May

2024

Convertible bonds: the little-known investment that offers extra income

DIY Investor

12 May 2024

A blend of stability and growth, convertible bonds have a unique ability to offer market protection and participate in upward trends. They’re not just another investment option—they’re your portfolio’s silent guardians and growth accelerators

Although not as renowned as their more conventional counterparts corporate bonds, convertible bonds have a history that spans a few centuries. First issued in the 1800s by canal and railway companies in the UK and the US to finance their latest projects, convertible bonds have seen a surge in popularity in recent years.

These hybrid securities that share some characteristics with both bonds and equities can potentially work well in the right type of portfolio for individual investors too, due to their low correlation with other assets.

The unique feature of convertible bonds (or simply convertibles) is their distinct reaction to market conditions, compared to equity or bond investments. While no investment is risk-free, this allows convertibles to provide some protection in declining markets while also offering participation in upward-trending markets.

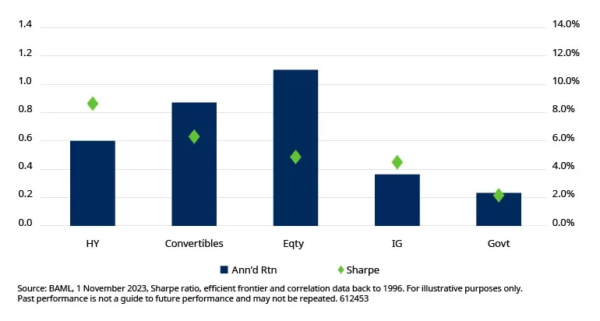

CHART 1: Unlocking the sweet spot: Convertibles deliver strong risk-adjusted returns between credit and equities

Note: The Sharpe Ratio is a measure used to assess the risk-adjusted return of an investment or portfolio.

The anatomy of a convertible

In its standard form, a convertible bond is simply a corporate bond that pays interest, but with an embedded option allowing the holder to convert the bond into shares of the issuing company at a time of their choosing. At maturity, the convertible is therefore worth either the redemption value of the bond, assuming the holder did not convert it into shares, or the market value of the shares into which the bond was converted.

There are multiple reasons why an investor would want to convert a convertible bond into shares. These vary from stock price movements, dividend considerations and market conditions to the desire for voting rights and the investor’s strategic outlook on the company.

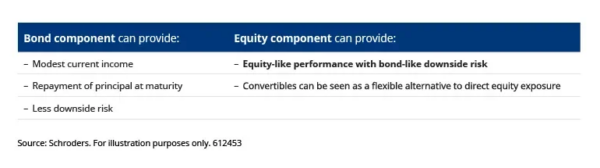

CHART2: Convertibles have an asymmetrical pay-out profile. In simple terms, convertibles provide a balance of stability and potential for gains. The bond floor protects the convertible price from severe declines in the underlying stock, while the equity option allows bondholders to potentially benefit from any increase in the stock’s value.

Besides this standard structure, convertibles can incorporate additional bond features. These can allow the company that issued the bond to buy it back before it reaches its due date, typically at a predetermined price or give the investor the right to sell the bond back to the issuer at a certain price before the bond matures. In essence, these features provide more flexibility for both the issuer and the holder of the bond.

Convertibles offer protection and extra income

Due to their built-in equity exposure, convertibles increase in value when the underlying stock increases in price. On the flipside, when the underlying stock depreciates, the convertible’s value also decreases but not as much as the shares, thanks to the bond floor – the bond component of the convertible. This bond floor in the structure of convertibles establishes a minimum price that serves as a safety net during market downturns.

Provided the issuing company of the convertible continues to meet its debt obligations, the convertible’s value will be at minimum equal to the bond floor, regardless of how much the stock price drops. In these situations, the convertible functions like a regular bond, offering capital protection to the investor.

Furthermore, as most convertibles are senior unsecured securities, they rank higher in the capital structure than other bonds and equity. This means that in the event of liquidation, convertible holders are paid before those holding securities lower in the capital structure, offering an additional layer of capital protection.

Convertibles also tend to have a lower sensitivity to rising interest rates than traditional bonds. This is largely attributed to their typically shorter durations (usually between three to five years) and the built-in equity option, which tends to respond positively to rising interest rates, serving as a compensatory mechanism. The embedded equity option also protects the convertible in case of increased volatility, which usually occurs in times of declining stock prices, as the equity option increases in value when volatility increases.

On the income side, convertibles offer interest payments that can provide a steady income stream, making them attractive to investors seeking both growth and income. The interest rate on a convertible bond is typically lower than that of a standard bond from the same issuer, reflecting the potential for equity upside. However, this trade-off is often acceptable to investors who value the combination of income generation, capital appreciation potential, and downside protection that convertibles offer.

Takeaway

Thanks to the unique features of convertibles, they offer investors the “best of both worlds” by providing exposure to equities with the added value of being protected by a bond floor (expected to generate a return between equities and bonds given the downside protection and income of the bond component, and sensitivity to rising equity prices from the equity component).

As such, they are a real alternative for anyone who is interested in gaining exposure to the growth potential of equities but with a more defensive view and the bonus of interest payments. Convertible bonds could offer an attractive anchor in your portfolio.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Alternative investments Commentary » Alternative investments Latest » Brokers Commentary » Commentary » Fixed income Commentary » Fixed income Latest » Latest

Leave a Reply

You must be logged in to post a comment.