Aug

2024

Bitcoin’s dominance under threat as gold closes in on top spot in Finder’s annual investment challenge

DIY Investor

12 August 2024

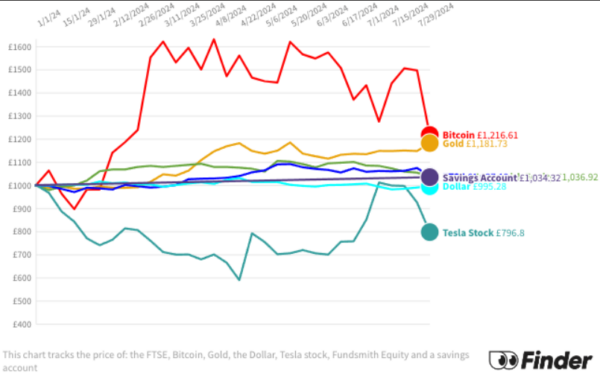

Resilient Bitcoin continues to outperform gold in Finder’s annual investment challenge, shrugging off a 20% price swing.

A fictitious £1,000 Bitcoin investment from early 2024 fell over 20% in just two weeks, plunging from an April peak of £1,630 to £1,216 – now just outpacing gold.

Tesla takes the crown for worst performer, with a £1,000 investment at the year’s start now worth just £797.

Bitcoin has seen a 20% drop in recent weeks, prompting market observers to reassess the cryptocurrency landscape as Bitcoin trades below $50,000, with other digital assets facing similar headwinds.

Every year, the personal finance comparison site, finder.com, follows popular types of investments in a tracker to see how they perform against each other. By fictitiously investing £1,000 in the 7 different types of investments, the aim is to understand the risk associated with different approaches.

Bitcoin, which has topped Finder’s Investment Challenge for 3 of the 4 years it has been running, is now in danger of losing its top spot to an investment at the opposite end of the risk spectrum: gold. As of August 2024, the cryptocurrency investment only has a narrow £34 margin on the gold investment.

Global turbulence causing cryptocurrency chaos

The recent drop in Bitcoin’s value can be attributed to global economic turmoil and murmurs of a US recession at the beginning of August. As stock markets in Europe and Asia tumbled, so did the crypto markets as investors were less willing to hold onto riskier assets.

A similar pattern was seen in 2022’s turbulent markets, impacted by the conflict in Ukraine among other factors. That year, Bitcoin came last in the Investment Challenge with significant losses. If someone had invested £1,000 in Bitcoin on 1 January 2022, they were left with just £387 by the end of the year.

This highlights the volatility of riskier investments like cryptocurrencies, which can see gains in one year but losses in another, without a guarantee that you will see an overall return on your investment.

Another strong performer from 2023, Tesla, is worst investment of 2024

Tesla, which was the second-best performer in the investment challenge in 2023, is the worst performing investment by far in 2024. A fictitious £1,000 investment at the beginning of 2024 would’ve returned just £797 as of 5 August 2024, over a 20% loss.

The US dollar is currently in second-to-last place. If you had invested £1000 in the dollar at the start of 2023, it would now be worth £995. An investment in the FTSE 100 would also have seen a slight loss as of 11 December, returning £980.

Gold performing well amid economic uncertainty

Gold is an investment that tends to perform better in more volatile markets, so it makes sense that it is currently the investment with the second-largest gains. If you had invested £1,000 in gold at the start of 2024, you would have £1,181–just £34 behind Bitcoin. .

If you had placed £1000 in a savings account, invested it in the FTSE, or invested it in a popular UK fund, you would have seen slight gains – an average of just £36.

To see the research in full visit: https://www.finder.com/uk/

Commenting on the findings, investing expert George Sweeney (DipFA) said,

“The sharp movement in the price of different assets, and the fact that different investments have the ability to leap frog each other over short timeframes, shows just how important it is to stay diversified. By leveraging trading apps and other tools to spread their portfolio across a range of assets, with a custom allocation that suits their risk profile and goals – there’s a better chance of picking winners and less likelihood of lengthy periods of poor performance or severe drops.”

Methodology:

The 2024 investment challenge tracked the performance of the most popular fund in the UK, the best savings account at the start of the year, the dollar, the FTSE 100, Tesla shares, Bitcoin and gold. The tracker follows the current value of a fictitious £1,000 investment at the start of 2024 in each product.

Alternative investments Commentary » Alternative investments Latest » Brokers Commentary » Commentary » Equities Commentary » Latest

Leave a Reply

You must be logged in to post a comment.