Nov

2024

Investing Basics: Investing in Emerging Markets with ETFs

DIY Investor

3 November 2024

Emerging Markets are a must for globally diversified investors. We explain how you can use ETFs to easily invest in fast-growing Emerging Markets economies – writes Jan Altmann.

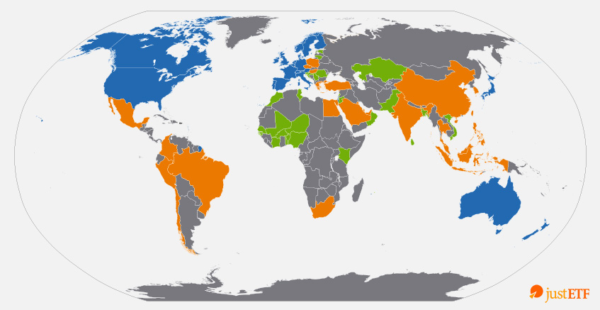

Entry criteria for the Emerging Markets Club aren’t strictly defined but notable members include the BRICS (Brazil, Russia until March 2022, India, China, South Africa), most of the MINTs (Mexico, Indonesia, Turkey) plus other big names from the Asian Tigers, the Gulf States, Eastern Europe and Latin America. In other words, when you buy into the Emerging Markets, you’re buying into thousands of local firms with a large stake in some of the fastest-growing and rapidly transforming countries in the world.

Opening up Emerging Markets with ETFs

Emerging Markets ETFs enable you to diversify across all these countries and participate in their long-term growth by tracking a reputable index, like the MSCI Emerging Markets.

Naturally, performance tends to be more volatile in fast-developing countries, but you can reduce risk through the sheer diversity of an Emerging Markets index. Low costs increase the prospect of returns, and you’re also spared the complexity of dealing with fluid regulatory regimes when it comes to items like foreign ownership and withholding taxes on dividends.

Each index provider divides the world differently. For example, MSCI counts Poland and South Korea as Emerging Markets whereas FTSE classifies them as Developed. MSCI categorises 24 countries as Emerging Markets, 23 as Developed, while remaining investable countries are labelled Frontier Markets. There are ETFs that cover Frontier Markets too, and of course, big Frontier Markets like Vietnam are also covered by MSCI individual country indices.

Countries can be promoted and relegated. For example, MSCI demoted Argentina to Frontier Market status in 2009 but reclassified it from Frontier Market to Emerging Market in May 2019. Meanwhile, Kuwait entered the MSCI Emerging Markets for the first time in December 2020. Country influence upon an index can change too. The big mover here is the increasing weight of China in Emerging Market indices. That process was driven by the liberalisation of China’s domestic stock exchanges, gradually allowing foreign investors (including ETFs) to own a wider range of Chinese firms.

The three main Emerging Markets indexes tracked by ETFs are:

- MSCI Emerging Markets

- FTSE Emerging

- MSCI Emerging Markets IMI

Emerging Markets indexes compared

| Index | MSCI Emerging Markets | MSCI Emerging Markets IMI | FTSE Emerging |

|---|---|---|---|

| Number of countries | 24 | 24 | 23 |

| Largest countries | China (31%), Taiwan (15%), India (14%), South Korea (13%), Brazil (5%) | China (28%), Taiwan (16%), India (15%), South Korea (13%), Brazil (5%) | China (33%), Taiwan (17%), India (16%), Brazil (7%), South Africa (4%) |

| Largest 3 stocks | Taiwan Semiconductor, Tencent, Samsung | Taiwan Semiconductor, Tencent, Samsung | Taiwan Semiconductor, Tencent, Alibaba |

| Number of stocks | 1,398 | 3,163 | 1,909 |

| Weight of the largest 10 positions | 23.9% | 20.8% | 22.3% |

| Total market capitalisation (USD) | 6.8 trillion USD | 7.9 trillion USD | 6.4 trillion USD |

| Coverage of target markets (market capitalisation) | about 85% | about 99% | about 91% |

| Dividend yield | 2.69% | 2.69% | 2.92% |

| Adjustment | quarterly | quarterly | semi-annually |

Emerging Markets ETFs vs Developed Markets ETFs

Emerging Markets are generally characterised by higher volatility than Developed Markets. That’s the outcome of a riskier economic and political environment that’s susceptible to the effects of weaker institutions and regulation. Many emerging economies are strongly dependent on exports and can be disproportionately affected by a demand crisis in developed countries.

As the graph shows, Emerging Markets have rocketed ahead at times, only to fall back to Earth later. However, you’ll also notice the often-times relatively low correlation in performance between the Emerging Markets and the MSCI World ETF that tracks developed countries. Low correlation can be a good source of long-term performance for your overall portfolio.

Performance: MSCI World vs MSCI Emerging Markets (30/04/2007 – 30/04/2022)

iShares MSCI EM UCITS ETF (Dist)

Cheap Emerging Markets ETFs

Emerging Market ETF costs have fallen sharply over the last decade and now start with OCFs of 0.14%. Competition between ETF providers means that Emerging Markets trackers are cheaper than single country products covering the same space – unlike with Developed World products. There’s also a range of physically replicating Emerging Markets ETFs available.

Of course, cost should not be your only selection criteria. The table below shows a strong level of competition between providers of MSCI Emerging Markets ETFs, so use our comparison tools to compare returns and choose a product that tightly tracks the index.

| MSCI Emerging Markets | MSCI Emerging Markets IMI | FTSE Emerging | |

|---|---|---|---|

| Number of ETFs | 17 | 2 | 2 |

| OCF cost | 0.14% to 0.55% | 0.18% | 0.22% |

ETF portfolios: Emerging Markets asset allocation

Passive investors typically seek to hold equities in the same proportion as broad global market capitalisations and then adjust in line with their individual investment strategy.

Emerging Markets present a conundrum though because their investable stock markets only account for 11% of global capitalisation while their economies account for 40% of global production.

Hence there’s a strong case for up weighting your allocation in favour of the long-term growth opportunity. An asset allocation of up to 40% to Emerging Markets may be justified. However, bear in mind your tolerance of volatility if you want to allocate to Emerging Markets using a share of world GDP.

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » Latest

Leave a Reply

You must be logged in to post a comment.