Sep

2023

Investing Basics: A beginners guide to investing

DIY Investor

25 September 2023

Often bracketed as ‘savings and investment’, the two are in fact very different and moving from the former to the latter can sometimes be seen as a daunting prospect. – writes Christian Leeming

However, if you believe as we do that we are all going to have to take more personal financial responsibility, many more people may be seeking returns from stock market investments in the future.

Knowledge and financial education are key to debunking a financial services industry that has long profited from imparting its knowledge, and with so many sources of information and social media interaction, it is now easier than ever for those that spend a little time on their financial education to get to grips with the basics and build a long term investment strategy.

Surveys have shown that despite the ‘avocado on toast’ image, young people are relatively disciplined when it comes to money but are inclined to save rather than invest; however with such meagre returns on offer, by being better informed they could become confident enough to benefit from the fact that over time stock market investments deliver demonstrably higher returns than any other investment.

For the sake of these introductory guides to investing, it is important to make the differentiation between investing and trading.

Muckle is committed to encouraging more and more people to embark upon a long term investment strategy; measured wealth creation in pursuit of long-term financial independence.

There are plenty of get-rich-quick sites out there and for some the adrenaline rush provided by borrowing money to buy into the latest crypotocurrency off the rank may give certain types their fix, but Muckler take a rather more measured approach.

Here are some basics to help those new to investing:

What is an investment?

When you put your money into a savings account, the bank rewards you with a small amount of interest; the amount of interest is usually agreed at the time, and your money is safe and yours to withdraw.

When you use your money to invest in, for example, shares, funds, bonds, wine, art or property, you are gambling that the value of that asset will increase and you will make money by selling it at a higher price than you paid for it.

You will have shunned the guaranteed returns and security of saving and taken a risk with your money in the hope of achieving a better return; the risk/return curve has it that the greater the risk you take, the greater the potential profit you may make. Conversely, by definition, the higher the risk you take, the greater the chance that you may lose some, or all, of your money.

Not something to undertake lightly and worth spending some time getting to grips with the basics.

This introduction will assume that however they are accessed, the underlying investments are in quoted companies on the stock market; you may become confident enough to invest in individual companies, or you may seek so called collective investments such as funds or ETFs, but the fundamental principle is that you are investing in a company or range of companies in the hope that they will perform well and go up in value.

The different financial products, or ‘asset classes’ will behave differently in certain circumstances and will be explored in a later post, but that is the basic premise.

Any stock market investment is a gamble – you may hit it rich, you may lose your shirt – but education is the key to managing the risks you are taking; for most, investing will bear little resemblance to the Wolf of Wall St – it will involve selecting a small number of investments and monitoring them over time, ensuring that they are able to benefit when markets rise and survive when they fall.

All to be explored in future editions, a solid portfolio can deliver dividend income over time and investing for a long duration will allow you to achieve the ‘free money’ from Einstein’s ‘eighth wonder of the world’, compound interest; interest paid on interest.

What is a stock market?

When you invest in the shares of a company, you effectively own a piece of that company, and hope to benefit from its future performance; a stock market is simply where those that wish to buy shares in a company meet those that have some to sell.

Companies issue shares to raise money to further grow their business and those that become shareholders do so in the hope that they will benefit from that development; shareholders can sell at any time, and the market decides the price – shares in a popular company, deemed to offer potential, will be more sought after, and therefore expensive than those in a company on the wane.

So called open outcry is largely a thing of the past as technology allows buyers and sellers to be matched efficiently and cheaply; billions of pounds are traded every day on the London Stock Exchange with The FTSE 100 being an index of the most valuable companies in the country.

In addition to a company’s performance, many factors may affect its share price such as broader economic and social issues such as Brexit, or what is termed ‘sentiment’ when markets have a particular ‘feel’ for a stock and respond as a collective.

What returns can I expect from my investment?

There is of course no definitive answer to this; you are putting your money at risk and the stark fact is that by investing you may lose some, or all of it; with some investments, you can even lose more than your initial investment, but that is for another day.

The key is to find an investment that gives you the best chance of achieving your target with the minimum amount of risk; those currently receiving 0.5% on their savings may set a relatively modest target of 5% annual return on a basket of investments.

Investments behave differently – those that invest in bonds are guaranteed a certain level of return, and are often called ‘fixed income’ products; others come with no such guarantee – that’s why you’ll see the phrase ‘past performance is no indicator of future success’.

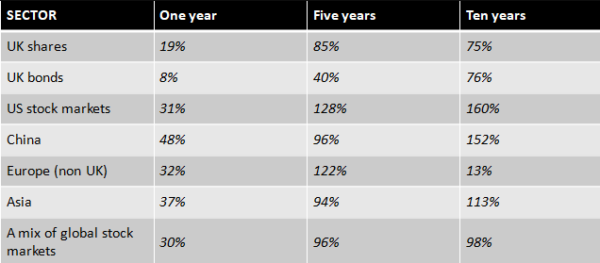

The following is based upon the performance of various investment funds, to give a flavour of each sector’s historical performance:

Is investing right for me?

Historically stocks and shares have outperformed money in savings accounts, but that’s no guarantee they’ll do so in future; your decision to become an investor is entirely based upon your personal circumstances, objectives and response to a potential loss.

Before considering investing, it makes sense to clear your debts as it is entirely possible that you are paying more in interest than you could achieve from your investments.

An investment strategy is often much more effective if there is an end game – possibly the purchase of a property or school fees.

Investing is a long game rather than a quick fix, and embarking upon risky investments in the hope of achieving returns to solve other financial woes is a sure-fire way to compound them.

Investing is not for everyone, and for some the poor returns on offer from even the best performing Cash ISA may be acceptable in return for a good night’s sleep.

However, if you do decide to become an investor, it is essential to keep it personal – set your personal financial goals, understand your response to risk or potential loss, and unless you are using a collective investment or using an automated investment platform such as a robo advisor, do your own research; no ‘racing certainties’ from the bloke down the pub!

Next time out we will be looking at what you can invest in, and how to do it; in the meantime, here are the five golden rules for investing:

Brokers Video » Equities Video » Latest » Take control of your finances video » Video » Video General » Video Latest

Leave a Reply

You must be logged in to post a comment.