Sep

2020

A turning point for investors

DIY Investor

23 September 2020

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by Majedie Investments. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

2020 could mark a turning point in the fortunes of traditional value versus growth investing…

The collapse in share prices across the world sparked by the COVID crisis could mark a turning point in the fortunes of traditional value versus growth investing, according to the managers of The Tortoise Fund, an absolute return focused long/only vehicle managed by Majedie Asset Managemet (MAM).

Amid almost unprecedented global stock market volatility, and against a backdrop where growth and ‘big tech’ stocks like Amazon – already the dominant trend among investors – have seemingly cemented their position as market leaders even as the physical world has ground to a halt, cyclical ‘value oriented’ stocks have seen their already depressed valuations battered as investors have fled to the perceived safety they offer, and to defensive assets like gold.

But massive government stimulus all around the world, which is likely to continue well into next year, could support a dramatic revival in the performance of cyclical stocks – which are dependent on a fair wind from the economy in order to perform and currently trading on deeply depressed valuations.

Despite the devastation which COVID has wreaked upon the world, and the grim headlines the virus continues to produce, an improvement in the economic climate could be closer than people think, thanks to the rapid, and immense, response from governments worldwide in terms of fiscal stimulus.

Jerome Powell, chairman of the U.S. Federal Reserve, effectively promised to throw the kitchen sink at creating an economic boom in the wake of COVID-19 at a recent press conference, saying: “We will do this to the absolute limit of our power, we will keep using our authorities until we get out of this… and there will be other authorities that may need to be used. This is the time to use the great fiscal power of the United States to do what we can to support the economy.”

The following month, the Fed chairman dismissed any qualms about the fact that government stimulus might result in inflated asset prices – a criticism which has been levelled since the quantitative easing programme began, underpinning a ten year bull market for equities until the COVID crisis hit.

At the same time, after years of resistance from Germany, the European project seems to have found new life as the continent fights to find its footing in the wake of the virus which could have a hugely positive effect on European equities.

For the first time ever Germany – the most powerful economy in Europe – is pushing forward fiscal integration with the poorer southern states. Angela Merkel seems determined to use Germany’s presidency of the EU to drive home a rescue package and that long sought-after integration.

Majedie Asset Management’s Matthew Smith and Tom Morris think this has created a significant opportunity in value-oriented cyclical stocks.

Tortoise was hit by the downturn which happened when the virus struck, having already moved toward cyclical stocks which – having performed poorly for some time – were looking particularly cheap in Q4, at a time when the global economy looked as if it were about to gather pace.

“Cyclicals were already looking cheap [in Q4 2019],” says lead manager Matthew Smith, “So we added to our net long exposure there. A quarter later and the virus had hit; instead of an acceleration we had the sharpest downturn in 90 years – and with it cyclicals were smashed down to levels consistent with a depression.

“While the downturn has been sharp, we are pretty sure that this is a short term hit for the global economy, and we took the opportunity to bulk up our positions after prices fell – the advantage being that they were 30%-60% cheaper than were a couple of months previously.

“You now have cyclicals priced for a pretty deep recession just at the time where it looks even more likely than it did in Q4 that the economy is going to accelerate and that’s at the same time as the overwhelming consensus is very cautious, investors are overweight growth and defensives, and generally short on value stocks.”

Tortoise has had a difficult time in the last three or four years as the underperformance of value has turned from ‘a headwind into a hurricane’ according to the managers, but valuation spreads are now at record levels, and they believe this provides an opportunity to ‘make up the lost ground quickly.”

“Stocks in this category are cheap in absolute and relative terms at a time when the stars are aligning in their favour and the economy is about to accelerate; the policies of austerity have been largely discredited, and taking the US as an example the support schemes they are offering are so generous that they will offset the damage to disposable incomes caused by the virus entirely for the rest of this year.”

The managers are also convinced that the kind of lockdowns we have seen all over the world in the initial stages of the pandemic will not be repeated, as more and more data becomes available showing that the majority of those who are suffer worst are in vulnerable groups which can be shielded while the less vulnerable majority go about their business more or less freely.

“Back in February and March there were fears that the fatality rate for the virus was seven or eight percent and thankfully this has turned out to be wide of the mark because they missed out a significant number of asymptomatic cases; and in fact over the last couple of months its become apparent that the fatality rate is more likely to be less than 0.5% – so the virus poses a lot less risk than people feared.

“The cost of the lockdowns – when it comes to a cost benefit decision – it has become apparent, are actually very significant and that means a return to nationwide lockdowns is very unlikely.”

The managers have added to their positions in a number of areas where they believe this positive outlook supports the case for investment. Cars, they think, will benefit from a threefold effect of the return to normality as individuals are less keen on public transport, more likely to go on holiday closer to home, and there is less inventory available after the supply of vehicles was halted by the impact of the lockdown in 2020.

Airlines too – one of the worst hit areas of the market – could benefit. “The bears think demand will fall and people will travel less, so airlines will have to cut pricing – but the bullish side of that argument is that the market will be forced to rationalize, and with less seats in the air they will be able to exact better prices than before. We are already seeing better than expected resumption of air travel where air-routes are opening up.”

European telecoms companies – among the least loved businesses among investors because of the heavy handed regulatory intrusion they’ve been subject to – are also facing a renaissance.

Until recently there was little scope for efficiency in telcos across Europe – as anyone who has ever paid roaming data fees will be aware – as regulators have deliberately prevented consolidation; the result being that Europe has more than a hundred carriers, while the US and China both have just three.

The mood music from Brussels has taken a decidedly friendlier tone – to such an extent that the EU’s competition commissioner, Margrethe Verstager, said in June this year that there was ‘room for consolidation in the industry’- paving the way for long overdue deals to take place..

“The recent crisis seems to have triggered a change in heart from regulators,” the managers say, “Policy makers have realized that outside food, water and power, high-speed and reliable telco networks are what hold the global economy together.

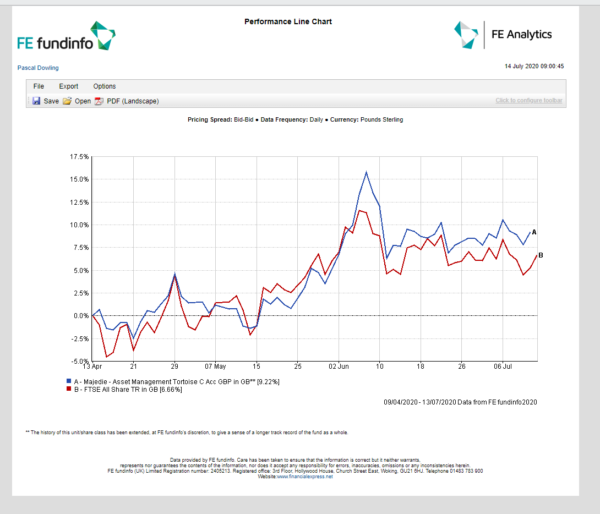

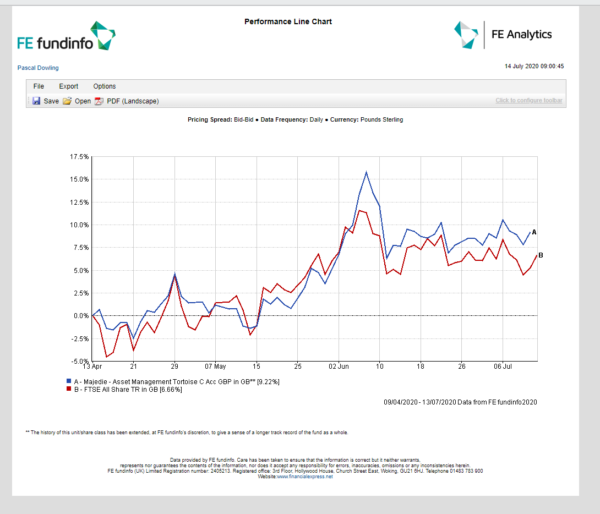

Tortoise has already seen an improvement in its fortunes since markets began to recover, delivering total returns of 9.22% in the three months to 13 July 2020, compared to 6.66% from the FTSE All-Share according to data from FE Analytics.

The majority of private investors are unable to access the Tortoise Fund, which has a minimum investment of £500,000, however it is accessible as part of a broader package of funds via Majedie Investments plc.

Majedie Investments plc is a multi-manager global investment trust which has an exposure of 10% to the Tortoise Fund, alongside a number of other funds which are out of reach for ordinary investors, including the highly regarded Majedie UK Equity Fund – the largest holding in the investment trust’s portfolio at 28.1% – and a mix of international equities, all managed by the investment teams at MAM Asset Management.

Currently trading on a share price which reflects a discount of 17% to the value of the underlying assets the trust, it has suffered as a result of its exposure to the UK in recent years as the debate around Brexit has rumbled on.

Should performance of the Tortoise Fund continue to improve, Majedie Investments plc could be an interesting opportunity for those who believe that the COVID crisis has sharpened the focus on a productive outcome for the Brexit negotiations as well, as this will likely improve sentiment toward the UK, removing a headwind for the trust’s largest regional exposure.

You can read more about Majedie Investments and the rest of its portfolio in our detailed note on the trust here.

Click to visit:

Disclaimer

This report has been issued by Kepler Partners LLP. The analyst who has prepared this report is aware that Kepler Partners LLP has a relationship with the company covered in this report and/or a conflict of interest which may impair the objectivity of the research.

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that if you are a private investor independent financial advice should be taken before making any investment or financial decision.

Kepler Partners is not authorised to market products or make recommendations to retail clients. This report has been issued by Kepler Partners LLP, is based on factual information only, is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Leave a Reply

You must be logged in to post a comment.