Jun

2018

Ethereum 101

DIY Investor

15 June 2018

-

What is Ethereum?

Ethereum can be thought of as a virtual supercomputer. It’s designed as a platform to host applications that can run without the need for human interference.

These applications are called ‘Decentralized Apps’, and I’ll explain how they work later in this guide; the cryptocurrency, Ether (usually referred to as Ethereum) is the currency or ‘utility token’ that you pay to use this virtual network.

-

How Ethereum Works

Ethereum Blockchain

Like Bitcoin and other cryptocurrencies, Ethereum has it’s own blockchain.

This is like a record of all transactions on the Ethereum network. It’s stored on nodes (computers, miners, etc.) across the world.

However, while Bitcoin’s blockchain just stores transaction records, Ethereum’s blockchain also hosts smart contracts and decentralized applications (DApps).

Smart contracts are contracts programmed to run by themselves. In simple terms, this means: If x happens, y results.

The Ethereum blockchain keeps a record of the latest execution of each smart contract.

How Do Transactions Work?

Transactions, whether they are simple money transfers or executions of smart contracts or DApps, require “gas”.

Gas can be thought of as transaction fees. You pay for gas using Ether.

Transaction fees go to miners (explained below).

What is Ethereum Used for?

Since you can program different smart contracts and DApps on the Ethereum blockchain, Ethereum use cases are only limited by the imagination.

This potentially makes Ethereum more useful than single use cryptocurrencies, such as Bitcoin (payments). It’s also led to the coining of the term “Blockchain 2.0” (programmable transactions).

Ethereum’s innovation in this regard has even led to copycats trying to mimic Ethereum’s popularity and success.

Smart Contracts

As mentioned, smart contracts are contracts that are programmed to run by themselves.

So why is this helpful?

Smart contracts can eliminate the inefficiencies often caused by middlemen.

Smart contracts get rid of middlemen like banks and even service providers like Airbnb and Uber.

For example, banks are usually the ones that give people loans.

Instead of having a bank, smart contracts could be written so that loans are disbursed once certain conditions are fulfilled.

For instance, once you pay your loan amount, funds could be disbursed into your account automatically without the need for a loan collector.

For something like Airbnb, instead of having Airbnb connect renters and landlords, smart contracts could grant a renter access to an apartment once he or she makes a payment.

The examples are endless.

Smart contracts could be revolutionary and have the potential to upend many industries and business models.

Mining Ethereum

When you make a transaction, this transaction is broadcast to the Ethereum network.

Miners verify transactions and group them into blocks (groups of transactions), which are added to the blockchain (groups of blocks or all Ethereum transactions).

The way that miners verify Ethereum transactions is via “proof of work”. However, they are planning to move towards “proof of stake”.

Miners, using their mining devices, such as computers or specialized mining devices, perform computationally difficult work.

Whoever finishes this work first gets to add a new block to the blockchain.

For their efforts, miners are paid in transaction fees (gas paid for in Ether) and newly created Ether (if they finish the work first).

-

History of Ethereum

Who Created Ethereum?

The founder of Ethereum, Vitalik Buterin, published the idea of Ethereum in late 2013 in a whitepaper.

Buterin had originally pushed for application development (DApps) on Bitcoin’s blockchain, but others in the Bitcoin community didn’t share his vision.

This led him to create Ethereum.

Ethereum was officially announced in January 2014 and other team members included influential cryptocurrency figures:

- Charles Hoskinson (Founder of IOHK – behind Ethereum Classic and Cardano)

- Anthony Di Iorio (Founder of Jaxx)

- Mihai Alisie (Co-Founder Bitcoin Magazine)

Ethereum’s ICO took place from July 2014 to August 2014. Crowd sale participants paid for Ether using Bitcoin.

A year later, in July 2015, Ethereum went live.

Ethereum’s Growth

People realized the potential of Ethereum (Blockchain 2.0), and Ethereum quickly gained in popularity.

Within the span of a few short years, Ethereum became the second largest cryptocurrency by total market capitalization.

Ethereum Hacks

While Ethereum has risen quickly in the cryptocurrency sphere, it’s unfortunately suffered some high profile hacks.

Here’s a couple of examples.

The DAO

Though The DAO was the largest crowdfunding campaign in history (at the time), it was unfortunately hacked.

One third of The DAO’s funds were stolen (valued at about $50 million at the time).

The community was split with regards to how to deal with the hack, which led to the split of Ethereum (discussed below).

Parity Hacks

Parity is an Ethereum wallet provider that’s had a run of bad publicity.

In July 2017, $30 million in Ether was stolen from Parity wallets.

Not shortly after in November of that year, $100 million in fund was frozen because of a coding issue.

Ethereum Classic

The aforementioned DAO hack was the first of its kind in the Ethereum community.

People weren’t sure with how to deal with the hack and two camps emerged.

On the one hand, some wanted to hard fork (split) the Ethereum blockchain to restore the stolen funds.

The other side argued doing so would go against the “immutability” ethos of blockchain.

This disagreement led to the split of Ethereum into Ethereum (forked blockchain) and Ethereum Classic (unchanged blockchain).

-

Benefits Of Ethereum

Here’s a few of Ethereum’s benefits (we’ll come onto it’s disadvantages next)…

Censorship Resistant

Nothing can be censored on Ethereum because of blockchain technology.

Data is hosted on nodes across the world so censorship or changing of data wouldn’t be possible without controlling thousands of nodes

No Downtime

Since Ethereum isn’t held on one server (centralized) and is instead hosting on thousands of nodes (decentralized), there’s no downtime.

(Unless all nodes crash at the same time – which is rare).

Versatile

With the introduction of Smart Contracts, Ethereum is a very versatile platform and could revolutionise many industries (as mentioned earlier with banking and Airbnb.

Fundraising

Ethereum is one of the most popular platforms for launching ICOs.

Ethereum’s blockchain makes it relatively easy for developers to create DApps, DAOs and other crypto-assets.

Therefore it’s become an increasingly more popular and convenient platform for ICOs and developers to launch from.

Transaction Speeds

Mining and transferring tokens is faster on the Ethereum blockchain, especially when compared to Bitcoin.

Transferring Bitcoin can take 10 minutes (or even longer) – whereas transferring Ethereum takes a matter of seconds.

-

The Disadvantages Of Ethereum

Unfamiliar Programming Language

Ethereum uses its own programming language, Solidity.

Developers’ unfamiliarity with Solidity has led to code being written incorrectly, which led to problems like The DAO hack.

Projects similar to Ethereum have emerged addressing this issue and allow programmers to use more familiar languages like Javascript.

Scalability Issues

Ethereum, like Bitcoin, is facing problems, as it grows more popular.

The fact that games like CryptoKitties can cause network congestion is a cause for concern.

If Ethereum can’t handle many transactions, some critics are wondering how will it ever scale to meet the demands of a mainstream user base?

Inflation

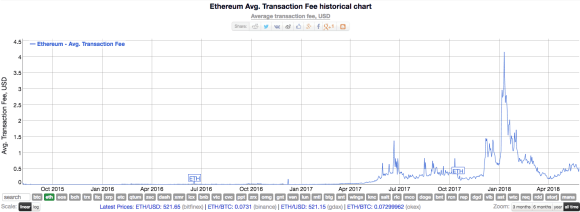

Transaction fees on the Ethereum platform are paid in Gas – and they can quickly inflate.

In fact, transaction fees increased by up to 70% for Ethereum at peak usage.

As you can see in the chart below, transaction fees have fluctuated dramatically over the last few months.

Syncing Problems

Another technical problem with Ethereum is that sometimes the Ethereum wallet won’t sync properly with the blockchain.

This means sometimes users can’t see their wallet’s actual balance – and the figures are can be inaccurate.

As you can imagine, that’s a bit worrying for some users!

You can find more details about this here.

-

Ethereum vs. Bitcoin

So what are the biggest differences between Ethereum and Bitcoin?

Smart Contracts – the main difference between Ethereum and Bitcoin is that Ethereum allows for smart contracts and DApps instead of just payments.

Faster Transactions – the time for a single Ethereum block to be mined is measured in seconds vs. minutes (Bitcoin).

Purpose – Bitcoin is more like a store of value, whereas Ethereum allows decentralised apps to be developed on it’s platform.

Functionality – Ethereum’s technology is designed to allow DApps and smart contracts for developers. Ethereum is more versatile than Bitcoin in this respect.

Proof Of Work Vs Proof Of Stake – Whilst Bitcoin and Ethereum are both currently mined using Proof Of Work, this could change soon.

Vitalik Buterin (creator of Ethereum) has actually released details of the Casper Protocol, which would integrate Proof Of Stake instead.

I’ve compared both models in my guide to cryptocurrency mining.

-

Examples Of How Ethereum Can Be Used

Decentralized Autonomous Organizations (DAOs)

DAOs are decentralized and autonomous organizations that operate using smart contracts.

The smart contracts contain the rules and operating structure of the organization, eliminating the need for centralized control and leadership.

For example, members could submit proposals, which are then voted on by the whole organization.

If a proposal gains enough votes, it is automatically approved without the need to count votes or move the initiative forward.

While a DAO is decentralized, it is “owned” by those who purchase its tokens. The tokens give members voting rights in proportion to the percentage of the organization’s tokens members hold.

Perhaps the most famous example of a DAO is The DAO, which was a decentralized venture fund.

Investors in The DAO received voting rights on investment proposals proportional to the amount of DAO tokens that they held.

Unfortunately, The DAO was hacked (as mentioned earlier).

Initial Coin Offerings (ICOs)

Initial coin offerings, or ICOs, are one of the most famous uses of Ethereum. Though ICOs take place on other platforms too, the overwhelming majority are Ethereum-based.

ICOs really took off in 2017.

According to ICOdata, ICOs raised $6.1 billion in 2017.

Similar to initial public offerings (IPOs), ICOs allow companies to raise funds from investors. The difference is that instead of issuing shares, ICOs issue digital tokens.

Also, unlike IPOs, ICOs don’t require giving up any equity.

Investors purchase ICO tokens with the hope that their value will appreciate. However, the tokens can also be purchased to simply use the platform that the ICO team releases.

Though ICOs have emerged as a great way for projects to get funding without giving up control of their companies, the ICO model has come into question.

For one, most ICOs are scams.

Another thing to consider is that some ICO projects have raised hundreds of millions of dollars. But this level of funding is often unnecessary for the development being proposed.

The DAO at the time of its ICO was the largest crowdfunding campaign in history ($120 million).

Since then, other projects have eclipsed that already huge number. Yet some don’t even have working products!

Useful Resource: If you’d like to learn more about ICOs, check out my guide here.

Decentralized Applications (DApps)

As mentioned, Ethereum hosts many DApps.

State of the DApps lists over 1,500 DApps (May 24, 2018), but those are only the ones that State of the DApps has chosen to highlight. There could be many more out there too.

OmiseGO

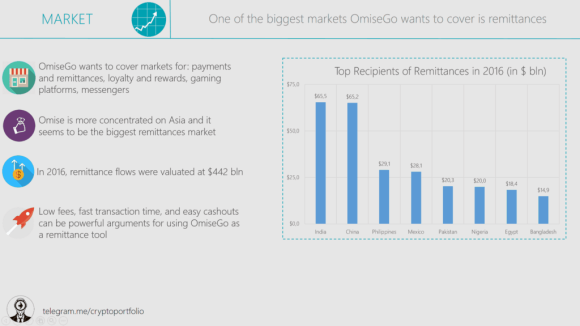

OmiseGO was one of the biggest Ethereum ICOs of 2017 and raised $25 million.

The company behind the project, Omise, is a Southeast Asian payment services company.

With OmiseGO, the company aims to develop a platform that allows for value exchange and various payment solutions across different currencies (both cryptocurrencies and fiat currencies like the dollar).

Omise itself is already a well-established company with over 100 employees, offices throughout Asia, and recognition like being named a “” by Forbes Thailand in 2016.

Plus their platform won’t require a bank account or international transaction fees.

This would be especially useful in places like Southeast Asia, where many people don’t have traditional banking services.

While there are plenty of ICOs, and even ICO projects doing similar things as OMG (great acronym), the OmiseGO project stands out because of its team.

CryptoKitties

No mention of Ethereum DApps would be complete without the infamous CryptoKitties.

CryptoKitties is an Ethereum-based game that allows players to buy, collect, breed, and even sell virtual cats.

Each cat is unique and can’t be destroyed thanks to blockchain technology storing Ethereum’s blockchain on nodes across the world.

While the game sounds like somewhat of a joke, it has taken off like other similar games in the past (Tamagotchi, Pokemon, etc.)

Some of these virtual cats have sold for over $100,000.

Not only that but the CryptoKitties company itself has raised $12 million from investors, including top investment funds like Union Square Ventures and Andreessen Horowitz.

CryptoKitties’ popularity has even slowed down the entire Ethereum network, raising transaction fees and increasing unprocessed transactions.

Golem

Golem is another Ethereum-based project.

Like Ethereum itself, Golem aims to be a decentralized “supercomputer”.

However, instead of storing smart contracts and DApps that can be run using computing power from Ethereum nodes, Golem users can rent computing power from others.

People with extra computing power let others use it while collecting a fee.

This model has led to Golem being nicknamed the “Airbnb of computing”.

Since heavy computing can be expensive, this could be useful for people who need heavy computing resources but have limited finances.

Use cases that come to mind include artificial intelligence, CGI rendering, and medical research.

-

Ethereum FAQs

How Many Ethereum Are There?

Unlike Bitcoin, Ethereum’s total supply is not set.

As of May 24, 2018, the circulating supply (ETH in existence) is 99,630,274 (Coinmarketcap).

What Is The Price Of Ethereum

As of May 24, 2018, the price of Ethereum was $606.96.

However, Ethereum prices tend to fluctuate dramatically, and these prices swing on a daily (and hourly) basis.

It’s important to note that the cryptocurrency market is very volatile – as you can see from the chart (5 year period) below:

You can actually track the live prices of Ethereum and other cryptocurrencies via websites like Coin Market Cap.

Coin Market Cap breaks down the price history, total market cap and current market prices.

How Long Does Ethereum Take to Send?

As mentioned earlier, Ethereum block times are measured in seconds.

You can see how long it takes to send Ethereum by looking at the average Ethereum block time (15.3 seconds as of May 23, 2018).

Note: Block time is how fast a new block is mined.

Since mining a block means adding a block (group of transactions) to the blockchain, block time is how fast Ethereum transactions are settled.

Where Do You Store Ethereum?

Ethereum can be stored in cryptocurrency wallets, such as the official Ethereum Wallet, or other popular alternatives.

You also can store Ethereum on a hardware wallet, online exchange or even a paper wallet.

- Who Created Ethereum?

Vitalik Buterin is the founder of Ethereum.Vitalik – a programmer from Toronto – was building video games from the age of 10.Then in 2011 he discovered Bitcoin through his father, when he was just 17.When Vitalik first heard about Bitcoin, he actually dismissed the idea.

However, he later co-founded Bitcoin Magazine, writing hundreds of articles about cryptocurrency.Then in 2013, he released a white paper that discussed the idea of using the blockchain for more than just a store of value, like Bitcoin.

Instead, he proposed developing Decentralized Apps via a blockchain powered platform – now known as Ethereum.

Useful Resources: Want to learn more about what it’s like to run a $125bn blockchain?

Here’s an interesting interview with Vitalik Buterin.

How Do You Mine Ethereum?

Ethereum is mined in a similar way to Bitcoin – using the Proof of Stake model.

Typically, you’ll need a mining rig and GPU hardware to mine Ethereum. It is possible to mine with a CPU processor, but it will be slower and overall, less efficient.

However, with plans for the Casper Protocol, Ethereum is moving towards Proof of Stake.

I’ve actually explained how both mining models work in more detail here.

Why Is Ethereum Going Down/Up?

Like any cryptocurrency, prices of Ethereum are incredibly volatile and unpredictable.

The market mainly depends on news – and overall investor confidence. For example, if investor confidence is low, prices will drop.

Here’s a few examples of why Ethereum’s price has dropped significantly over the last few months:

- The cryptocurrency market has been bombarded with bad news in 2018.

- Governments are cracking down on decentralization.

- High profile exchanges have been hacked – which is enough to scare off most investors.

- The domino effect: when the market sentiment is down, it creates a tidal wave where Ethereum’s price will drop lower and lower.

What Is Ethereum Gas?

Ethereum Gas is the fee of processing a transaction on the Ethereum blockchain.

It measures the amount of computational power required to process an Ethereum transaction.

Note: Examples of transactions on the Ethereum blockchain include transfers of Ethereum, executing smart contracts or even an ICO purchase.

The power required to compute these transactions is called ‘Ethereum Gas’.

Leave a Reply

You must be logged in to post a comment.