Oct

2015

The Road to Becoming a D.I.Y. Investor is Paved with Good Intentions

admin

20 October 2015

Richard Webb, Managing Director

Saltydoginvestor

The financial world would have you believe that successfully running your own investments requires the expertise of Warren Buffett, the cunning of Nick Leeson and a skyscraper in the City of London full of analysts gorging upon reams of investment data. This is simply not true, as we amateurs at Saltydog have proven.

Those with the courage to go it alone will not only enjoy a better return, they will also acquire a fascinating and educational hobby; all you need is a computer, a supply of up-to-date fund performance information, access to a good fund supermarket platform and, of course, some training.

You should cautious but not fearful; managing your own money will provide the motivation to succeed and you will have the instant gain of not having to pay an IFA`s charges.

Remember, as the government endeavours to balance the economy and reduce the country`s debt it cannot give to anybody, anything that it first does not take from somebody else. As a saver and therefore a person of means, they will be coming to you, whether you like it or not.

My initial investment target was to produce an income greater than my wife and two daughters could spend; I have now adjusted this to include a further contribution towards the economy.

Your savings and investments are your ‘baby’ – put simply, will you or an outsider have the most interest in securing for you a well-financed retirement and an inheritance for your children? Believe me, today`s politicians and financiers are not going to come to your rescue, so now is the time for all good men and women to come to the aid of their own savings.

The thought process behind Saltydog Investor was not complicated; we simply wanted to produce a process and a supply of fund performance numbers that were straightforward and productive for ordinary people to use to enhance their savings. Some key considerations were:

- Investing in stock market equities will make you money in the long term.

- There is some risk involved, but as an active DIY investor this should be controllable.

- IFAs were not the solution since they could not actively manage all of their clients` portfolios and even if they were to try to, it would be prohibitively expensive and therefore pointless.

- Investments should be in Unit Trust funds and OEICs, not shares

- You get the advantage of scale and are buying a diversified portfolio of companies.

- Professional managers and their teams have the time and expertise to investigate and monitor the performance of the companies in which they invest.

- We would monitor the relative performance of the funds and remove the non performers from our considerations.

- Funds are broken down into Investment Association (IA) sectors, are highly regulated and it is cheap and easy to switch funds in response to changing market conditions.

- Selecting the IA sector in which to invest is the first decision followed by individual fund selection; when a sector is performing well it floats all funds in that sector. Some funds will float higher than others and these will be the ones we would seek to identify.

- Momentum trading is the approach to the selection of sectors in which to invest.

This was the basis upon which we started to formulate our method of operation and at this time we happened across the story of legendary American momentum investor Jesse Livermore, one of the most remarkable investors in history, making and consequently losing four fortunes through not adhering to his own maxims.

‘Events Dear Boy’

At the height of the American stock market collapse in 1929 Livermore was worth over $100million, equivalent to $4billion in today`s terms. In his book ‘Reminiscences of a Stock Operator’ Edwin Lefevre records Livermore`s thoughts, sayings, methods of working, and where and why he made his fortune-losing mistakes.

Livermore left us a set of axioms that remain relevant today; here are four out of his many sayings which influence the way in which we operate Saltydog.

- The game of financial speculation is the most uniformly fascinating game in the world. It is not for the stupid, the mentally lazy or the get-rich adventurer. They will all die poor.

- The only thing to do when a man is wrong is to be right by ceasing to be wrong.

- A stock operator has to fight a lot of expensive enemies within himself.

- Losing money is the least of my troubles. A loss never bothers me after I take it. I forget it overnight. But being wrong- not taking the loss- that is what does damage to the pocket book and the soul.

His message and our lesson is that it is important to recognise a loss-making situation and step away. He is also saying that it is not necessary to get rich quickly. After all, what is so bad about getting rich slowly?

Also, you do not have to be super clever to make a good investor, you must just not be greedy and be prepared to leave your mistakes behind and move on.

Early on we recognised the necessity to control the amount of risk that we would be willing to take and grouped sectors according to their volatility. We chose nautical terminology to indicate the amount of risk in the group.

-

Safe Haven

-

Slow Ahead

-

Steady as she Goes.

-

Full Steam ahead Developed markets.

-

Full Steam Ahead Emerging markets

We then created what we called our `cautious risk` pie-chart named the Tugboat and allocated percentages from each group into the pie-chart. This would act as a control when we felt like being adventurous. It was to remind us that however we might like it to be, Grimsby unlike Hong Kong does not translate into ‘Fragrant Harbour’!

Safe Haven

The funds with the lowest risk and the least volatility but also ones likely to deliver the lowest return. They include cash and cash equivalent funds and are worth considering if you may need to draw on your investment in the short term, or you believe the market conditions are currently unfavourable.

Slow Ahead

These funds involve a higher level of risk and greater volatility than the Safe Haven funds but should offer the potential for greater returns. These are predominately fixed interest funds represented by UK Gilts, UK Index linked Gilts, Corporate Bonds, Strategic Bonds, Global Bonds and High Yield Bonds.

Steady as she Goes

These funds should be considered if you are willing to accept even greater short term volatility in return for even higher returns. You would also believe that the markets were in a period of general growth.

Funds in this group are equity income funds or managed funds represented by UK Equity Income, UK Equity & Bond Income, UK Equity Income and Growth, Global Growth, Cautious and Balanced Managed Funds.

Full Steam Ahead Developed Markets

These funds are intrinsically more volatile and need regular reviewing; to be considered only if you believe that there is growth in the market.

They will however produce good returns if the markets are rising but similarly large losses if they are falling. Sectors in this group are UK All companies, UK Small companies, Europe (including the UK), Europe (excluding the UK), European Smaller companies, North America Small companies, Japan (including small companies) and Property.

Full Steam Ahead Emerging Markets and Specialist

Sectors in this group are; Asia Pacific (excluding Japan), Asia Pacific (including Japan), Global Emerging Markets, and Technology and Telecommunications. The Specialist sector carries funds that do not really fit into the other sectors; Latin America, Russia, India, Korea, Natural resources, Agriculture, Healthcare and Biotechnology.

By varying the amount invested in each group it is possible to control the overall volatility of your portfolio.

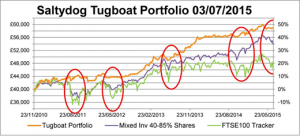

Saltydog has been operating for just over four years and during this time the markets have experienced five large corrections and as you can see from the charts we have managed to avoid these falls whilst still obtaining a very reasonable return of 9% per annum.

At the start of this article I said that the point of The Saltydog Investor was to assist people to become successful investors in their own right, to finish I’’ share an article from one of our subscribers to demonstrate his investing experience using Saltydog numbers and philosophy.

‘Events Dear Boy’ by Ken Turner

It seems to have been a great effort to keep up the momentum of my investment portfolio since mid-April. The reasons for this are ‘events dear boy,’ as I reminded myself with the well-known quote from Prime Minister Macmillan in the nineteen sixties.

The events I was concerned about at the time seemed to be coming thick and fast with no apparent end in sight. Translating all of this into strategy with my portfolio led to a course of action which for me has been unprecedented.

When the market adjustment came at the beginning of May, I carried out the biggest sell off into cash that I have ever done since starting with Saltydog in 2010. These actions also took me further away from the published sample portfolios than I had probably ever been.

I am still holding back from a full re-investment. My main reason for this is that I do not trust EU officials to deal with the creative negotiating tactics of the Greek government. It all seems to me like a bank manager trying to make headway with Del Boy from the TV show, Only Fools and Horses.

‘I am not without sin Mr Livermore’

These present tactics are so different from my early days of investing. Then, as a complete novice, I wrote here that I would have been rushing about looking for a quick gain from a fund on the basis of just a couple of weeks’ positive performance.

As a consequence of this new approach, I am presently back to within 1.7% of the best levels achieved this year, and in a way which allows me to feel more in control. Or rather, I should say, less out of control, I am also now, more aligned with the sample portfolios.

However, in another aspect of my recent activity, I am not without sin Mr Livermore.

I have had a brief skirmish with some shares purchased in a well-known Supermarket, which has fallen on hard times. I timed things wrongly, and managed to come out of it, without loss. Then there was the gold fund. Same story. With hindsight, it must have been a reaction to all of that cash sitting around in my accounts. Old habits are difficult to contend with.

I have therefore learnt two more lessons recently. The first is not to get distracted and let cash burn a hole in my portfolio pocket – if market conditions are uncertain, then cash is as valid an asset class as any other. The second is not to play the equity speculation game.

Most importantly, I have confirmed that being out of the market can be a valid tactic in certain circumstances. Unlike most professional fund managers I have the luxury of not having to have a minimum amount invested at all times.

Learning lessons seems to be a continuous process. Investment history never seems to repeat itself. That is one of the reasons why I still find this Saltydog investing process so interesting and absorbing, as well as the financial gains.

Commentary » Equities Commentary » Exchange traded products Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.