Feb

2023

Inflation and Gold: The case for holding Gold in difficult times

DIY Investor

20 February 2023

When Gold works against inflation and why it can succeed when equities and bonds fall – by Kianusch Cacace

Introduction

The main reason to own gold in your portfolio is that it can work when the other major asset classes fail.

Take the current slump – triggered by an energy crisis and compounded by war, surging inflation, and rising interest rates. Both equities and government bonds have tumbled together (which historically happens about a third of the time during major market downturns).

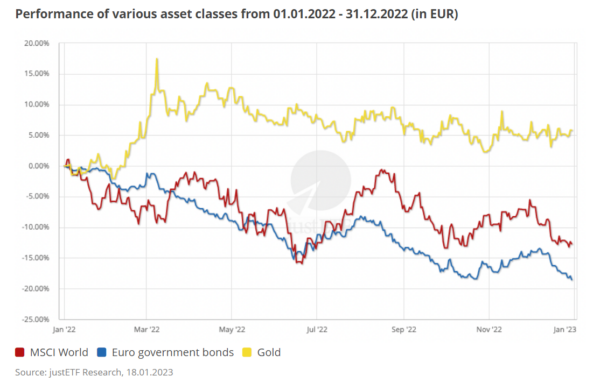

Yet gold has stayed in positive territory throughout as you can see in this chart:

The chart illustrates the potential of gold to add an extra level of diversification beyond equities and bonds.

- Gold (the yellow line) was up 9% when World equities (red line) were at their lowest ebb – slipping to -15,9% in June 2022.

- And when Euro government bonds (blue line) fell to -18.5% on New Year’s Eve 2022, gold provided some cheer with a 5.8% return.

The precious metal typically enjoys low correlations to both those asset classes – thus it’s capable of bolstering your portfolio when more conventional holdings buckle under pressure. But there’s more to the gold story than that. It’s no coincidence that equities and bonds have been hit hard in a year when inflation got out of hand. High and unexpected inflation has historically hurt the returns of the two main asset classes. And gold outperformed the last time this happened, too…

The inflationary 1970s

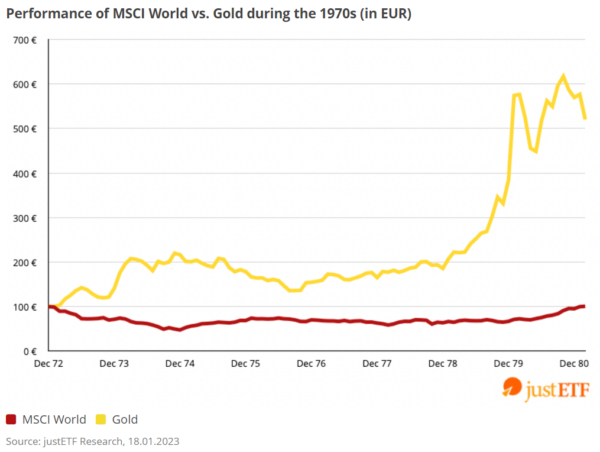

The 1970s were years of economic strife, rampaging inflation, and eye-watering interest rates.

Equities and bonds both suffered back then, but gold bucked the trend:

While world equities slipped underwater for eight years (and bonds dropped too), gold thrived in the conditions of social and economic turmoil that marked the era. And this gives us a clue as to why gold belongs in a fully diversified portfolio.

Investors often turn to gold during times of great fear and uncertainty about the future. The yellow metal’s role as a long-term store of value reassures people that it’s a sound repository for their wealth – irrespective of the fate of conventional assets such as equities, bonds, and cash.

Does that mean gold is a good inflation hedge?

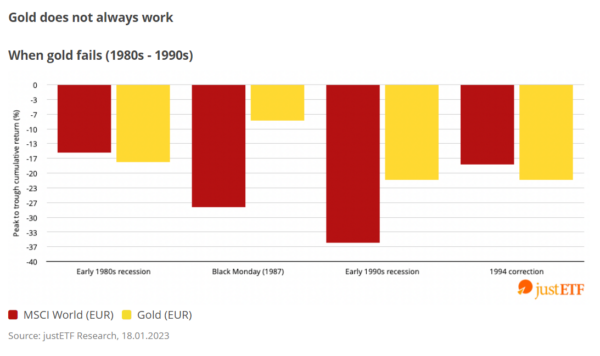

If the question is “will gold always beat inflation,” then the answer is “no.”

If the question is “has gold historically coped with extreme inflation better than other asset classes,” then the answer is a qualified “yes.”

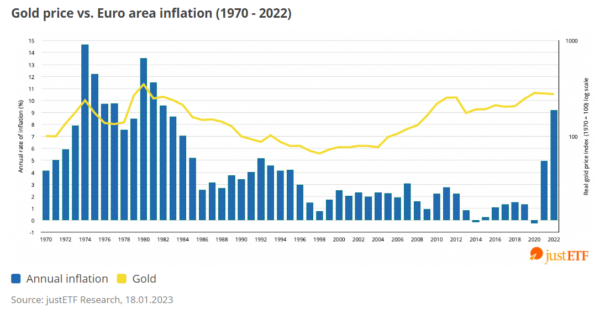

This graphic shows that gold dealt admirably with the two bouts of high, unexpected inflation that bookend the half century from 1970 to 2022:

See how the gold price rose in real terms during the 1970s and, again, as inflation took off in 2021-22. But the gold price dropped from 1980 to 1999 – regardless of inflation’s path during those years. You can also see that the gold price does not reliably track inflation’s fluctuations across the second half of the graph. If gold was a true inflation hedge then the yellow line would be much flatter. Instead its price has ranged widely without paying much heed to inflation’s rise and fall.

Before 1971, gold’s price was often artificially constrained. Gold was controlled by its peg to the US dollar (1944 – 1971) or by the gold standard system (which collapsed in the 1930s). Thus we can’t put much weight on gold’s data points before the 1970s. And in the contemporary era there have only been two periods when inflation escaped its leash – as discussed above. So while gold’s record against inflation is good during both those episodes, we cannot draw definitive conclusions from only two events. However, there is another reason to diversify into gold.

Gold as a diversifier against stock market crashes

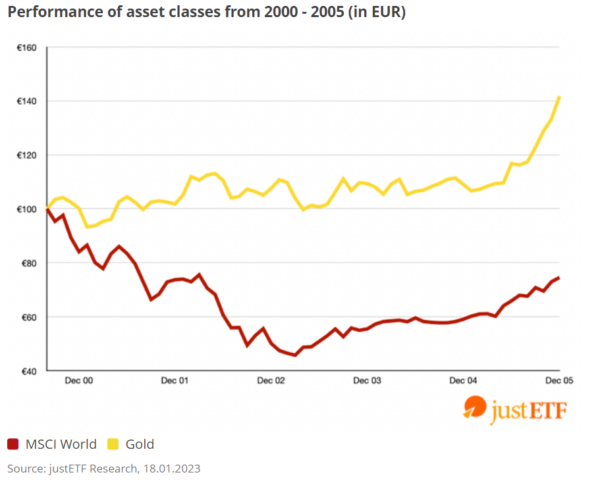

Gold’s ability to rise when World equities fall is even more impressive than government bonds in the 21st Century.

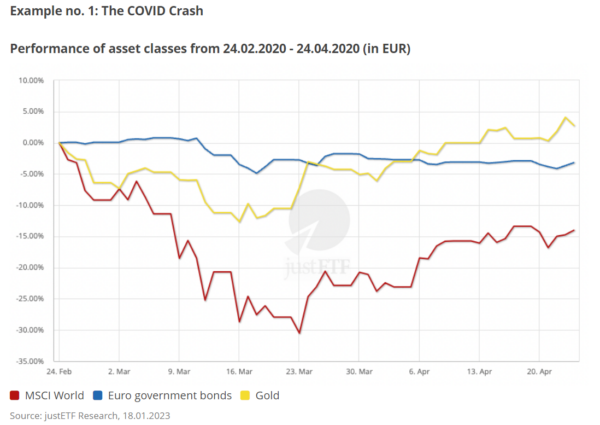

Let’s quickly run through the charts that show how good gold was during every bear market and correction dating back to the bursting of the dotcom bubble.

justETF noteWe’ll compare a gold ETC (yellow line) versus a MSCI World ETF (red line) and a European government bond ETF (blue line) during the critical months of each downturn.

Gold diversification rating

Beat equities: Y

Beat government bonds: N

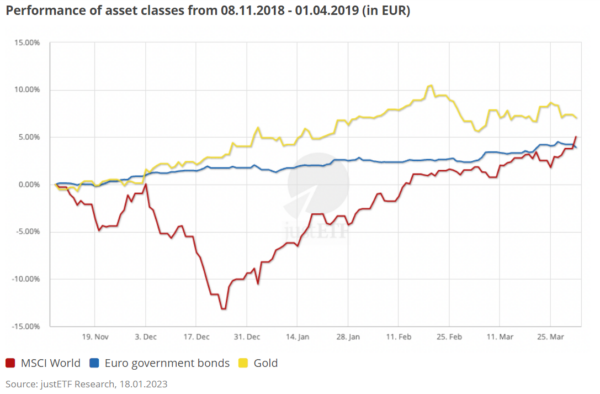

Example no. 2: 2018 Global Stock Market Downturn

Gold diversification rating

Beat equities: Y

Beat government bonds: Y

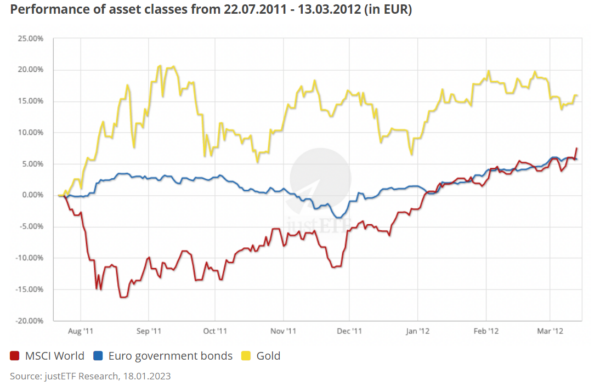

Example no. 3: August 2011 Stock Market Downturn

Gold diversification rating

Beat equities: Y

Beat government bonds: Y

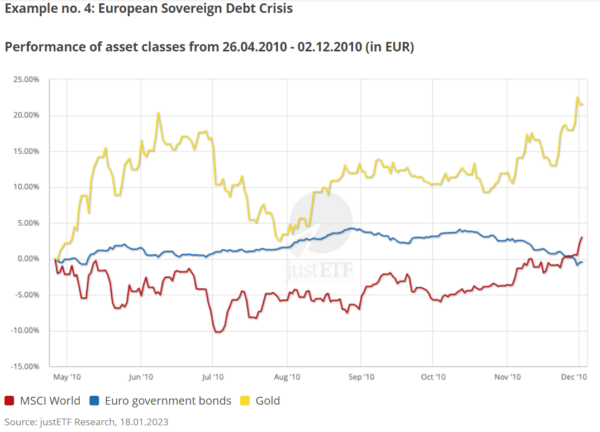

- The aftershocks from the Global Financial Crisis continued to shake the world. As equities sagged 10% in July 2010, government bonds only managed 1%, but gold was the place to be.

- The precious metal spiked over 20% in June and was still more than 20% ahead of equities when the market bottomed in July.

Gold diversification rating

Beat equities: Y

Beat government bonds: Y

The aftershocks from the Global Financial Crisis continued to shake the world. As equities sagged 10% in July 2010, government bonds only managed 1%, but gold was the place to be.

The precious metal spiked over 20% in June and was still more than 20% ahead of equities when the market bottomed in July.

Gold diversification rating Beat equities: Y

Beat government bonds: Y

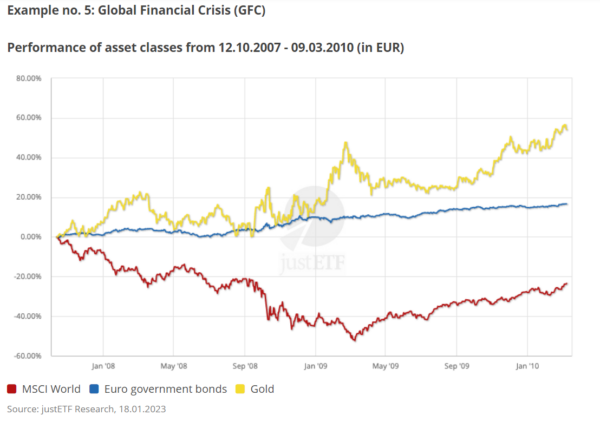

- The greatest threat to the financial system since the Great Depression saw equities crash 52.4% in March 2009.

- But Gold had its finest hour since the 1970s – registering a 38.3% gain on the darkest day for the market.

- Bonds performed their defensive duties too: up 10.4% on 9 March.

But the plaudits went to gold as the asset that shines when investors fear financial chaos.

Gold diversification rating

Beat equities: Y

Beat government bonds: Y

Example no. 6: Dotcom bust

Good as gold

One reason why gold has performed so well from the dotcom bust onwards is that when the world panics, investors often seek refuge in dollar priced assets. And because gold is priced in dollars, European owners enjoy an exchange rate bonus on top of their gold returns, as the dollar strengthens against the euro.

When the dollar falls against the euro then it will weigh down gold prices for Europeans. If that happens in a slump then gold could make the situation worse not better. This is the downside of currency risk. Moreover, while gold had a spectacular 1970s and 2000s, it suffered a 19-year bear market from 1980 to 1999. So like every asset class, gold should be handled with care. But as investors our best protection against risk is adequate diversification.

That’s why there’s a good case for a strategic asset allocation of 5% to 10% in gold – based on its historical record as a portfolio diversifier. If the precious metal also continues to do well when inflation and interest rates maul equities and bonds then that’s worth the asking price alone. Discover the best gold ETCs and ETFs on the market.

Alternative investments Commentary » Alternative investments Latest » Brokers Latest » Commentary » Exchange traded products Commentary » Exchange traded products Latest » Latest

One response to “Inflation and Gold: The case for holding Gold in difficult times”

Leave a Reply

You must be logged in to post a comment.

[…] post Inflation and Gold: The case for holding Gold in difficult times appeared first on DIY […]