Oct

2017

The world is your lobster, my son! Going global in search on investment returns

DIY Investor

21 October 2017

As we draw stumps on the latest edition of DIY Investor Magazine we bring you the breaking news that nothing much appears to be broken.

As we draw stumps on the latest edition of DIY Investor Magazine we bring you the breaking news that nothing much appears to be broken.

To illustrate our point we had a word with some of our most influential friends to ensure that the FTSE 100 closed at a record high of 7,556 on Friday and remains above 7,500.

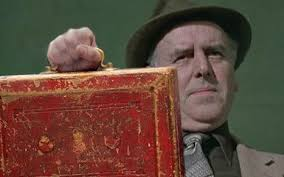

Inflation has nudged up in response to the weakness of the pound, but does not appear rampant and the MPC decision on interest rates could be finely balanced; ‘Spreadsheet’ Phil’s promise of a ‘big, powerful and revolutionary budget’ should be interesting.

So, what of Project Fear? Where are the bankers jostling each other in the queue for German lessons?

However well advised Theresa May would have been to have sucked a Fisherman’s Friend before taking the stage in Manchester, she remains in post and determined to ‘deliver on the will of the people’.

Whilst most of our contributors to this issue acknowledge that the precise nature of Brexit could have an impact, we are in uncharted territory, and one opinion appears as valid as the next.

Are we living through is a ‘new normal’ – a recent study for Investec Click & Invest identified the ‘Resetters’ – people taking control of their lives, turning hobbies into jobs and aiming for financial freedom; this dovetails with an article by Easy As 123 which says that ‘employment’ will never be the same again as the ‘gig economy’ encourages people towards financial self-reliance.

DAN Norman acknowledges that markets are high, but sees little immediate cause for panic, and we have some tips from Vanguard legend ‘Jack’ Bogle for millennials setting off on their journey toward FIRE – an oft-used acronym in the States describing the quest towards Financial Independence/Retire Early.

If this chap Cliff Edge does lead to a sharp fall in markets, is that the time for active fund managers to reassert themselves?

Passives such as ETFs and index trackers have grabbed more than their fair share of the headlines of late as investors have enjoyed the benefits of generally rising markets and ultra low costs; however, if things turn turtle, trackers follow the direction of travel – low fees may not be consolation enough.

Now, we all know that investing should be for the long term and that markets are cyclical, but no one wants to see masses of red figures in their portfolio; and what about if it really is different this time?

In this issue we have articles from a number of fund managers that illustrate just how much endeavour goes into active fund management and now that fees are generally coming down, maybe it is time to reconsider either unit trusts or investments trusts for your portfolio?

With domestic markets high, contrarian Scottish Investment Trust has been to Brazil in search of opportunities and JP Morgan has been seeking income and growth in Europe; Old Mutual describes the exciting opportunities that are to be found amongst European smaller, ‘disruptive’ companies and Janus Henderson asks if now is the time to consider alternative assets in the quest for returns.

Should markets down turn, that manufacturing plant in Guangzhau in your portfolio could be your salvation.

We have reached the half way point in the Great British Trade Off and Fagin is thumping Humbug; more than £22,000 up in just six months, he’s now offering Humbug advice. Oh dear.

We hope that you find DIY Investor Magazine informative and we are pleased to hear from you at any time – ask@diyinvestor.net

As self-reliance replaces state support it is inevitable that people will have to take more personal control of their finances; whether a debt-laden graduate starting out on life’s journey or a pensioner starved of income – Do it Yourself, Do it For Me, Do it With Me – just don’t do nothing!

Click to view

- The world is your lobster my son!

- The Big picture

- Income and growth from Europe with investment trusts

- DIY investing tips for millennials from ‘Jack’ Bogle

- European equities: Back to school

- European smaller companies: punching above their weight

- Moore about Money

- Avoiding ETF pitfalls

- Time for alternative assets?

- ‘Core and satellite’ investing for your ISA or SIPP

- The ‘gig economy’ and the need for financial self-determination

- Money in a Cash ISA is a missed opportunity – DIY invest

- Q&A with The British Investor

- Postcard from Brazil

- Markets are high: are we heading for a fall?

- ‘Resetters’: taking control and seeking financial independence

- October market: seasonality effects and anomalies

- Small, medium or large, Sir?

- The Great British Trade Off: Fagin is on fire!

Leave a Reply

You must be logged in to post a comment.