Aug

2023

Energy transition and energy security – complementary or conflicting?

DIY Investor

7 August 2023

The war in Ukraine has exposed key vulnerabilities in the world’s energy mix, bringing the issues of energy security, affordability, and resilience to the fore – by Julien Girault

However, this also heightens the near-term risks to energy transition and the Paris Agreement goal of limiting global warming to 1.5°C. A key question to explore now is whether the twin goals of energy security and energy transition can be complementary?

Key takeaways:

- War in Ukraine has accelerated the urgency to define the future energy mix, which requires a fundamental shift towards renewable energy sources by 2050

- A separation of energy consumption from GDP growth is required to reach a trajectory of global warming below 1.5°C

- While there is agreement on broad trends, there is still a lack of consensus on the precise energy transition pathways

- Prioritising short-term energy affordability over decarbonisation is a risk, although the exposed energy security vulnerabilities may aid the transition

- Closing the energy transition funding gap will open the door to investment opportunities in three areas: fossil fuel reduction; transition to renewables; climate-focused solutions

In April 2022, the International Panel on Climate Change (IPCC) confirmed that the critical target of limiting global warming to 1.5°C by 2050 will be reached only if we halve CO2 emissions by 2030. Although the world is not currently on track, the goal is still within reach if action is taken now – according to the IPCC. Russia’s war in Ukraine and the consequent threats to energy security have heightened the risks of remaining behind these targets and failing to fulfil national pledges made at COP26 in Glasgow. Yet, the war has also served to highlight the need to invest more in energy infrastructure.

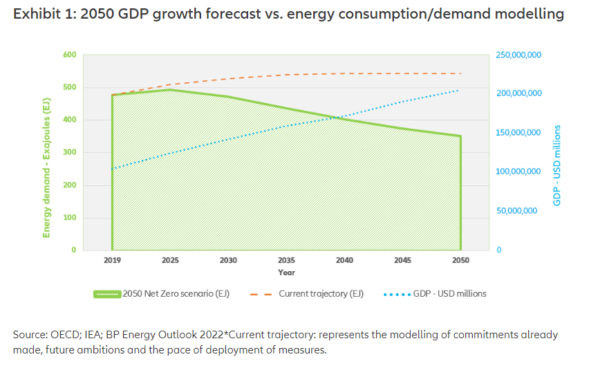

Energy consumption is the starting point. To reach the required trajectory, governments must decouple energy consumption and GDP growth (see Exhibit 1). As economies grow, energy demand rises; when energy is constrained, GDP growth slows. Decoupling the two will enable one measure of the limiting of global warming. Further adaptation measures, behavioural changes and energy efficiency are essential to reduce energy demand without reducing GDP growth.

Critical issues to be addressed in determining the future energy mix:

- consensus on future energy sources

- how these will be sustainable and sustained into the future

- behavioural change leading to lower consumption

- greater energy efficiency and effective offset mechanisms.

Challenges in modelling the optimum energy mix

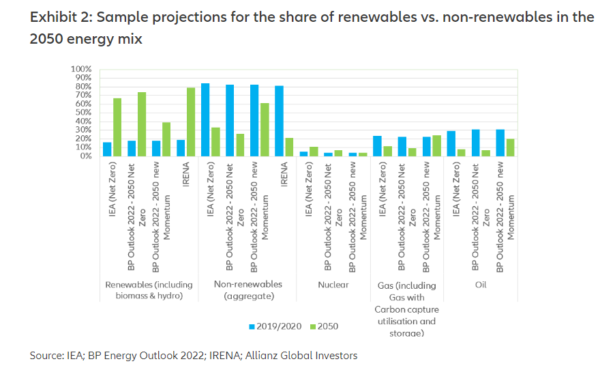

While there is broad public consensus on the need to change our energy mix to meet the Paris climate goals, agreement on the optimum mix remains elusive. Major international bodies like the International Energy Agency (IEA), IPCC and International Renewable Energy Agency have carried out extensive modelling. Their expectations about future energy sources vary significantly (see Exhibit 2).

Analysis of these models does reveal three clear trends:

- Fossil fuels’ share of the mix should fall from about 80% currently to 20-30%

- Renewable energy needs to replace fossil fuels, by growing from a 15% share to 60-80% (see Exhibit 2)

- While there is no consensus on nuclear, most models envisage its share remaining significant (even doubling from around 5% currently to at least 10%).

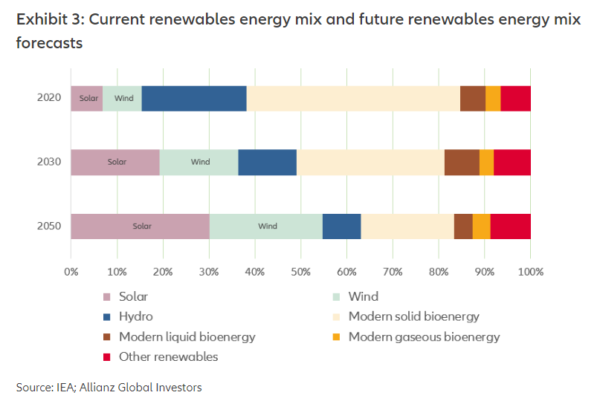

More specifically, fossil fuels’ decline would see the phasing out of coal and a reduction of up to 80% in oil consumption. Solar and wind energy would be the driving forces behind the expansion of renewable energy, growing respectively by 20 and 10 times from 2020 levels and, ultimately, accounting for more than half of renewables (see Exhibit 3). Hydrogen and bioenergy will play a part too, with double-digit percentage growth in annual production expected (initially “green” hydrogen and “blue” at a later date if it becomes cost effective)1. What’s more, there will be a significant scaling up of carbon capture utilisation and storage (CCUS).

Such a fundamental shift requires solving some key interconnected challenges, which would otherwise constrain the scaling up of renewable technologies. For instance, how should strategic metals and minerals be sourced? What is the role of the circular economy2 in managing e-waste and energy storage? What are the potential renewable energy headwinds from climate change itself, such as lowering wind speeds and photovoltaic obstruction from forest fire dust and debris?

Differing pathways lead to uncertainty

The various international bodies base their scenario planning on differing assumptions. This has resulted in uncertainty. For example, the IPCC has tested a huge number of scenarios, with over 100 consistent with a 2°C trajectory3 and somewhat fewer compatible with the more ambitious objective of limiting global warming to 1.5°C.

Together, this extensive analysis indicates that the probability of success from even the most optimistic models is only 50-66% – and still involves a high degree of uncertainty. In many cases, estimates of success are far lower.

Yet, there is consensus on what is needed for a successful pathway. This includes a commitment by all countries; strong global coordination and cooperation, including aligned energy policies; limited energy price volatility; CO2 pricing in all countries; a significant acceleration of applying new technologies. Remove any of these factors and the likelihood of success falls.

War emphasises greater challenges

Russia’s war in Ukraine has redirected policymakers’ attention to the concerns of energy security and resilience in addition to exposing supply chain weaknesses for the materials needed for renewable energy technologies. War has also emphasised the need for a socially just transition to a cleaner energy infrastructure. Furthermore, the reliance of so many European countries on Russian energy has forced the continent to address long-standing differences of opinion about base load options, most notably around nuclear energy.

While none of the main international bodies have provided updates since the war began, the immediate priority of supplying affordable energy is stirring up uncertainty about their model projections. Nuclear and renewable energy cannot deliver any near-term relief. Renewable energy sources are already operating at full capacity and lead times for commissioning new infrastructure are estimated at five to eight years.

Similarly, it will take time to ramp up nuclear capacity after a period of structural decline. Almost half of France’s nuclear reactors have either stopped or are undergoing maintenance; there is a significant skills shortage in the nuclear industry; and RTE – France’s transmission system operator – has suggested 2035 is the earliest date for commissioning new reactors.

We are concerned about possible delays in energy transition arising from interim solutions that are not consistent with a long-term decarbonised energy mix. As Russia turns off Europe’s energy supplies, countries are importing liquified natural gas (with twice the environmental impact of natural gas), recommissioning coal-fired power stations and resuming fossil fuel exploration and production. Notably, new investments in these short-term energy solutions have uncertain returns as they are assets in danger of being “stranded” in the long term.

Investment urgently needed to close the energy infrastructure funding gap

The most inconvenient truth to arise from the current crisis is the shortfall in energy infrastructure investment in recent decades, especially in Europe. The just-in-time economy prioritised cost over resilience and the impact of that is now being felt. Yet that gap means there is a significant opportunity for investment, with the IRENA’s World Energy Transitions Outlook 2022 report estimating investment needs at USD 5.7 trillion annually through to 20304.

Just as IRENA lays out a map for the next eight years for policy makers, asset managers are increasingly constructing portfolios with formal climate goal overlays, making use of continuing improvements in climate data and disclosures. As Allianz Global Investors is a member of the Net Zero Asset Managers initiative – and our parent company Allianz is a member of the UN-convened Net Zero Asset Owners Alliance – we have formal portfolio commitments for certain assets under management, with specific climate goals. However, we are also actively seeking the opportunities arising from decarbonisation.

Implications of the future energy mix for investors

We classify the investment opportunities arising from a changing energy mix into three groups:

1. Support the transition from fossil fuels

1. Support the transition from fossil fuels

As the net-zero goals for decarbonisation become increasingly embedded into portfolio construction and outcomes, we expect these to be reflected in several ways:

- Formalised carbon performance outcomes using carbon key performance indicators. These may be “green” (an ambitious threshold versus the benchmark) or “transition” (a less ambitious starting point, but progressively more ambitious).

- Net-zero alignment. This can vary from requiring companies to have a formal decarbonisation strategy to validating companies’ Science Based Targets5.

- Formalised alignment of portfolio carbon intentions and proxy voting.

- Formalised screening of high carbon intensity, or unconventional, energy sources.

2. Seek renewable energy opportunities

2. Seek renewable energy opportunities

- Investing in clean tech. This includes backing firms developing and applying rapidly evolving technologies like energy storage, green/blue hydrogen, and grid technology, as well as mainstream renewable energy eg, solar and wind.

- Investing in the raw materials that support the clean energy transition. Another consequence of war is the vulnerability of access to the strategic metals and minerals required for producing renewable energy infrastructure.

- Rare earth elements are essential for capturing wind power; magnesium is a key component of fuel cells, as well as wind and photovoltaic technology; cobalt and natural graphite are critical for batteries and fuel cells. As prices for these essential commodities rise, formerly uneconomic sites with respectable provenance and governance can reopen.

3. Invest in climate solutions

3. Invest in climate solutions

- Carbon capture utilisation and storage is vitally important for reaching net zero6. CCUS facilities in operation have tripled since 20107, CCUS retrofits of power stations and heavy industries could cut CO2 emissions by more than 2GT annually by 20508, and the global CCUS market could grow to USD 7 billion by 20309.

- Energy efficiency solutions are multifarious. The many options lend themselves to private sector development, especially those concentrating on alternative or clean energy infrastructure. Beyond solar and wind power, potential private sector projects include clean electricity transmission, adapting energy networks to alternative energies (eg, hydrogen or green gases) and building supporting infrastructure such as energy storage and CCUS.

Three final points for investors to consider. First, climate strategies will evolve as the data disclosed by companies improves, especially regarding the key constituents of aligning with net zero. Second, until data improves, engaging with company management is the only way to gain a full perspective of climate goals, especially for those companies at an earlier stage of transition. Lastly, companies’ activities must be judged within the context of the countries in which they operate – collective engagement through industry body participation can help to promote action by governments. As the next global forum for such discussions approaches – the UN Climate Change Conference (COP27) – to be held in Egypt’s Sharm el-Sheikh in November 2022, expectations remain high.

1 Grey hydrogen uses steam reformation of methane – carbon emitting process; blue hydrogen adds CCS to grey hydrogen to reduce carbon emissions from hydrogen production; and green hydrogen is produced using decarbonized energy (like renewable energy).

2 The circular economy addresses “how we manage resources, how we make and use products, and what we do with the materials afterwards” and “is underpinned by a transition to renewable energy and materials”, www.ellenmacarthurfoundation.org

3 IPCC, Mitigation pathways compatible with 1.5C in the context of sustainable development

4 Hydro Review, $5.7 trillion in annual investment needed for clean energy transition, March 2022

IRENA, World Energy Transitions Outlook, 2022 (page 26)

5 The Science Based Targets initiative (SBTi) defines and promotes best practice for organisations in science-based emissions reduction targets.

6 Stated by Professor Johan Rockström, a director of the Potsdam Institute for Climate Impact Research, during the Allianz Global Investors 2021 Sustainability Days conference

7 IEA, A new era for CCUS, 2020

8 IEA, A new era for CCUS, 2020

9 Carbon Capture, Utilization and Storage Market Overview 2030

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication’s sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional /professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK). #2305592

Alternative investments Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest

Leave a Reply

You must be logged in to post a comment.