Jan

2024

Full steam ahead for London’s IPO Markets in 2024!

DIY Investor

8 January 2024

For over 20 years, I’ve had the honour of helping companies start their journey as a listed company, in London and in other leading marketplaces. So as I close out another year, I wanted to give my thoughts on things that have happened both in our industry and personally and what I think this year will bring – by Jon Roast

For over 20 years, I’ve had the honour of helping companies start their journey as a listed company, in London and in other leading marketplaces. So as I close out another year, I wanted to give my thoughts on things that have happened both in our industry and personally and what I think this year will bring – by Jon Roast

It was a very challenging 2023 in many ways with conflicts starting all over the globe, interest rates remaining high, inflation still above where the Bank of England (BOE) would like it to be, supply chain issues, earthquakes, volcanic eruptions and volatile political issues having a profound effect on global markets. Make no mistake, London is not the only listing venue struggling.

However, there have been some notable listings in the UK last year with DAR Global and Ithaca Energy being the standouts proving that London Stock Exchange (LSE) is still a premier listing venue. In fact, we saw more companies exploring the possibility of listing in the UK when their main listing is held in another jurisdiction in the form of DIs.

I think, however, for the short to mid-term this year we will continue to see plenty of M&As, making me slightly fearful for the smaller companies. In terms of brokers and registrars, the income they receive for supporting the M&A of the companies that are on their books is not being replaced as the market shrinks and new money slows down.

Now, while that does sound a bit depressing to start off a new year, I believe that there is light at the end of the tunnel. Mergers and acquisitions will continue but the private equity pumped into businesses over the last couple of years to support them through some very challenging times will start to slow.

There is only so much PE around and those family offices/private individuals will want to have some sort of exit strategy as they look to reinvest in something else. This means that listing to release equity can may again become a viable option. The caveat being that market conditions need to be right!

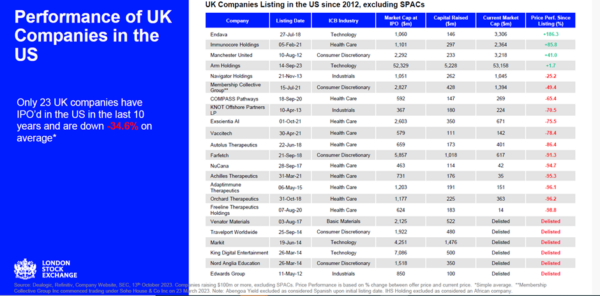

We also need to promote the UK more. Press articles around London as a listing venue have been mainly negative and the narrative has certainly been that a US listing would give a better valuation and liquidity option. The below slide (kindly supplied from the LSEG) would suggest that a listing over the pond may not be all sunshine and rainbows.

The listing reforms that UK markets are waiting on should have a positive effect on London becoming the go to listing venue in the future. We must make listing a business easier and cheaper.

We at @link understand that budget certainty is a big thing when listing and we have seen since July 2022, 36 companies float on the Main Market or AIM. Of those companies, 30 of them had a Market Cap of under £50 Million. We have devised a new offering aimed at those companies with a Market Cap of £50M or under which also gives us a competitive edge on our pricing.

In 2023 I hosted a lunch and learn webinar which examined the grittier things companies need to know before they make the big decision to go public. This gave us an opportunity to dive deeper into what it takes to list. The roadshows/funding meetings etc. are only the tip of the iceberg. Please feel free to get in touch if you want some further information on how we can help you with your listing.

With our brand new investor centre launch https://www.linkedin.com/posts/link-group-lnk_wearelinkgroup-capitalmarkets-shareholderengagement-activity-7141041635768938499-ncyN?utm_source=share&utm_medium=member_desktop and our Miraqle platform in its final stages of testing, 2024 will be a transformative year with this market first product.

Now that we have closed out 2023, I must mention that in 2024 we will have a new home as the business moves even closer to the heart of the city and we will also (shareholder and regulatory approval permitting) have a new owner in MUFG , a NYSE and Tokyo listed business, which will help us at Link Group (LNK) achieve our goal of being the global leader in shareholder solutions.

I wish everyone a happy New Year and I look forward to speaking to old and new contacts in 2024.

Leave a Reply

You must be logged in to post a comment.