Apr

2022

Outlook 2022: Sustainable investment

DIY Investor

28 April 2022

Sustainable investing is maturing – and so are the policies, disclosures and debates that surround it – by Andrew Howard, Global Head of Sustainable Investment

Sustainable investing is maturing – and so are the policies, disclosures and debates that surround it – by Andrew Howard, Global Head of Sustainable Investment

- ESG priorities to watch – including climate change, biodiversity and natural resource constraints

- Increasing regulatory scrutiny globally hitting all parts of the value chain

ESG (environment, social governance) investing has entered the mainstream.

According to analysis by Bloomberg, ESG assets soared to an unprecedented $37.8 trillion by the end of 2021 and are predicted to grow to $53 trillion by 2025, which would be a third of all global assets under management.

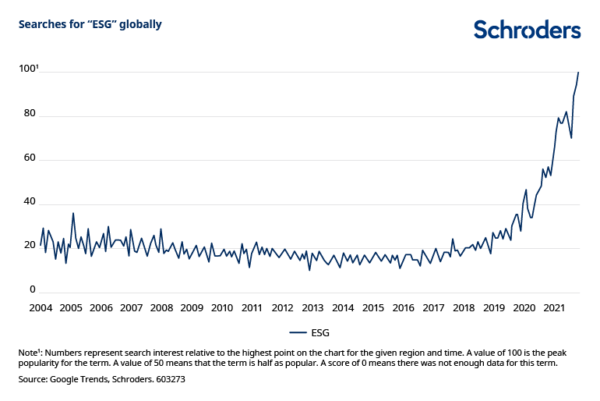

This rise is mirrored by a growing interest in ESG more generally. For example, the number of Google searches of the term “ESG” has grown exponentially in the last couple of years.

That escalating interest is reflected in demands on investment managers. There are no ifs and buts about sustainability anymore. It is now all about how you do it, how you implement it, and how you report on what you have done. This is why we expect an intensifying debate on what a robust sustainable investment process should look like. This underpins the investment we have made over many years in research, analysis, active ownership and information systems.

The connection between investment returns and sustainable outcomes is becoming deeper and stronger. Companies’ licenses to operate, the sustainability of their business models, and the returns to their investors are increasingly interconnected.

How companies impact societies and the environment is not just an academic question, it is an increasingly tangible issue. Carbon pricing, plastics, minimum wages, tax avoidance – these are all factors that are translating into corporate financial statements, not just social costs.

ESG priorities to watch – including climate change, biodiversity and natural resource constraints

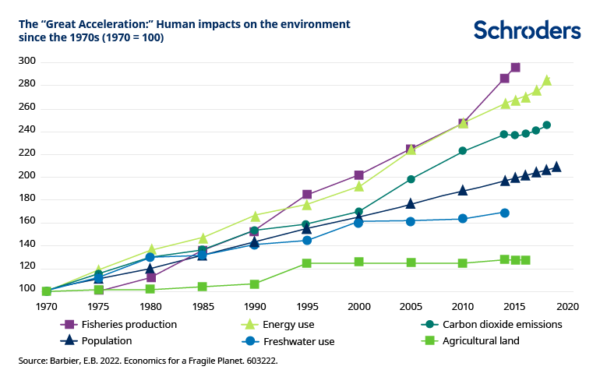

Climate change has long been a focal point for sustainable investment and is, undoubtedly, a critical concern. But exponentially increasing pressure on finite environmental resources is exposing cracks across a spectrum of environmental dimensions, bringing a wider range of natural capital issues into focus.

The UN’s COP 15 summit – the biggest biodiversity summit in a decade, which is focused on drawing up a plan to slow and reverse damage to nature – is due to reconvene in April this year in China after Covid-19 delays. We will be watching for a Paris-style agreement for nature considering how dramatic the increase in human impacts on the environment has been since the 1970s.

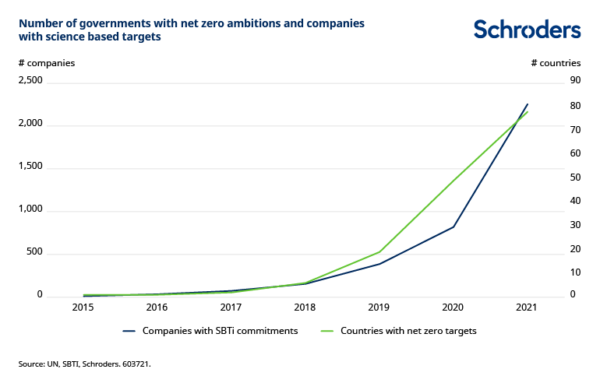

Last year’s COP 26 climate summit in Glasgow underlined the growing expectations on the private sector to pick up the mantle of action. So it is now companies rather than governments making commitments around sustainability issues such as carbon emissions, deforestation and methane.

For example, a growing number of companies – more than 1,000 including Schroders – have adopted climate action targets through the Science Based Targets initiative (SBTi) in line with the Paris Agreement goals to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

Asset managers have an ability to engage with companies to drive change and different outcomes, and to hold them to account. We welcome the role we have to play in pushing portfolio companies to transition as the global economy decarbonises.

Our active ownership team has set climate change and biodiversity and natural resource constraints as key priorities for engagement in 2022.

We will also be looking at the S and the G parts of the equation. We see human capital management as well as diversity and inclusion and human rights as critical factors for the sustainability of our investments. And governance – which has long been a focus of the asset management industry – will remain a focal point, particularly in light of increased scrutiny of voting records and shareholder resolutions.

Laggards will no longer have a place to hide. Our own demands for action are rising and the industry voice is getting louder. For example, we have already announced that from 2022 we will be voting against nominations committee chairs of FTSE 100 firms not meeting diversity recommendations of the Parker Review (the Parker Review is an independent review looking at the ethnic diversity of UK boards).

Increasing regulatory scrutiny globally hitting all parts of the value chain

While companies’ sustainability practices and ambitions are becoming subject to greater scrutiny by asset managers, the sustainability practices of asset managers themselves are coming increasingly under the regulatory lens.

Sustainable finance regulation keeps evolving at a dizzying pace and 2022 will be no different to last year. Indeed, one pattern that we see is that what used to be a predominantly EU phenomenon is increasingly “spilling over” to other regions, and most notably Asia. At the heart of this is transparency and the robustness of sustainability claims.

And it is not just asset managers who are now increasingly scrutinised. Everyone in the investment value chain is facing similar levels of regulatory change over sustainability practices. For example, asset owners such as pension funds and insurance companies are targeted by the same or similar transparency and risk management obligations as asset managers. We see this not only in SFDR in the EU but also in the UK rolling out the Task Force on Climate-related Financial Disclosures (TCFD) requirements for occupational pension funds last October, and in the US Department of Labor’s plans to provide an update on the use of ESG in managing assets or retirement plans.

Intermediaries such as advisers are targeted too. We see this in the new requirement within the EU legislative framework MiFID II for advisers to include clients’ sustainability preferences in their suitability assessment, which will come into effect this August. References to the possibility of a similar course of action were made in the UK’s Greening Finance Roadmap last October.

ESG data and rating providers are not off the hook either. There are increasing calls for further transparency in ratings methodologies and better management of conflicts of interest. Concerns have also been voiced by European and global regulations, such as the International Organisation of Securities Commissions (IOSCO), around the increasing concentration in the market and the lack of consistency in ESG ratings.

Last but not least, companies may be at the end of the investment value chain but company disclosures are certainly at the centre of all sustainability-related transparency. Everyone else in the value chain, from asset managers to ESG data and rating providers, is dependent on companies for sustainability data. The most hotly anticipated development in this space is going to be the output of the recently launched International Sustainability Standards Boards by the IFRS Foundation.

Schroders very much welcomes this initiative and we expect the output will start being formed within the next couple of years. In parallel, national regulators are developing their own company reporting frameworks such as TCFD for companies in the UK and in many markets in Asia, or the Taxonomy-related disclosures for companies in the EU.

One key challenge we see for the market in 2022 (and further into the future) is how to deal with regulations not being sequenced in the right order. A specific issue is how the market will treat disclosures of sustainable investment products that have come into effect before the corresponding reporting requirements for companies. The most immediate test in 2022 is going to be the figures that will ensue for investment products’ alignment with the EU Taxonomy. Given that the EU Taxonomy remains incomplete and that companies have not started reporting on their Taxonomy alignment yet, many products are likely to report 0% or figures that may not be very meaningful in the absence of underlying data.

Moreover, with differences between national regulations already apparent, we are likely to see an increasingly complex regulatory picture of the industry, despite stated ambitions for global alignment.

This will make implementation more challenging, particularly for global asset managers such as Schroders. This makes it all the more important that firms have dedicated resources and capabilities to integrate sustainability in everything that they do.

Approaching sustainability as a compliance exercise is unlikely to result in the transformation that our industry has to go through to support its clients’ needs.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Brokers Commentary » Commentary » Exchange traded products Commentary » Fixed income Commentary » Investment trusts Commentary » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.