May

2022

What are Structured Deposits?

DIY Investor

25 May 2022

When you buy a structured deposit you agree to tie up your money for a set time – often five or six years – in return for a lump sum at maturity; it is like a cash account, in that it protects the money (capital) you deposit by Christian Leeming

Structured deposits always return at least the initial amount deposited at the end of the product life.

The interest rates you could earn are normally dependent on the level of a share index, such as the FTSE 100, on a particular date.

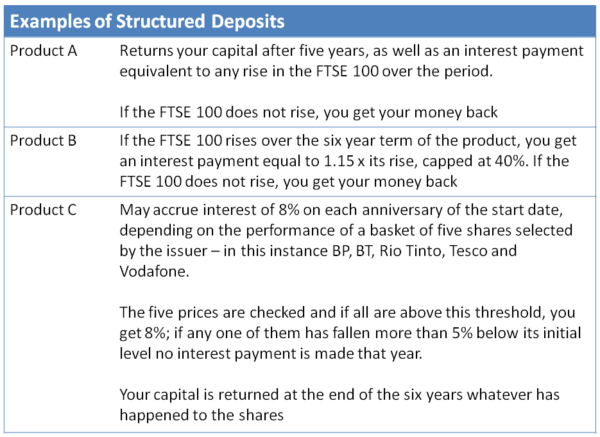

A typical structured deposit will pay you a set interest rate if the FTSE 100, other chosen index or basket of shares reaches or exceeds a particular level.

Here are a couple of examples of rules for a three year structured deposit with an investment of £1,000.

- If the FTSE 100 is higher at the end of the three years than it was at the beginning, you get your original investment back plus interest equal to 15%, giving you a total of £1,150.

- If the FTSE 100 is higher at the end of the three years than it was at the beginning, you get your original investment back plus interest equal to 100% of the growth in the index.

If the FTSE 100 does not reach that level, you earn no interest, but your capital is protected; structured deposits give you the possibility of getting a stock market return without risking your investment as you would if you invested directly in shares.

‘structured deposits give you the possibility of getting a stock market return without risking your investment’

However:

- you might get less interest than you would have done with an ordinary savings account – or no interest at all.

- if you invested in shares instead, you would potentially benefit from a rise in the stock market and you would usually receive income in the form of dividend payments.

Benefits of Structured Deposits

Structured deposits are described as offering ‘100% capital protection’ or a ‘capital guarantee’; your capital is protected and you will get the money you deposit back regardless of any fall in the index level or asset.

‘your capital is protected and you will get the money you deposit back regardless of any fall in the index’

Even in that eventuality structured deposits are covered by the Financial Services Compensation Scheme which means that you should be able to claim back up to £85,000.

Structured deposits may deliver a better return than an ordinary bank deposit account and can be sheltered in tax efficient wrappers such as NISAs, Junior ISAs and SIPPs.

Risks of Structured Deposits.

If the FTSE 100, index or basket of shares does not reach the level specified by the product you may receive no interest at all; you do not receive dividends that are paid out by shares in the index.

At the end of the term of the product, the real value of the deposit that is returned to you may have declined because of the corrosive effect of inflation.

When you make your initial deposit you are committing to tie your money up for the duration of the product; if you need to access your money before then it may be difficult to cash in the product or you may have to sell it at a loss.

Leave a Reply

You must be logged in to post a comment.