Oct

2023

Investing basics: Investing in bonds with an ETF

DIY Investor

21 October 2023

Bonds ETFs provide ample opportunities to invest in the space of low risk and high risk fixed income – writes Dominique Riedl

As with equities, there are many types of bond ETF available, although it’s fair to say that the purpose of bonds in a portfolio is less widely understood.

Bonds are most commonly a promise made by a government or company to pay a guaranteed flow of interest in exchange for a loan. The loan is made for a set number of years and, if all goes well, then you’ll get your capital back at the end of the period on top of the interest earned along the way – whereby the actual, effective interest rate can also be negative in today’s low-interest world.

Bonds are in general less volatile than equity

Bonds are popular because they’ve historically been less volatile than equities. Meanwhile, returns have been higher than cash although not as strong as equities over the long term.

Another positive feature is that highly rated government bonds have often performed well during times of market stress when equities falter.

This means bonds can be used to diversify a portfolio away from equities and to shore up returns during recessionary or deflationary conditions. As a low-risk portfolio component, bonds, therefore, help to reduce losses, especially in times of crisis.

Bond ETFs are an easy mean to invest in fixed income

Because the bond markets are generally less transparent, liquid and well known to retail investors than the equity markets, many prefer to get their bond exposure through funds, like ETFs.

As with their equity cousins, the role of a bond ETF is to approximately match the performance of an index that benchmarks a group of broadly similar securities.

Bonds ETFs provide different facets for any risk appetite

For example, government bond ETFs will track the performance of UK gilts or US Treasuries or perhaps the sovereign debt of emerging markets.

Corporate bond ETFs seek to match the return of debt securities issued by companies.

Some ETFs will mix the two and add in mortgage-related and local authority debt to provide a highly diversified total market product.

Meanwhile, an inflation-linked bond ETF’s primary role is to provide an inflation-resistant return whether sourced from government or corporate entities.

Bond trackers are grouped not only by issuer and geography but also by:

- Credit rating

- Maturity

- Duration

- Currency

Let’s take each one of these characteristics in turn. Note, because ETFs track groups of bonds, they will generally report holdings in terms of averages e.g. average credit rating, maturity or duration.

Credit rating is a measure of the quality of the bonds tracked by the ETF. The higher the rating, the less likely the bond’s issuer is to default on the loan and damage your returns. Ratings are provided by the main credit rating agencies – Standard and Poor’s (S&P), Moody’s and Fitch.

Each agency’s system is slightly different but according to S&P anything rated BB+ or below is classified as a junk (or high yield) bond. Any bond that makes BBB- or above is known as investment grade. The UK Government’s current rating is AAA according to S&P which is the highest rating possible.

In general, bond ETFs are only suitable as a low-risk component in the portfolio if the creditworthiness of the securities they contain is rated at least BBB.

Why bother with junk bonds? Because they offer higher rates of interest to convince investors to take on the credit risk.

Maturity is the length of time before the issuer must pay back the full amount of the loan that underpins the bond.

Long maturity bonds are more sensitive to interest rate changes

ETFs are often characterised by a number that represents the range of maturities their bonds cover. For example, the SPDR Barclays 1-5 Year Gilt ETF holds UK government bonds with a maturity anywhere between 1 and five years. The longer the average maturity, the greater the ETF’s volatility. This is because a long-term bond has a greater chance of being adversely affected by rising interest rates and inflation in comparison to a short-term bond that will pay back its entire cash flow in a few years.

Long-term bonds tend to pay higher rates of interest to compensate for the greater volatility.

Duration is another way to measure the potential riskiness of a bond. The average duration of 10 means that for every 1% rise in interest rates, the bond will lose approximately 10% in value. If rates fall by 1% then the ETF would gain 10%.

Bond values fall when interest rates rise (and vice versa) because new bonds will be issued paying higher rates of interest. Supply and demand mean that an existing bond’s price must fall to compete against the higher payout of the new bond.

In reality, bond ETF values will not change precisely as predicted by duration but it’s still a useful measure. The less volatility you can stand then the lower the average duration you should be looking for in your ETF.

Be aware of currency impact when investing in foreign bonds

It’s important to check the underlying currency of your bond ETF because investing in foreign currency assets is likely to add to the product’s volatility. For example, if you invest in US Treasuries and the pound soars against the dollar then the returns of your bond ETF will be reduced as the value of the underlying assets are now worthless in pounds.

Many investors stick to domestic currency bonds to avoid unwanted volatility. That said, you may be able to earn higher yields by investing in the bonds of less stable foreign currencies and you can also reduce currency risk by investing in hedged bonds.

The range of bond ETFs has proliferated in recent years as investors have sought to diversify their sources of fixed income return. However, the least volatile bond trackers are still likely to be high-quality, short-term domestic government bonds. The UK equivalents are gilt ETFs with maturities of 0 to 5 years.

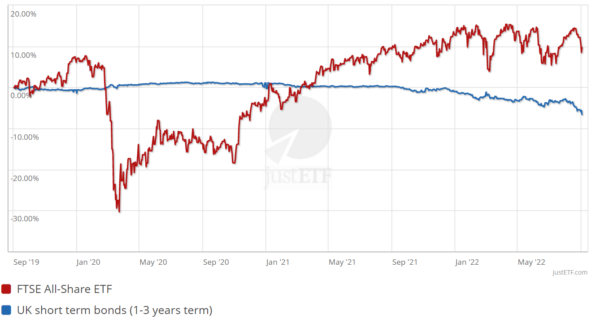

Performance of UK short term bonds (1-3 years term) versus FTSE All-Share ETF in comparison

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education

Leave a Reply

You must be logged in to post a comment.