Dec

2016

Wealth Managers Embrace Robo-advice as an Incubator Service

DIY Investor

2 December 2016

A year ago to the day, the Daily Telegraph carried the following headline – ‘Brewin Dolphin shrugs off threat of robo-advisers as it looks to grow financial advice business’ – outlining the firm’s expansion plans based upon the provision of discretionary wealth management and financial planning services to its wealthier clients.

Pointing to the limitations of automated solutions where a client may have even a hint of complexity in their financial affairs, chief executive David Nicol acknowledged the dearth of advice available to less wealthy clients but said: ‘The thought that a computer can somehow juggle ‘do I pay off my mortgage, do I put it into an ISA, how much do I contribute a pension?’, I don’t know. Some of that can and will be done online, but it’ll be a while yet. I certainly wouldn’t trust a computer myself.’

However, in something of a volte face, hot on the heels of UBS and Killik & Co, Brewin Dolphin has become the latest of the big guns to announce that it will be offering a fully automated investment service – Brewin Portfolio Service.

Presumably to plug that very gap identified by Mr Nicol – a lack of advice for those with only a modest investment pot – Brewins will offer the new low-cost service as an alternative to its high-end advice.

‘I certainly wouldn’t trust a computer myself’

The company’s own version of robo-advice has just been made fully accessible online, allowing those with between £10,000 and £200,000 to invest in one of six model portfolios at a cost of 0.7% of invested assets, plus underlying fund charges of between 0.11% and 0.16%.

Its announcement comes shortly after another traditionally high-end wealth manager, Killik & Co announced the launch of a robo service aimed at the mass savings market called Silo; with clients able to invest as little as £25 per month this represents a considerable departure from Killk’s current model where investments start from £200 a month and is presumably being used as a nursery product to the company’s high-ticket services.

(see Killik Introduces ‘Bionic Finance’ with ‘Silo’ – Muckle 21st November)

In October, UBS added its considerable voice to what is becoming the cri de guerre of the robos by announcing its intention to ‘democratise wealth management’ by offering a service with a minimum investment of just £15,000; OK, that’s not loose change but it does make the bank a little more accessible given that its usual target market of wealthy individuals needed more than £2m to open a UBS private bank account.

(see UBS Enters the Robo Fray with Smartwealth – Muckle 10th October)

Brewin’s move is yet another example of how wealth managers are having to respond to the disruption that companies such as Nutmeg, Scalable Capital et al have brought to the industry, by chipping away at some of their traditionally high-end clients with professionally managed portfolios and low fees.

In truth, the concept of offering model portfolios is hardly ground-breaking, but it is a departure for Brewin Dolphin and offers the opportunity to have your money managed by a team that is entrusted with £33bn of company-wide assets for just a fee of 0.81% – 0.86% per annum; you get to assess your own attitude to risk and therefore the mixture of assets in your chosen portfolio – all online.

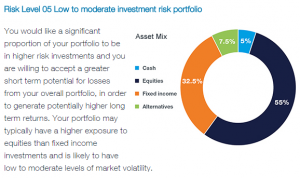

Brewin Portfolio Service identifies ten levels of risk and delivers portfolios to the ‘middle six’ – ranging from ‘Very Low’ to ‘High’; if you’re ‘No’ or ‘Extremely Low’ or ‘Very High’ or ‘Extremely High’, this is not considered a service for you.

The presentation of the asset allocation is clear and the process simple:

Each portfolio links to a fact sheet showing the precise nature of the investments it comprises:

Initially touted as the way to engage tech-savvy millennials with savings and investment, robo technology is being rolled out in a range of different ways, for example underpinning a new crop of financial advisers – the very market that felt most threatened when automated advice was first announced.

Ironically, and there may have to be a slice of humble pie to accompany the omnipresent Hobnob, but robo-advice may give advisers the opportunity to re-engage with clients that they ‘orphaned’ (dumped) after RDR on the grounds that they had insufficient investable assets to turn them a profit.

‘there may have to be a slice of humble pie to accompany the omnipresent Hobnob’

Digital discretionary investment management – as the new breed would have it – is also finding favour with wealthier and more sophisticated investors that recognise the benefit of an actively managed and inherently diversified investment portfolio, at a reasonable cost.

Predictions of just how wondrous robo-advice 2.0 will be, as artificial intelligence (AI) technology kicks in are manifold, but anything that engages with the next generation of savers and investors can only be positive.

Brewin’s finance director Andrew Westenberger, said the company hoped to use its online service to ‘incubate new clients’, explaining that ‘we launched an online application process, and so with £10,000 or more you can open an account, put money in, and off you go to the races,’

The company aims to establish a long term relationship with clients initially attracted through digital channels, and then upgrading to a more traditional interaction with a financial adviser when their circumstances require and their finances allow.

Paul Killik, founder of Killik, said that Silo represents ‘the first step on a journey that will shortly reinvent the entire industry’.

One thing is for sure; the automated investment space will be fascinating in the coming years with twists and turns aplenty.

Commentators were quick to write off the new kids on the block as being fundamentally unprofitable because of their high cost of customer acquisition and fine margins that require massive levels of AUM to turn a profit.

‘there is no indication that a fat lady will provide the entertainment at its Christmas party’

Nutmeg will have done little to remove the wry smiles from those of such beliefs when it announced losses of £9m in 2015 on sales of £1.7m; however with 20,000 clients and £500 m AUM, there is no indication that a fat lady will provide the entertainment at its Christmas party as Nutmeg recently announced the biggest fintech investment post-Brexit, attracting £30 m from Convoy, Hong-Kong’s largest listed financial advisory firm.

With the States a couple of years ahead of Europe in the roll out of the technology, US bank Citigroup estimates that assets managed by robo-advisers could reach $5 trillion during the next decade, boosted by younger investors who are comfortable investing online.

There’s much to consider – will the current crop of trailblazers make it in their own right? What will be the key message that will successfully engage with the next generation of savers and investors? Will they be acquired by the big boys along the way? Will the banks and wealth managers leverage their might and ‘own’ the market? Will there be an ‘anti-brand’ that succeeds precisely because it’s not part of the establishment?

Some wealth managers have seen the new platforms as a way to prove the value of their own services; investing in passives such as ETFs and trackers will not deliver market-beating performance, and so robo-advice should be sought as part of a long-term investment strategy reaping the considerable benefits of compounding; the acid test of all of these new platforms will be their relative investment performance and returns after fees, once they have experienced a few economic cycles.

Leave a Reply

You must be logged in to post a comment.