May

2023

Beating inflation with ETFs

DIY Investor

17 May 2023

High inflation chews up cash in the bank whereas investing can help you increase your spending power over time. So how should you fight inflation with ETFs? By Anja Wetzel.

Everyone knows that high inflation erodes spending power as surely as waves knock down a sand castle on the beach. So it makes sense to move spare cash into assets that can stay ahead of inflation and grow your wealth over the long-term. But which asset classes should you pick? Some inflation-busters do not live up to their reputation so allow us to explain your best options.

Beating inflation vs hedging against inflation

There are two ways to deal with inflation:

- Beat it over the long-term with an asset class that probably delivers returns well in excess of inflation over time.

- Hedge against inflation with asset classes that protect against it in the short-term.

Both options sound good, but the first is much more reliable than the second. Here’s why:

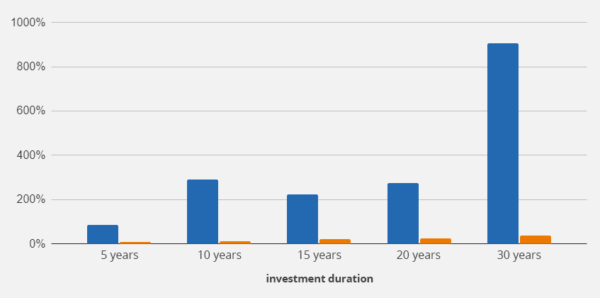

Diversified equity returns beat inflation over long-term time horizons. For example, here’s the track record of the MSCI World vs inflation in Germany:

Result: The longer you stay invested in equities – best via ETFs –, the more likely it is that your growth will soar above inflation. This is why diversified equities are the mainstay of all portfolios.

Because equities are risky, investors demand a real return that outstrips inflation and makes the pain of holding them through short-term dips worthwhile.

justETF tip: The real return is an asset’s nominal return minus inflation. In other words, it’s your return adjusted for inflation.

Remember that equities do not hedge against inflation. Therefore they can and do underperform during periods when inflation runs hot.

The key: The real return of diversified World equities is comfortably ahead of other asset classes over many decades and business cycles. And that includes periods when inflation span out of control such as after both World Wars and in the 1970s.

Ultimately, equity investors beat inflation because profits generated by firms adapt to and overcome price pressures.

While profits are temporarily hurt by rising production costs and wages, competitive firms restore their earnings by passing on those increases to consumers.

Moreover, inflation is a growth signal. It spurs business to resolve supply-bottlenecks and meet excess demand. That sets the stage for future growth.

justETF tip: As long as your portfolio is mostly built on diversified ETFs such as the MSCI World, then you’re positioned to reap the rewards from firms that crack these challenges.

Hedging against inflation

Inflation-hedging is a more complex and less reliable strategy than beating inflation over the long-term.

Hedging relies on pre-loading your portfolio with asset classes that respond quickly to high inflation with strong returns that offset some of the damage.

Reputed inflation hedges include:

The anti-inflation properties of these asset classes fall into three buckets:

- Unreliable hedge with questionable long-term growth prospects

- Reasonable hedge but compromised by historically adverse conditions

- A myth

Let’s go through the three points in detail:

Inflation-hedge bucket no1: the unreliables

Gold, broad commodities and energy equities fall into the unreliable bucket.

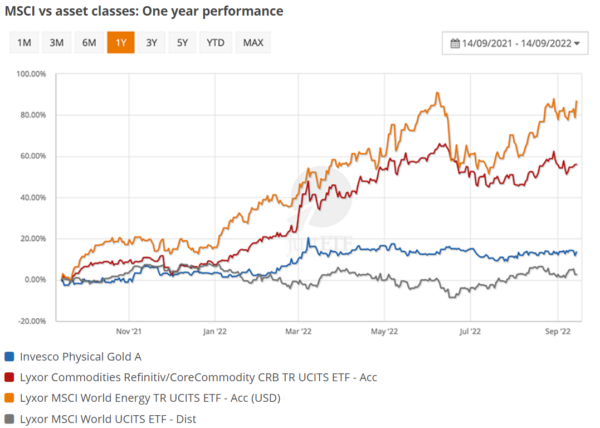

Here’s how ETFs representing each asset class have performed in the past year as inflation started lifting off. We’ve included an MSCI World ETF as a comparison.

Our three inflation-hedges don’t look unreliable in these conditions versus World equities. Indeed, they’ve all outmatched European Union inflation:

- Energy equities (orange line). 86.53% 1-year return.

- Broad commodities (red line). 63.76% 1-year return.

- Gold (blue line). 14.1% 1-year return

- MSCI World (grey line). 5.22% 1-year return.

This is the kind of surge you want to see from an inflation hedge – with the energy sector being the star performer.

But this success comes with an advisory warning.

The reason these three hedges are tagged as unreliable is because they do not counter unexpected inflation everytime.

- Gold in particular has been shown to have a weak historic correlation with unexpected inflation. Its reputation as an inflation hedge is largely driven by a single, stratospheric 200% return in 1980.

- Meanwhile, the energy sector has only worked fitfully against past inflation spikes. Notably it posted a loss during the infamous 1972-74 oil crisis.

- Broad commodities are similarly unreliable.

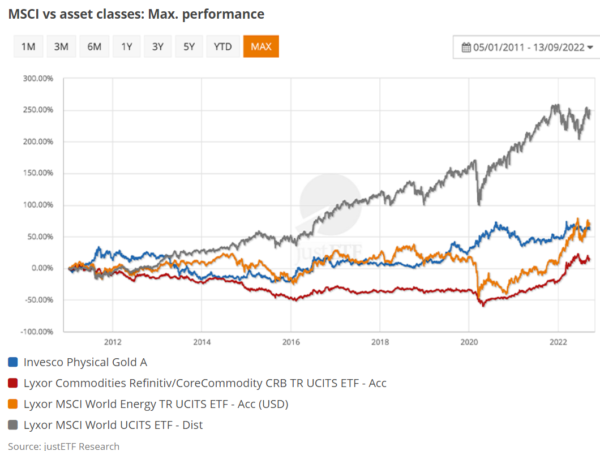

And these hedges can be costly over the longer term. Let’s zoom out and see how they performed against the MSCI World over more than a decade.

Here’s the cumulative return for each asset class over the longest time frame available using relevant ETFs (since 5 Jan 2011):

- Energy equities (orange line). 72.6% max return

- Broad commodities (red line). 17.65% max return

- Gold (blue line). 64.88% max return

- MSCI World (grey line). 250.23% max return

The MSCI World is the clear winner against more sluggish asset classes over time. This is exactly what we’d expect.

The comparison shows that you may give up a great deal of growth if each hedge occupies a large position in your portfolio. Indeed, broad commodities were loss-making over the period until 2022. This does not mean diversification is a bad thing. But there is a price to pay for inflation insurance.

Historically, the long-term real annualised returns of gold and commodities hover around 1%. While developed world equities posted over 5% real annualised returns since 1900.

A concentrated equity sector position can go either way. It could outperform diversified world equities or lag by some distance – as happened from 2011 through 2022.

justETF tip:It’s the unreliability and uncertain expected returns of inflation-hedges that makes a simple inflation-beating strategy of investing in an MSCI World ETF a good move.

Inflation-hedge bucket no2: the compromised

Inflation-linked bonds are the one asset class specifically designed to hedge against inflation. Their interest and principal payouts increase in line with prices to compensate investors against inflationary shocks. For this reason, inflation-linked bonds are widely considered to be a reliable hedge.

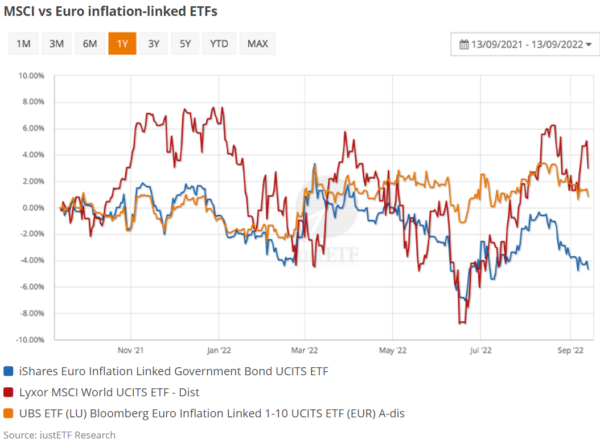

However, ETFs on Euro denominated inflation-linked bonds have not shone at this stage in the cycle:

This is what the return looks like after one year:

- Shorter term Euro inflation-linked government bonds (orange line). 3.56% 1-year return.

- Medium term Euro inflation-linked government bonds (blue line). -1.75% 1-year return.

- MSCI World (red line). 5.22% 1-year return.

The reason inflation-linked bond funds have performed poorly is because they also include real yield risk:

- Real yield is the return bond investor’s demand on top of their inflation protection.

- When bond yields rise the prices of existing bonds fall to compensate.

- This is why the bond ETFs charted above fell after March.

Shorter dated bonds are less vulnerable to yield rises than longer dated bonds. Hence the shorter dated UBS ETF is doing better than the medium dated iShares ETF in the chart above.

justETF tip: short bonds are relatively close to their maturity dates, while long bonds are many years (sometimes decades) away from maturing.

The anti-inflation mechanism embedded into the bonds is working as advertised but it’s temporarily overwhelmed by the capital losses stemming from rising yields.

Behind-the-scenes, the ETF managers are selling off older bonds (now at lower prices) and buying in new, higher-yielding bonds.

That process ultimately makes investors better off as they receive stronger cashflows from higher yielding bonds. But it takes time.

However, in the short-term, bond fund returns are dented by the drop in the value of their holdings.

Recent bond ETF performance tells us two things:

- Short dated inflation-linked bonds are a better immediate inflation hedge than longer dated ones.

- Bond funds in general are suffering as yields rise from the historic lows reached in the aftermath of the Global Financial Crisis and the pandemic.

Inflation-linked bond funds are now cheaper than they were but are still an expensive hedge versus the long-run potential of equities.

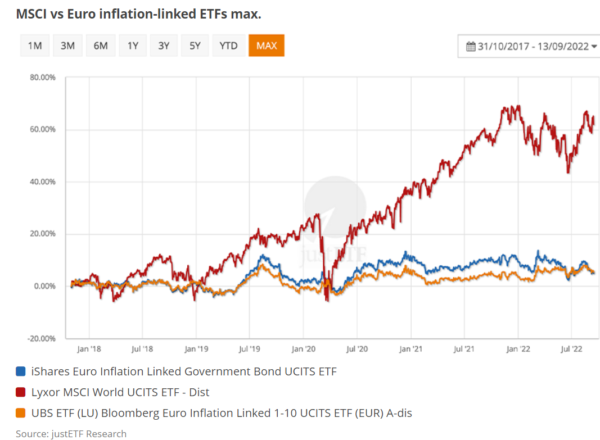

This point is brought home by comparing these bond ETFs vs an MSCI World ETF over the longest timeframe available:

- Shorter term Euro inflation-linked government bonds (orange line). 10.7% return since 31 Oct 2017.

- Medium term Euro inflation-linked government bonds (blue line). 11.06% return since 31 Oct 2017.

- MSCI World (red line). 71.08% return since 31 Oct 2017.

Once again inflation protection comes at the price of long-term returns. Notwithstanding the fact that historically low yields have undermined the inflation-linked component of bond funds.

Inflation-hedge bucket no3: the myth

Real estate is said to be useful against inflation. However commercial property is down year-to-date 2022, and has underperformed the MSCI World over the last year:

This is what the return looks like after one year:

- Global real estate (red line). 4.24%

- MSCI World (blue line). 5.22%

Investible commercial property is best thought of as a long-term inflation-beater in a similar vein to equities.

Why do people persistently claim that real estate hedges inflation? Well, like any good myth, it contains a kernel of truth.

Researchers have found that residential property is partially inflation-resistant. Although even they admit the evidence is tenuous. That’s because long-term residential property data is patchy and often misses critical elements such as taxes, ownership costs, and transaction fees.

Choose an inflation-beating strategy if you’re a wealth builder

High, unexpected inflation is a problem without a slam-dunk solution. If you’re a retiree or near-retiree focussed on preserving wealth then it’s reasonable to devote some of your portfolio to inflation-hedges no matter how imperfect.

But if you’re building wealth, and still have many investing years (or decades) ahead, then prioritise inflation-beating asset classes.

Regularly saving into a diversified equity ETF – held through thick and thin – is the best way to beat inflation and hit your financial goals in the long-term.

Remember that high inflation won’t last forever, so it’s better to be ready for a range of scenarios rather than being caught always fighting the last war. The key is not to panic or doubt the wisdom of your strategy when the economy hits short-term speed bumps.

Visit our friends at:

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.