Jan

2022

Green off-piste with BlackRock ESG multi-asset ETFs

DIY Investor

13 January 2022

My recent Vanguard LifeStrategy analysis triggered lots of reactions and messages with a couple of recurring questions from readers:

- Can I invest through an ESG-friendly portfolio?

- Can it include Inflation Linked Bonds?

While I suspect the majority of UK and European Investors will choose Vanguard for its simplicity, BlackRock has something to offer that is slightly off-piste. A greener one.

BlackRock recently launched a series of ETFs that aim to compete with Vanguard LifeStrategy. The funds are also available in GBP.

This analysis below is a comparison, not an introduction to fund of funds. If funds of funds, like Vanguard LifeStrategy, are new to you read this first.

What are BlackRock Multi Asset ETFS?

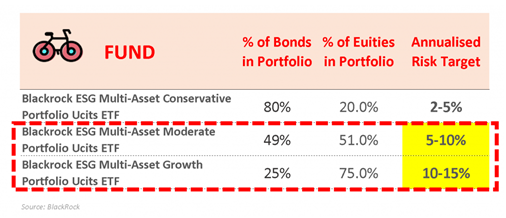

The three Blackrock ESG multi-asset ETFs that were launched use iShares ETFs to provide access to stocks and bonds according to three risk profiles – conservative, moderate and growth – with the aim of delivering a total return; each is available on XETRA (EUR) and LSE (GBP)

BlackRock ESG Multi-Asset Conservative Portfolio UCITS ETF – MACG

BlackRock ESG Multi-Asset Moderate Portfolio UCITS ETF – MAMG

BlackRock ESG Multi-Asset Growth Portfolio UCITS ETF – MAGG

What is the difference between BlackRock Funds?

BlackRock ESG Funds’ Risk Targets

The BlackRock funds differ by the level of risk; the allocation to equity and bonds is only indicative – BlackRock is not committed to rebalance these on a regular basis to these levels.

The investment objective is to generate the highest Total return within a risk limit (volatility target calculated on a 5-year basis); e.g. the BlackRock ESG Multi-Asset Growth Portfolio UCITS ETF has a target annual volatility of 10-15%, measured as an average over 5-years.

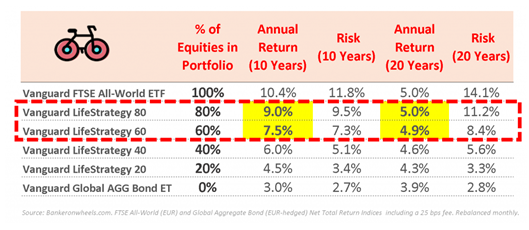

How is this objective different to Vanguard?

Vanguard LifeStrategy historical risk

Risk by Vanguard is measured by the allocation to equities (that’s why LifeStrategy Funds are called Relative Risk Funds); BlackRock Funds target a volatility level (these funds are called Target Risk Funds)

Given the levels of risk observed on LifeStrategy funds over the past two decades, the broad guidance seems adequate. E.g. the BlackRock ESG Multi-asset Growth Fund investors may reasonably expect that these ranges could vary between 70% and 80% of allocation to Equities (unlikely to go materially higher given that target volatility is measured over 5-year horizon, and tail risks, like 2001 or 2008 can have a major impact over such time horizon).

That’s one of the reasons BlackRock funds are active – their objective is to keep volatility within the range no matter the market conditions.

BlackRock ESG Multi-asset vs. Vanguard LifeStrategy

What makes them similar?

Vanguard LifeStrategy and BlackRock Multi Asset ETFs have some common charcateristics:

- Provided by world’s top two largest ETF asset managers with strong track record

- One cheap (0.25% TER) fund covers all your needs and provides exposure to world equity markets and bonds

- A choice of three/four investor risk profiles

- Regularly rebalanced by the asset manager to maintain risk profile

What makes BlackRock Multi Asset ETFs different?

BlackRock ETF offering provides some differentiating factors:

- Actively managed

- BlackRock makes an ESG commitment – at least 80% of assets track ESG Indices

- Targeting a certain risk profile not fixed allocation to Bonds and Equities

What are the underlying ETFs?

BlackRock is using an asset allocation that is not too dissimilar to a World Equity Benchmark; ultimately, they want to compete with Vanguard LifeStrategy – I suspect they won’t venture too far away from a World Index.

However, the underlying funds are using iShares ETFs that have ESG benchmarks e.g. over 50% of the exposure to US Equities are through ETFs tracking an index very closely correlated to MSCI USA – an Index slightly larger (600+ companies) than the S&P 500:

- MSCI USA ESG Enhanced Focus Index

- MSCI USA SRI Select Reduced Fossil Fuels

Index - MSCI USA ESG Screened Index

Why does BlackRock need three different ETFs to track one market? Probably for the same reasons as Vanguard LifeStrategy – due to limitations imposed by UCITS (20% threshold per ETF). You shouldn’t be too concerned about that.

How much does it differ from passive funds?

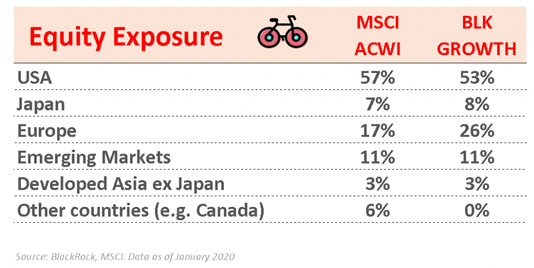

EQUITY – Illustrative difference in exposure

BlackRock ETFs are not tracking any specific benchmark but they have a large overlap with a World ETF (and broadly similar composition to passive funds like LifeStrategy).

I had a look at the Growth Fund Equity portfolio and there seems to be a home bias in the allocation and lack of certain other countries (e.g. Canada). Whether that’s an active call or an ESG consideration is not entirely clear.

This is, of course, subject to change with the portfolio managers’ forward looking views.

BONDS – Illustrative Allocation

Looking again at the growth fund, bonds seem to be well diversified across traditional and inflation linked bonds.

This is great and something Vanguard LifeStrategy (EUR) lacks (LifeStrategy in GBP does include them, though).

Are the bonds currency hedged?

The documentation is not fully clear on how exactly currency hedging is performed, but given the volatility targets, bonds are certainly hedged. E.g. the conservative fund has 80% of exposure to bonds, including 50% to US Treasuries and US Inflation Linked Bonds. The aggregate currency exposure is 93% in EUR. For the Growth fund, some of the underlying holdings are short USD FX forwards confirming this also being the case.

The most likely scenario is that the EUR funds are dynamically hedged to meet the goal of target portfolio volatility. It is also a view of the fund’s portfolio manager. The GBP Funds are then hedged vis-à-vis the Fund Base currency (i.e. EUR).

What else do I need to know?

Similarly to Vanguard LifeStrategy, BlackRock ESG Funds have been recently launched in EUR. In that respect, they do not have a track record.

However, BlackRock has already tested the ground in the UK with a range of funds called BlackRock MyMap. Both the UK and the newly established European Funds are managed by the same portfolio managers – Rafael Iborra and John Wang

There are numerous factors you need consider before buying an ETF; some apply to BlackRock’s ESG Multi Asset ETFs – I have listed them below.

Key considerations

- Available in Accumulating UCITS Format

- Available to UK and European Investors

- Active funds with potential biases towards regions/sectors

- Lower US withholding taxes (Irish Domiciled Fund)

- Physical replication

- Available on Xetra and London Stock Exchange

- No assets under management yet

- Slightly confusing components due to UCITS law

Conclusions

When should you choose BlackRock

From a passive investor’s perspective, the main selling points for these funds vs. Vanguard LifeStrategy are:

- Strong ESG Focus

- Inclusion of Inflation Linked Bonds

Note, that UK Vanguard LifeStrategy funds have inflation linked bonds so that’s only a differentiating factor for European investors.

BlackRock is managing these funds actively, which may or not outperform a more passive approach like Vanguard.

Show me the Funds

These are the funds with their ISINs on the LSE; most brokers would allow you to access Xetra – see ISINS here.

What’s the difference between accumulating and distributing? Here is the answer.

| FUND | Distribution policy | ISIN |

| BlackRock ESG Multi-Asset Conservative Portfolio UCITS ETF GBP Hedged (Acc) | Accumulating | IE00BLP53N06 |

| BlackRock ESG Multi-Asset Moderate Portfolio UCITS ETF GBP Hedged (Acc) | Accumulating | IE00BLLZQ797 |

| BlackRock ESG Multi-Asset Growth Portfolio UCITS ETF GBP Hedged (Acc) | Accumulating | IE00BLLZQ912 |

Good Luck and keep’em* rolling !

(* Wheels & Dividends)

Alternative investments Commentary » Alternative investments Latest » Commentary » Exchange traded products Commentary » Exchange traded products Latest » Isas commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.