Inside Exchange Traded Products

Exchange Traded Products are increasingly popular with the DIY investor. ETP are passive investment funds that track a wide range of indices and provide exposure to different asset classes, in a wide range of industry sectors around the world. Because they have no fund manager or analysts to support, the cost of ownership of ETPs can be low in comparison to other types of pooled investment and they are simple because they trade on an exchange like a share. Many brokers allow regular investments and drip feeding into a basket of ETPs can be a cost effective way of building a diverse, and potentially income generating, portfolio. DIY Investor looks at the different types of exchange traded products available and includes content from issuers and partners to explain how to select  the right product for you and how to include ETPs in your investment portfolio.

the right product for you and how to include ETPs in your investment portfolio.

Elevator Pitch for Index Investing

The DIY investor can construct a portfolio of passive investments in line with their risk tolerance. Indices deliver exposure to most types of investment, home and abroad, with differing volatility and risk profile If you want a readymade, diversified range of investments without the costs that come with actively managed funds you may find index investing an attractive option; here are five reasons why…..  Read more

Read more

ETF Portfolio Investing Made Simple

Dominique Riedl, founder and CEO of justETF, explains why he thinks ETFs are the right choice for DIY investors and explains how his platform can assist in selecting the right products to build and maintain a balanced investment portfolio. Taking a DIY approach can be a daunting prospect for those new to investing but, happily, there is a straightforward yet powerful strategy available – passive investing with Exchange Traded Funds (ETFs)  Read more

Read more

What do ETFs Invest in?

ETFs enable you to construct a diversified portfolio cheaply and easily. There are five major asset classes to consider when building your ETF portfolio:

- Cash

- Bonds

- Property

- Equities

- Commodities

Read more

Read more

How Much do ETFs Cost?

One of the great advantages of ETFs is that they are a cheap way to invest; cost is a crucial factor in determining your long-term success, so consider the Total Cost of Ownership (TCO) as well as the Total Expense Ratio (TER).  Read more

Read more

How do ETFs Work?

ETFs enable you to gain diversified exposure to a stock market, sub-sector or asset class by investing in just one cost effective and easily traded product. ETFs operate just like mutual funds with the big difference that they are listed on the stock market which means that whereas traditional funds can only be bought into or cashed out of once a day, you can trade ETFs whenever you like during normal market hours just like other share.  Read more

Read more

Passive vs Active

ETFs are most often associated with passive index-tracking strategies, but they have a role to play for investors trying to beat the market, too. Active investors either pick individual stocks or put their money into funds run by managers who aim to do better than average, or to judge the best times to get in and out of different assets. ETFs use mechanical rules instead of expensive managers to construct index-following portfolios and cover all mainstream markets and asset classes, making the construction of a diversified, low-cost DIY passive portfolio a realistic prospect for anyone.  Read More

Read More

ETFs for Income

Years of near-zero interest rates have crushed the income that can be achieved from traditional sources. ETFs that deliver good dividend yield could be just the answer for those looking to take advantage of new pension freedoms and generate income in retirement.

With just a handful of ETFs, you can build a diverse income portfolio, with less risk and because fees are much lower than those of an actively managed fund, you’ll retain more of your income to reinvest or to spend.

Read more

What are Synthetic ETFs?

You would expect an index tracker to actually invest in the same holdings as its index. This is how a physical ETF works and why it returns the same results as the market it mimics. But synthetic ETFs don’t work this way often because the markets they track are very hard to physically recreate at a reasonable cost; a market may consist of many small and illiquid securities that are very expensive to trade or complexities of tax, time zones and local laws may make it difficult to track some global indices.  Read more

Read more

What are Smart Beta ETFs?

A Smart Beta ETF aims to deliver the best of both worlds – to beat the market or to match it while taking less risk – precisely what an active investing product would hope to do, yet they follow an index and deliver the advantages of passive investing. Smart Beta ETFs exploit investing anomalies that are known to have beaten the market over the long term – finding companies that are undervalued, highly profitable or with a long track record of outperformance and creating an index that filters out those that do not fulfil those criteria.  Read More

Read More

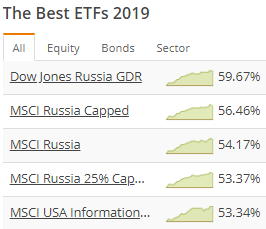

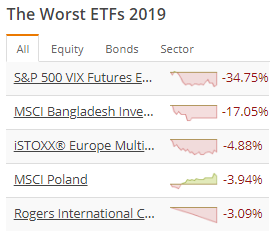

How well is Your ETF Performing?

How do you know if an ETF is performing in the way it should and delivering the results you wanted? How do you compare the likely future performance of different ETFs that track a common index? Merely looking at its performance over the previous year may not reveal much because markets rise and fall regardless of how well an ETF does its job. The measure used to assess the performance of an ETF is its ‘tracking difference’ which is one of the most important statistics to consider. Most ETFs aim to track an index—i.e. they try to deliver the same returns of a particular index; tracking difference is the discrepancy between the performance of the ETF and the performance of the index. 1-Year Performance ABC Index 8% ABC Index Tracking ETF 6.8% Tracking difference -1.2% Tracking difference is rarely zero and in most cases the ETF performance is poorer than the index it tracks; tracking difference can be small or large, negative or positive and are caused by the following factors:  Read more

Read more

Understand ETF Names

ETF names can look complicated, but you’ll soon decode them with our handy guide. Cryptic names can be off-putting, but they are usually based on a simple logic that can help you understand whether an ETF is right for you; once you know how to read ETF names you’ll be able to target your searches more quickly. An ETF name is built from keywords that reveal the product’s most important features; there are typically five key components: Provider – who issued the ETF? Index – which index does the ETF track? Regulatory information Share class – characteristics of the ETF Additional information – inter alia, domicile, currency, replication method, treatment of income.  Read more

Read more

Commodity ETFs

The main attraction of commodities is in their potential to diversify your portfolio beyond the staple asset classes of equities, bonds, property and cash. Commodities have shown a very low correlation to equities and bonds in the past and strongly outperformed them both during the high-inflation of the 1970s. That promise of performance in conditions that hit equities and bonds hard makes commodities worthy of serious consideration in an all-weather portfolio. Commodities, of course, are the raw materials of global production. The main commodity categories cover:

- Agriculture – example commodities include wheat and coffee.

- Energy – think oil and gas.

- Precious metals – gold and platinum are your poster boys.

- Industrial metals – zinc and copper, for instance.

- Livestock – hello lean hogs and cows.

Naturally you can gain exposure to the diverse trade in commodities through commodity ETFs. Commodity ETFs seek to capture the return on the major global commodities by tracking a commodity index and trading on the stock exchange. You can also track single commodities – for example gold – using another investment vehicle called an Exchange Traded Commodity (ETC).  Read more

Read more

Investing in ETFs with a Buy and Hold strategy

Buy and hold investing is a simple and effective strategy that saves investors from damaging their returns by market-timing and stock-picking. There is now overwhelming evidence that attempting to predict which securities will outperform, and when, is a losing strategy for the vast majority of investors. Even the most skilled fund managers can rarely do this with any long-term consistency. The few that do beat the market can have years of gains wiped out when their luck runs out or confer no actual benefit to ordinary investors once their fees and dealing costs are deducted. The alternative to accepting sub-average returns in a doomed attempt to beat the market is to accept the market return by investing in ETFs using a Buy and Hold strategy  Read more

Read more