May

2024

What might the UK election mean for the economy and markets?

DIY Investor

27 May 2024

We consider the wider macro-economic and investment backdrop as the country heads to the polls – by Azad Angana and Graham Ashby

Prime Minister Rishi Sunak has fired the starting pistol for the race to form the next government. A general election will be held on 4 July, which if opinion polls and betting markets are correct, will make for a challenging result for the current government. So what is the state of the UK economy and markets heading into this election?

Azad Zangana, Senior European Economist and Strategist

‘One of the three key questions I’ve been asked by clients is around the timing of this election. At face value it seems odd, but perhaps not so odd when you consider a likely slowdown in growth ahead (after a surprisingly strong Q1) in combination with stickier-than-expected inflation.

‘Stickier inflation seems likely to push out interest rate cuts and with them the prospect of lower mortgage costs in the immediate future.

‘The decision to call a summer election is a little surprising, with many, including ourselves, expecting an election in the autumn. Elections near holiday seasons (schools in Scotland will have started summer holidays) risk poor turn-outs.

‘And the timing doesn’t fit with the message from the Conservatives that the economy is strengthening while inflation is “back to normal”. The latter implies cuts to interest rates will follow shortly, which would surely be expected to boost support for the incumbent party when they arrive?

‘In Sunak’s speech outside 10 Downing Street, he claimed that the ‘…economy is now growing faster than anyone predicted…’, referring to the surprisingly strong Q1 GDP growth estimate, which marked the end of the UK’s recession.

‘Much of the surprise, however, was driven by what appear to be temporary factors, which is likely to mean a slowdown in coming quarters. He also mentioned that ‘…inflation is back to normal’ after the latest figures for April showed CPI inflation had fallen from 3.2% year-on-year (y/y) to 2.3% y/y.

‘While the fall in inflation was large, it was mainly due to a cut in home energy bills and base effects. April’s CPI inflation was in fact disappointing, as consensus estimates had been for a drop to 2.1%. As a result, expectations for the first Bank of England (BoE) interest rate cut moved out from June to September, which will effectively push up mortgage costs for those refinancing in the near future.

‘Moreover, our inflation model suggests that inflation is likely to rise from around July onwards, away from the BoE’s target of 2%. This could challenge the government’s claims of inflation being back to normal.

‘Another consideration is the recent pressure on the government to disincentivise illegal migrant small-boat crossings. This is beyond our scope to analyse in detail, but the summer is expected to prompt an increase in crossing, as the warmer weather helps calm crossing conditions.

‘Failure on this front could cost the centre-right Conservative Party votes to the more right-wing Reform Party, previously known as the Brexit Party.

‘The second question clients ask is who is likely to win this election?

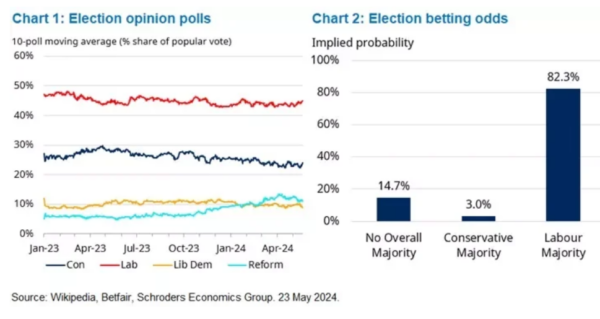

‘Opinion polls should always be taken with a pinch of salt, and while campaigning is only just about to get underway, the opposition Labour Party has a huge lead.

‘Indeed, they have what appears to be an unassailable lead in the polls of 21 percentage points over the Conservatives (see chart 1, below). That lead has been fairly steady throughout Sunak’s premiership, following the internal replacement of previous prime minister Liz Truss.

‘The implied probability from betting markets (Betfair) suggest a 95% probability that Labour Party leader Keir Starmer will be the next prime minister, and an 82.3% probability that his party will command a majority in the House of Commons (see chart 2, above).

‘Betting markets put a 3% chance of the Conservative Party retaining a majority. So, naturally this leads to the third question I’m being asked, which is what a Labour government might mean for the UK? At present, however, there is not an awful lot of concrete information to work with.

‘Having had a commanding lead for some time in opinions polls, Labour has not faced much pressure to announce its own policy prescriptions.

‘Combined with the significant changes in personnel and policies since the end of their previous time in government in 2010, this has raised questions on the intended policy approach, and the degree of socialist policies that may follow.

‘Shadow chancellor Rachel Reeves’ speech for the Mais Lecture on 19 March offered some insights of policy messaging to follow. The message of: ‘…building growth on strong and secure foundations, with active government guided by three imperatives. First, guaranteeing stability; second, stimulating investment through partnership with business; and third, reform to unlock the contribution of working people and the untapped potential throughout our economy.’

‘The first “imperative” is a clear political dig at the political instability under the last government, particularly the Liz Truss era, although Brexit was mentioned several times. Arguably, this has been less of an issue under Sunak, but Reeves stated the intention to legislate the mandatory provision of a forecast by the independent Office for Budgetary Responsibility (OBR).

‘This would apply whenever any government announces significant and permanent tax and spending changes. Truss was the first prime minister not to have the OBR provide an assessment of a fiscal event in her short time in power.

‘The second imperative appears to be an olive branch to business, which has had good reason to fear past Labour Party leadership. Showing that a Labour government can work successfully with businesses is not only important for attracting foreign direct investment, but also solidifying its reputation in the eyes of financial markets.

‘Lastly, focusing on reform to boost productivity and prosperity is an obvious area of focus, although very light on policy initiatives at this stage. A commitment to strengthen an objective to raise growth for HM Treasury in planning its fiscal policy may help.

‘There was also a significant section on what Reeves refers to as “securonomics”, which appears to signal a more considered approach to international trade and globalisation. This seems to lean more towards the current “Washington Consensus”, which could ultimately mean protectionist policies against China.

‘In terms of fiscal policy, there is a clear desire to improve the public services, which will undoubtedly mean increased public investment. New fiscal rules are likely to strip out public investment, and only focus on day-to-day spending, known as the “current budget”.

‘The objective is likely to be to balance the current budget using tax revenues, but to allow borrowing to pay for increased public investment. This is with a view to reducing overall debt over the medium term.

‘While Labour is avoiding the discussion of tax increases, the election campaign will inevitably force the party to offer more details. Some tax increases are likely to be needed, which is difficult given the “fiscal drag” which is occurring as the result of frozen income tax thresholds for the past seven years.

‘With more and more workers paying higher marginal rates, the nation’s tax burden is expected to rise to its highest level since 1948 by the end of the OBR’s current forecast period – a tough legacy to inherit.

‘Finding solutions for the long-term structural challenges to the UK economy will be key to successfully raising growth and living standards. These challenges include aging demographics, adapting to climate change, a more hostile external trading environment, and poor productivity growth.

‘These will hopefully also mean improved returns for investors, that have largely avoided UK public markets for some time.’

Graham Ashby, Fund Manager, UK All Cap

‘Equity investing always carries risks and trying to time shifts in markets is far from being an exact science, very much like politics. That said, sentiment towards UK equities is at a very low ebb, and we’re wondering if a change of UK government might coincide with a turning of the tide for sentiment.

‘With sentiment towards UK equities so low, contrarian investors might argue things can only get better. Legendary investor Warren Buffett once remarked that it’s wise for investors to “be fearful when others are greedy and greedy when others are fearful”.

‘Could now be the time to be greedy with UK equities? – certainly some of the contrarian indicators suggest it is.

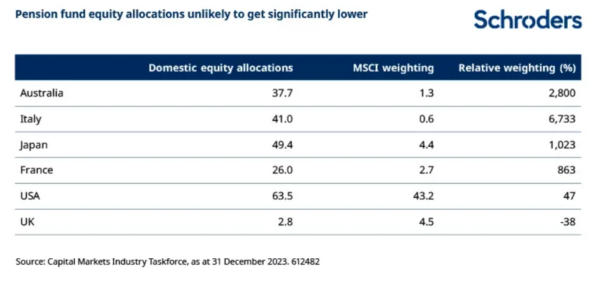

‘And a new government might just have some influence on when some on the conditions for UK equities improve. Take the very low levels of pension fund domestic equity allocations, which stand out versus other jurisdictions.

‘Nobody has a crystal ball regarding exact timing, but it’s hard to see that domestic pension funds can significantly further reduce their exposure to UK equities (see below).

‘What’s to stop a new government from mandating a certain minimum level of UK equity exposure within pension portfolios, following on from the current administration’s announcement of a British ISA?

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Brokers Commentary » Brokers Latest » Commentary » Equities Commentary » Latest » Pensions commentary

Leave a Reply

You must be logged in to post a comment.