Aug

2022

Starting to reinvest and the funds we’ve bought

DIY Investor

3 August 2022

The strong market rally in July has persuaded Saltydog to invest in a handful of new funds.

It has been a tough year for investors, but there could be some light at the end of the tunnel.

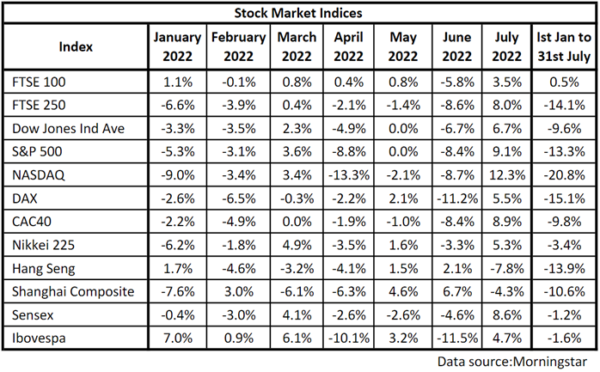

Although nearly all of the major stock market indices that we track are lower than they were at the beginning of the year, and some are a long way down, most went up in July.

In the UK, the FTSE 100 went up by 3.5% and the FTSE 250 made 8.0%. The star performer was the American Nasdaq Composite index, which rose by 12.3%, in dollar terms.

At the other end of the spectrum were the Shanghai Composite, which went down by 4.3%, and the Hong Kong Hang Seng, which lost 7.8%. It is a shame because a few weeks ago it looked like the Chinese funds might have been turning a corner, now it looks more like a false start. We were holding two funds from the China/Greater China sector but sold them last week.

On a more positive note, nearly all of the other sectors were showing four-week gains and some of them were quite significant. This could just be another “dead cat bounce”, or it could be the beginning of a more sustained recovery. Unfortunately, only time will tell, however we do not have to nail our flag to one particular mast. It is not a case of all or nothing, we can hedge our bets.

Our demonstration portfolios are still predominantly in cash, but last week we decided to start investing in the leading funds from the best performing sectors in our Saltydog groups. If they do well, we can add to them, if they struggle, then we can sell them, but we will have limited our losses by only making a relatively small initial investment.

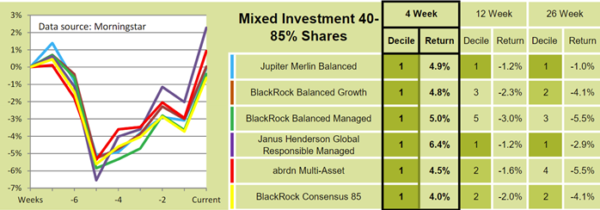

When we looked at the numbers last week, the best-performing sector in our ‘Slow Ahead’ group, based on its four-week return, was the Mixed Investment 40-85% shares sector. We invested in two funds that had been in decile one over four, twelve and twenty-six weeks. One was our old favourite, Janus Henderson Global Responsible Managed, and the other was the Jupiter Merlin Balanced fund.

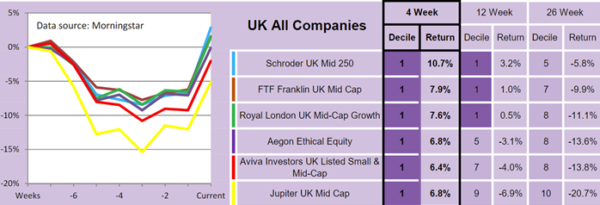

We have also bought a couple of funds from the leading sector in our ‘Steady as She Goes’ Group, which is currently UK All Companies.

Our Tugboat portfolio has gone for the Schroder UK Mid 250 fund, while the Ocean Liner has selected the FTF Franklin UK Mid Cap fund.

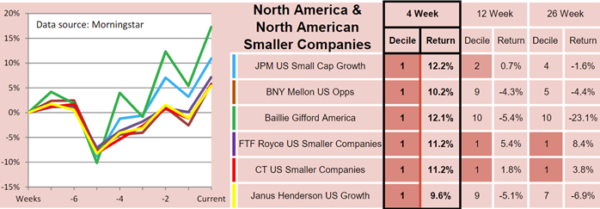

Finally, we have selected a fund from the best performing sector from the ‘Full Steam Ahead’ groups – North America and North American Smaller Companies.

We have opted for the FTF Royce US Smaller Companies fund. Even though other funds have done better in the last four weeks, it has a good record over four, twelve and twenty-six weeks.

As I said earlier, we have no way of knowing for certain that this current rally will continue, but there has definitely been a change in momentum over the last few weeks and we want to be in a position to take advantage if the trend continues.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

Brokers Commentary » Brokers Latest » Commentary » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.