Aug

2024

The top funds as UK shares recover

DIY Investor

10 August 2024

July was a strong month for UK shares, but all bets are off for what happens in August

The FTSE 100 and FTSE 250 both rose in July, recovering the losses they suffered in June.

The FTSE 250, which is more representative of our domestic economy, had a particularly good month. It went up by 6.5% and did significantly better than other indices tracking the major stock markets in Europe, Asia and the Americas.

Stock market indices |

2024 | ||||||

| Index | January | February | March | April | May | June | July |

| FTSE 100 | -1.3% | 0.0% | 4.2% | 2.4% | 1.6% | -1.3% | 2.5% |

| FTSE 250 | -1.7% | -1.6% | 4.4% | 0.4% | 3.8% | -2.1% | 6.5% |

| Dow Jones Ind Ave | 1.2% | 2.2% | 2.1% | -5.0% | 2.3% | 1.1% | 4.4% |

| S&P 500 | 1.6% | 5.2% | 3.1% | -4.2% | 4.8% | 3.5% | 1.1% |

| NASDAQ | 1.0% | 6.1% | 1.8% | -4.4% | 6.9% | 6.0% | -0.8% |

| DAX | 0.9% | 4.6% | 4.6% | -3.0% | 3.2% | -1.4% | 1.5% |

| CAC40 | 1.5% | 3.5% | 3.5% | -2.7% | 0.1% | -6.4% | 0.7% |

| Nikkei 225 | 8.4% | 7.9% | 3.1% | -4.9% | 0.2% | 2.8% | -1.2% |

| Hang Seng | -9.2% | 6.6% | 0.2% | 7.4% | 1.8% | -2.0% | -2.1% |

| Shanghai Composite | -6.3% | 8.1% | 0.9% | 2.1% | -0.6% | -3.9% | -1.0% |

| Sensex | -0.7% | 1.0% | 1.6% | 1.1% | -0.7% | 6.9% | 3.4% |

| Ibovespa | -4.8% | 1.0% | -0.7% | -1.7% | -3.0% | 1.5% | 3.0% |

Data source: Morningstar.

It is not surprising that there was some volatility in the lead-up to our recent general election, but the UK markets quickly settled after the result. The economic indicators have also been more favourable in recent months. Inflation dropped to 2% in May and remained there in June. The UK economy grew faster in May than anticipated, and the Bank of England has recently increased its forecasted growth for the year. The Bank of England has also reduced interest rates for the first time since March 2020.

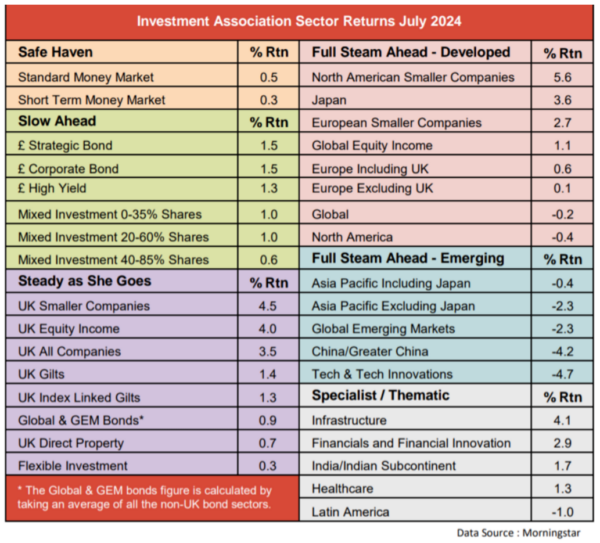

This improvement in the UK markets is also reflected in our latest sector analysis.

In June, the UK All Companies sector fell by 1.2%, the UK Equity Income sector went down by 1.3%, and the UK Smaller Companies sector ended the month down 1.8%. All three sectors bounced back in July.

The best-performing sector last month was actually North American Smaller Companies, up 5.6%, but then it was UK Smaller Companies, with a one-month return of 4.5%. The UK Equity Income sector was not far behind, up 4%, and the UK All Companies sector also did reasonably well, gaining 3.5%.

As you would expect, some individual funds have done much better than the sector averages.

Out of all the funds investing in UK companies, these were our top 10 in July.

Saltydog’s top 10 UK funds in July 2024

| Fund name | Investment Association sector | Monthly return (%) |

| Aviva Investors UK Listed Small and Mid Cap | UK All Companies | 7.9 |

| Royal London UK Mid-Cap Growth | UK All Companies | 7.8 |

| CT UK Mid 250 | UK All Companies | 7.7 |

| JPM UK Smaller Companies | UK Smaller Companies | 7.6 |

| L&G UK Mid Cap Index | UK All Companies | 7.1 |

| CT UK Smaller Companies | UK Smaller Companies | 7.0 |

| AXA Framlington UK Mid Cap | UK All Companies | 6.7 |

| M&G Smaller Companies | UK Smaller Companies | 6.6 |

| Jupiter UK Dynamic Equity | UK All Companies | 6.5 |

| Schroder UK Mid 250 | UK All Companies | 6.5 |

Data source: Morningstar. Past performance is not a guide to future performance.

In our Saltydog demonstration portfolios we started re-investing in UK equity funds late last year. In December, we bought the Ninety One UK Special Situations fund from the UK All Companies sector. Then, in May, we invested in the Schroder UK Smaller Companies fund, and last month we added the JOHCM UK Equity Income fund.

Although these funds invest in UK companies, they are not immune to what happens in other financial markets, especially in the US, the largest economy in the world.

Unfortunately, this month has got off to a bumpy start. US employment and manufacturing data that came out last week has rocked the markets, sparking concerns thatthe Federal Reserve has kept interest rates too high for too long. Investors are now worried that the US might fall into a recession.

After the first couple of days of the month, the Dow Jones Industrial Average was down 2.7%, the S&P 500 had lost 3.2%, and the Nasdaq had fallen by 4.7%. All the other indices that we track, including the FTSE 100 and the FTSE 250, were also showing losses.

This week is not looking any better at the moment. The Asian markets dropped on Monday, with the Japanese Nikkei 225 losing a staggering 12.4%. The European markets all opened down, and we are expecting to see further losses in the US.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.