Dec

2024

Buy and ho-ho-hold? UK stock market is one of the best places in the world to enjoy a Santa rally

DIY Investor

24 December 2024

- Analysis of 14 major stock markets reveals December performance accounts for 23% of yearly gains

- FTSE 100 sees second-biggest outperformance vs rest of year, with December accounting for staggering 36% of annual returns

- The FTSE 250 typically experiences an even greater Christmas rally, beating the monthly average by 2.19 percentage points

- UK second only to Hong Kong’s Hang Seng, which rises by 3.1% on average in December

Stock market investors enjoy almost a quarter of their annual returns in December, with this so-called ‘Santa rally’ more pronounced in the UK than in any major stock market bar Hong Kong, according to analysis from trading and investing platform eToro.

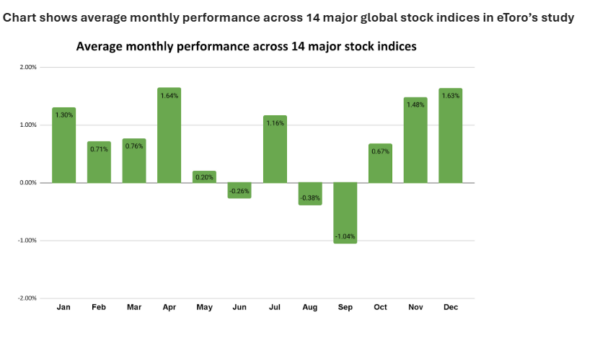

eToro looked at the monthly price returns for 14 of the world’s largest stock indices, from the USA’s S&P 500 to Germany’s DAX 40, going back an average of 50 years. The analysis shows that returns in December average 1.63%, comfortably outpacing the 0.57% average monthly return from January to November. Thanks to the Santa rally, December has typically accounted for 23% of the total gains these stock markets see across the year.

Commenting on the data, eToro Analyst Sam North said: “Although past performance is never a guarantee of future returns, December has historically been a standout month for global stock markets with the so-called Santa rally delivering the goods, and this is particularly true for UK investors.

“While the reasons behind this seasonal boost can vary – from optimism around the new year to increased trading activity – it’s clear that missing out on this period could be costly for retail investors, and further demonstrates the importance of staying invested over the long term to capture spikes in performance that can occur throughout the year.”

According to the data, based purely on the size of returns, the best hunting ground amongst major global indices for Santa rally investors in past years has been Hong Kong’s Hang Seng Index, which since 1965 (when records begin) has risen by an average of 3.1% in December. This is 2.15 percentage points more than the average monthly return for this index across the rest of the year (0.95%) and accounts for 23% of the stock market’s average annual performance.

Another festive season titan is the UK’s FTSE 100. Since its formation in 1984, December has outperformed other months by 1.93 percentage points, returning an average 2.29% and accounting for 36% of its yearly performance. Japan’s premier index, the Nikkei 225, is not far behind, with December delivering outsized gains of 1.98%, outperforming monthly returns from January to November (0.39%) by 1.59 percentage points, whilst accounting for 32% of annual performance.

Beyond the 14 premier indices examined by eToro, there are potentially even greater gains on offer for investors willing to look beyond the UK’s biggest companies, with the FTSE 250 returning an average of 2.71% in December, 2.19 percentage points more than the average across January to November.

Across all 14 indices eToro analysed, the only Christmas Grinch spoiling the party is Spain’s IBEX 35, with December underperforming the average returns from January to November by 0.14 percentage points. Meanwhile the December performance of Australia’s ASX 200 (+1.36%) proves that the Santa rally is just as prominent in the Southern Hemisphere’s sunny climes.

Sam North adds: “What’s clear from the data is that the Santa rally is far more generous in some parts of the world, with the UK a standout for festive returns. These regional quirks are a reminder that there isn’t a one-size-fits-all approach to global markets and savvy investors should keep an eye on local dynamics to make the most of the season.

“Although the UK market has so far failed to deliver a meaningful post-election bounce, this trend suggests that now could be the perfect time for British investors to back undervalued domestic stocks before the December bounce.”

Table shows December performance of stock markets included in eToro analysis

|

Stock Index |

Average December performance |

Average December outperformance vs rest of year (percentage points) |

December performance as % of yearly return |

|

Hang Seng (Hong Kong) |

3.09% |

2.15% |

23% |

|

FTSE 100 (UK) |

2.29% |

1.93% |

36% |

|

Nikkei 225 (Japan) |

1.98% |

1.59% |

32% |

|

TSX (Canada) |

1.84% |

1.34% |

25% |

|

ASX 200 (Australia) |

1.78% |

1.36% |

29% |

|

KOSPI (Korea) |

1.75% |

0.98% |

17% |

|

STOXX 600 (Europe) |

1.71% |

1.32% |

29% |

|

Nasdaq (US) |

1.53% |

0.48% |

12% |

|

SIX (Switzerland) |

1.42% |

0.92% |

20% |

|

DAX 40 (Germany) |

1.32% |

0.71% |

17% |

|

S&P 500 (US) |

1.28% |

0.63% |

16% |

|

FTSE MIB (Italy) |

1.26% |

1.05% |

39% |

|

CAC 40 (France) |

1.19% |

0.58% |

15% |

|

IBEX 35 (Spain) |

0.42% |

-0.14% |

7% |

*Past performance is not an indication of future results.

About this data

Calculated using Refinitv price data as far back as available until the end of October 2024 for 14 of the world’s largest stock indices: S&P 500 (data since 1964), NASDAQ (1980), Stoxx 600 (1987), TSX (1950), FTSE 100 (1984), DAX (1965), CAC 40 (1970), SMI (1998), FTSE MIB (1998), IBEX (1970), Hang Seng (1965), Nikkei 225 (1970), KOSPI (1975), ASX (1992). Average is a simple weight of all 15.

Leave a Reply

You must be logged in to post a comment.