Oct

2024

Green green grass

DIY Investor

23 October 2024

Why the biotech sector is bouncing back to rude health…by Jo Groves

Why the biotech sector is bouncing back to rude health…by Jo Groves

Billionaire hedge fund manager David Tepper once remarked: “I am the animal at the head of the pack. I either get eaten or I get the good grass.” The holy grail of investing is arguably finding the most promising pastures ahead of the crowd, with early-bird investors often reaping the greatest rewards.

The biotech sector might just fit the bill on the promising pastures front, with the Nasdaq Biotechnology Index (NBI) bouncing back from its post-pandemic downturn to deliver a total year-to-date return of 13% (in US dollars). A correction of the heady valuations reached in the pandemic may have been somewhat inevitable (and further exacerbated by rising interest rates) but the Darwinian shake-out has created a higher-quality universe for investors.

Ailsa Craig and Marek Poszepczynski, managers of International Biotechnology Trust (IBT), categorise the cyclicality of the investment environment into five stages, from despair and recovery through to euphoria and correction. They believe the biotech sector is entering the mid-cycle ‘equilibrium’ stage where improved investor sentiment drives up valuations, with the potential for attractive returns.

Investor sentiment may be cyclical but the underlying biotech sector itself is not: the sector has driven transformative change over the last few years from game-changing weight-loss drugs to revolutionary gene and cell therapies ‘treating the untreatable’. It also enjoys strong tailwinds from the increasingly complex needs of ageing populations and increasing prosperity in emerging economies, which should underpin growth in the decades ahead.

Why the future’s brighter…

1. Clinical trials hit record high

Clinical trials are the lifeblood of the biotech sector, validating the safety and efficacy of new treatments, but their significance extends well beyond regulatory compliance. Positive trial results can drive future revenue potential, enhance investor confidence and shape future innovation by validating new technologies.

The chart below shows the continued growth in global clinical trials, which is forecast to hit a record high this year (with Q1 trials already exceeding the annual total in 2023).

Innovation continues apace, with new methods of treatment (such as cell-based, gene and RNA therapies and gene engineering) helping to address previously unmet medical needs and rapid advances in treatments for diabetes and obesity. This acceleration in innovation should support revenue cycles over the next decade, with a record 70-plus novel medicines approved in the US and Europe in 2023.

2. Upturn in equity financing

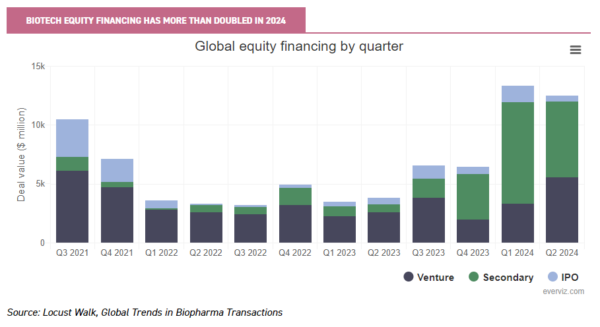

The appetite for biotech equity financing is a key indicator of the health of the biotech sector and an important source of funding for earlier-stage companies. There has been a sustained uptick in equity financing in the last six months, as shown in the chart below, and this should continue to benefit from an improving macroeconomic backdrop as interest rates start to fall.

Venture financing in the biotech sector has rebounded from its downturn in 2022 and 2023 to hit its highest level in three years in the last quarter, including renewed interest in earlier-stage companies. It was a similar story for secondary offerings, with the combined deal value in the first two quarters of 2024 comfortably eclipsing the aggregative total for the previous ten quarters combined.

The IPO pipeline also serves as a litmus test of the biotech sector’s health, providing access to public markets and an exit strategy for venture capital investors. Early signs of a modest rebound are emerging, with 15 companies going public in the first eight months of 2024 and more waiting in the wings. As companies remain private for longer, those going public tend to be higher quality and less speculative than during the IPO bubble of the pandemic.

3. Attractive valuations

Despite the biotech sector’s recent rally, valuations remain subdued: the S&P 500 biotech sector is currently trading on a forward price-earnings ratio of 19 (according to Yardeni), almost 25% below its pandemic peak, which could provide an attractive entry point for investors.

Ailsa and Marek, managers of IBT, added in a recent note: “The small-to-mid-sized biotech sector currently trades on an enterprise value/cash ratio of approximately 2, which means that the value of all the companies in this size bracket is around twice the value of the cash they have in the bank.

“In the context of history, this looks attractive. Historically, the sector has traded on an EV/cash ratio of 3.0 to 3.5x for most of the last 20 years. Importantly, cash levels are robust with the average small-to-mid-sized biotech company currently having a healthy cash runway (the time until they would run out of cash at their current rate of spending) of 2.2 years, suggesting the sector is well-financed.”

4. Outperformance when rates fall

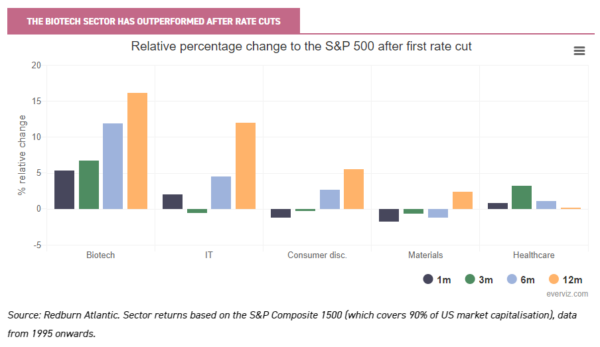

Due to the time taken to develop new drugs, the biotech sector is sensitive to interest rates (and the associated cost of capital) and, as a result, has typically outperformed other indices when interest rates start to fall.

The chart below shows the relative sector performance against the S&P 500 in the 12 months following the first cut in interest rates. Of the sectors achieving positive returns at the year mark, the biotech sector has delivered by far the highest returns and outperformed the S&P 500 index by an average of 16% in the first year. It has also rewarded early-bird investors with a 5% and 12% outperformance in the first month and six months respectively.

With interest rates having fallen in the UK, and the Fed expected to follow suit in the next couple of months, this shows the potential upside for investors.

Panning for gold

However, the biotech sector presents some challenges for retail investors. While it may be difficult for active managers to beat the S&P 500 index due to the dominance of the magnificent seven, a active approach to stockpicking in the biotech sector may make a significant difference to returns. As part of this, specialist scientific knowledge is required to understand highly complex medical technologies and clinical trial data, together with the relevant regulatory frameworks that are fundamental to success.

Ailsa Craig and Marek Poszepczynski, managers of IBT, blend this scientific and industry knowledge with a combined experience of 25 years working on the fund. The managers use various tools to manage risk for investors: they avoid companies that are lower-quality, over-valued or developing ‘me-too’ drugs in favour of well-priced, well-managed and well-financed companies targeting unmet medical needs with drugs that are near to (or have) approval.

Ailsa and Marek adopt a portfolio approach by backing a number of companies targeting the same clinical need rather than trying to pick a likely ‘winner’ and also reduce exposure ahead of binary events such as clinical trial results.

In addition, the level of risk is tailored to the stage in the market cycle, with the managers recently increasing the trust’s small and mid-cap weighting due to the more positive environment. While this potentially increases the volatility of the portfolio, it has the potential to deliver higher returns.

This focus on risk management has underpinned IBT’s returns, with the trust achieving a five-year net asset value return of almost 50% despite the challenging market conditions. IBT also offers an income for investors and is currently trading on a dividend yield of over 4%.

Looking ahead, falling interest rates and improving investor sentiment should continue to provide a tailwind for the biotech sector. Given the secular growth drivers of an older, richer and sicker population, the biotech sector may well appeal to investors looking for the greenest grass ahead of the pack.

All data as at 18/09/2024 unless stated otherwise.

View the latest research note on IBT here >

Disclaimer

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by International Biotechnology. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Leave a Reply

You must be logged in to post a comment.