Jul

2017

As investors flock to DIY platforms, City watchdog launches probe into charges and transparency

DIY Investor

26 July 2017

Since the government’s Retail Distribution Review forced advisers to charge upfront fees rather than to take commissions from the products they advised on, investors have rushed to DIY investing platforms in order to take personal control of their finances.

Those believing that their advice had been ‘free’ were often horrified to see the true cost of advice, whilst others were ditched as unprofitable by their advisers because they had too little to invest; the result has been a boon for online brokers and platforms as investors have piled into them as well as the rise of automated advice – ‘robo advice’ – platforms.

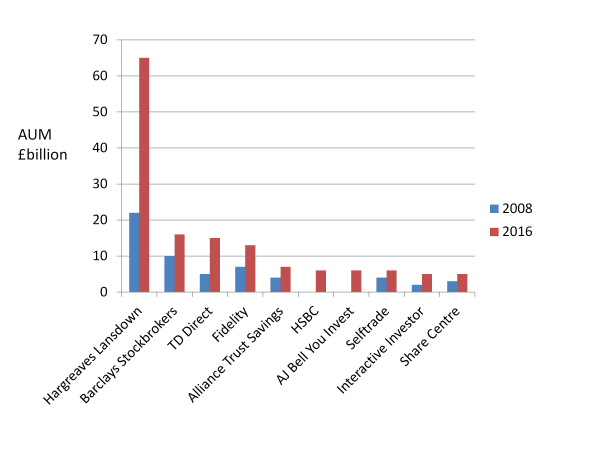

According to the FCA, DIY investing platforms held some £592billion of investors’ money in 2016, compared with £108billion in 2008, with a further £100billion held with D2C platforms operated by banks, insurers and wealth managers.

The chart below shows the dramatic growth that some platforms have experienced and the FCA is anxious to ensure that customers are getting value for money, that the brokers’ bargaining power is being passed on and that there is price transparency.

Fig 1: FCA’s figures show the surge in DIY investing platforms

The watchdog is to probe whether DIY investing platforms deliver value for money to the large and increasing number of investors that use them to buy funds, shares and other investment products; it will also spotlight the increasing number of model portfolios that are on offer to ‘Do it With me’ investors looking for an off-the-shelf portfolio as well as the ‘own brand’ funds that companies such as AJ Bell Youinvest and Hargreaves Lansdown have brought to market.

‘DIY, Do it With me or Do it For me – have become increasingly prevalent since RDR and their importance can only increase’

The probe was announced last month alongside the FCA’s review of the fund management industry, which called for firms to publish a ‘single, all-in-fee’; this would mean that costs such as trading commissions, which were previously ‘hidden’ in the fund, therefore affecting its performance, would be made explicit, allowing investors to see exactly what they are paying.

FCA executive director Christopher Woolard, said: ‘With the increasing use of platforms, and the issues raised by our previous work, we want to assess whether competition between platforms is working in the interest of consumers.

‘Platforms have the potential to generate significant benefits for consumers and we want to ensure consumers are receiving these benefits in practice.’

‘The Financial Conduct Authority will explore whether platforms help investors make good investment decisions and whether their investment solutions offer investors value for money.’

The FCA wants to find out whether the way in which platforms interact with other platforms, financial advisers, fund managers and fund ratings providers work in the interests of investors.

Due to report in 2018, the FCA probe will focus on five broad areas:

- Barriers to entry and expansion: Do large platforms benefit from economies of scale which smaller firms and new entrants struggle to match?

- Commercial relationships: Are platforms willing to negotiate a competitive price on investment charges, do commercial relationships drive investment choices, and what are the implications for investors?

- Business models and platform profitability: Do the drivers of profitability affect firm incentives and the factors over which they compete, and if so how does it affect investors?

- The impact of financial adviser platforms: Do these compete in the interests of the end investor, and are any benefits passed through to investors?

- Customer preferences and behaviour: Do platforms enable consumers and advisers to assess and choose services and products that offer value for money, and do new challengers struggle to compete as customers face barriers to switching?

What charges will be under the microscope?

All aspects of platform charging will be looked at including the way in which many cross-subsidise fees, meaning some investors pay more for investment services, to reduce the cost, or waive them for others.

Although some have not changed significantly in a decade, or may even have gone down, dealing commissions will be under close scrutiny as even £10 per trade may represent a huge mark-up on the actual transaction cost; what price blockchain technology?

Other anomalies include the treatment of funds – those platforms not charging on an AUM basis may still charge a commission, whereas others may be happy to get the cash on the platform, whilst whacking commission on to share trades.

‘many proclaim ‘FIRE’ as their objective – Financial Independence, Retire Early’

Sure to be more closely inspected by FCA than they are by Average Joe are entry and exit charges; it can be costly and complicated to move platform, and may be a barrier to entry for new, potentially cheaper players.

The sliding scales and thresholds are also likely to get the once over – some firms charge a flat fee which is more cost-effective for those with big pots, while others work better for those with small sums who trade infrequently and thereby pay only occasional trading commissions.

The review will get to the very heart of an industry that is still quite ill-defined – one wag in a recent blog declared that the only platform he professed any knowledge of was at Waterloo Station, but the precise definition of an XO broker, D2C platform, wrap platform, lifeco, wealth manager, online investment manager, digital investment manager can be hazy to say the least; add to that the burgeoning number of automated investment managers – robo advisers – and the scope, and the importance of the probe will be apparent.

The fact is that whatever they are called, platforms offering financial services to retail investors – be they DIY, Do it With me or Do it For me – have become increasingly prevalent since RDR and their importance can only increase as state provision declines and we are encouraged towards financial self-determination.

The advice gap remains and platforms deliver guidance and support to investors; they can also bring pressure to bear on asset manages to deliver improved performance at reduced costs, negotiating discounts, promoting good funds and highlighting poor performers.

The asset management study was not solely based upon price, but rather on value and that is likely to be the case when retail investment service providers are given the once over.

The regulator’s decision to take a detailed look at the platform sector, and in particular the value for money platforms deliver for savers should be welcomed, particularly now that the advent of ‘wealthtech’ will allow platforms to impact all aspects of our financial lives.

In terms of engagement and awareness the UK lags some way behind the US where the ‘401k/fifty-nine-and-a-half’ conversation is a dinner party staple.

However, DIY investing is growing apace in the UK and with more information and education, tips and techniques, engagement and transparency many more will be equipped to confront the very real issues of student debt, property purchase, saving for retirement and investing for income.

This will become all the easier it the FCA can cut through the jargon, ensure investors have access to good information and support and concentrate on achieving their financial goals; in the States many proclaim ‘FIRE’ as their objective – Financial Independence, Retire Early – sounds like it might have legs this side of the Pond.

Brokers Commentary » Brokers Latest » Commentary » Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.