firm BioNTech is working with Chinese pharmaceutical Fosun Pharma and U.S. pharma company Pfizer to develop a mRNA-based vaccine.

The vaccine, using BioNTech’s mRNA platform, is now in early clinical trials. If data are positive, Fosun and Pfizer will use their resources to help expand trials and ramp up production in China, the U.S. and Europe. Such partnerships – should they persist after the crisis – could help commercialize new therapies more quickly in the future.

Remote medicine takes off

Social-distancing measures have significantly impacted access to health care. As a result, demand for elective procedures, surgeries and some forms of routine care has dropped precipitously, with the American Hospital Association estimating U.S. hospitals will lose $203 billion from March through June due to COVID-19 expenses and lost revenue.[2]

But on the other hand, use of telemedicine has skyrocketed, facilitated in part by reforms that make it easier for patients to access remote medicine.

In Germany, the Digital Care Act, passed at the end of 2019, strengthened the use of video consultations and allowed doctors to prescribe digital health apps, with costs covered by the country’s health insurance system.

Since the pandemic, telehealth use in Germany has soared, with companies such as TeleClinic reporting 60% week-over-week growth.[3] In the U.S., the leading telehealth provider, Teladoc, says daily visits jumped more than 100% in early April from the month prior.[4]

We believe consumers are likely to continue using telemedicine after the pandemic, given the technology’s convenience and expanded reimbursement by health care systems.

As for elective procedures, we believe demand has been delayed – not lost. The timeline for when procedures will resume could vary due to the pandemic’s trajectory, creating some volatility for stocks of hospitals and medical device providers.

But long term, we believe these industries’ fundamentals remain intact.

China’s biotech industry rises

Lastly, the pandemic has cast a spotlight on just how much the global biotech industry has grown in recent years, particularly in China. During the SARS outbreak in the early 2000s, China had few homegrown pharmaceutical or diagnostic capabilities to handle the situation on its own.

Following SARS, the Chinese government launched an overhaul of the health care system aimed at improving disease surveillance and reporting, access to high-quality supplies, and epidemic prevention and control.

Fast-forward to the COVID-19 breakout, and it’s a far different story. China is no longer a country that solely manufactures generic drugs and active pharmaceutical ingredients.

Rather, China now possesses local talent and technological capabilities to develop novel diagnostics and engage in innovative drug discovery, with many companies now in clinical trials with potential vaccines.

THE RACE FOR A COVID-19 VACCINE

China’s nascent biotech industry has been one of the leaders in bringing vaccine candidates to clinical trials.

Source: World Health Organization, data as of 11 May 2020.

Furthermore, we believe that post COVID-19, China’s biotech industry will emerge stronger behind an acceleration of support and resources for the industry.

Healthy China 2030, China’s national health care strategy published in 2016, set ambitious goals for improving health outcomes for the Chinese population, including better access to innovative drugs.

Over the past few years, we have seen interest in the China region rise dramatically from both multinational companies and innovative biotech companies.

In our view, industry participants around the globe have come to the realization that the Chinese market is at an inflection point when it comes to both commercial prospects and opportunities for partnership to access the region.

[1] https://www.fiercepharma.com/marketing/pharma-industry-reputation-jumps-during-covid-19-harris-poll-finds-positive-surge

[2] American Hospital Association, “Hospitals and Health Systems Face Unprecedented Financial Pressures Due to COVID-19,” May 2020.

[3] Gtai.de/gtai-en/invest/industries/life-sciences/digital-health-64408

[4] teladochealth.com/newsroom/press/release/teladoc-health-previews-first-quarter-2020-results/

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Click to visit:

Commentary » Equities » Equities Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Uncategorized

Leave a Reply

You must be logged in to post a comment.