Jan

2024

Outlook 2024: Private markets strategy

DIY Investor

1 January 2024

The ongoing disruption of higher rates and the presence of durable global trends such as the energy transition should present investors with a window of opportunity to enter some sectors of the private markets on attractive terms“. By Emmanuel Deblanc

New window of opportunity

Interest in private market investments has grown strongly in recent years – and for good reason. Many investors were looking for additional yield in the post-2008 era of rock-bottom interest rates. Then, as inflation surged and interest rates rose rapidly, many investors sought the protection of the floating-rate and inflation-linked attributes of private markets.

Beyond these secular drivers – which remain relevant despite central bank hiking cycles coming to an end and inflation waning – we believe there are several factors making private markets allocations attractive. In fact, we think this is a big window of opportunity for investors when valuations and conditions are somewhat reminiscent of the post-crisis reset years of 2009-10.

Uncertainty breeds opportunity

Economies and financial markets are in transition as uncertainty around the path of interest rates gives way to uncertainty around the economic outlook and the threat of recession. Periods of uncertainty can be a good time to invest in private markets. As markets reset and assets are repriced, private markets strategies – most of which have multi-year deployment periods – can offer the potential to target specific relative-value opportunities alongside exposure to longer-term trends.

The less liquid nature of private markets means they do not suit the risk profile of every investor. However, private markets have developed into a global, highly diversified and heterogenous universe and we expect they will continue to attract new and growing allocations. In the context of the disruptive impact rate hikes have had on valuations and volatility in public markets, we think many investors will have recalibrated how much “illiquidity” they are willing to tolerate to extract the anticipated premium from private markets. In addition, we see a growing understanding among major real money investors that private markets can play an important permanent role in portfolios, with active asset selection and the protection of bespoke investment structuring helping to build resilience through the cycle.

Inflation still matters

One of the benefits of private markets is the inflation protection afforded to investors by the structure of many investments, a theme which we think will remain relevant in 2024. Seeing private markets as an inflation hedge can be an oversimplification, but many of the deal structures do offer a good level of protection against inflation. In private (corporate) credit, for example, many deals are on a floating-rate basis where payments rise in line with base interest rates, while infrastructure projects tend to have inflation-linked costs and prices. It should be said that these are by no means perfect hedges against inflation, and they are most effective amid “normal” levels of inflation (ie, in the low single digits) rather than the spikes witnessed in the last 18 months. With inflation gradually moderating but with structural factors likely to keep it above central bank targets for some time yet, private markets can be a strong tool for addressing that concern.

Two near-term entry points

We think the most compelling opportunity going into 2024 is in private credit, where the risk-reward profile looks attractive. Just like in public credit markets (ie, corporate bonds), the rise in interest rates has pushed yields in private credit to levels investors haven’t been able to achieve in years. Higher rates clearly also lead to stress in terms of corporate funding costs, and there are questions around the affordability of certain capital structures. With major bank lenders likely to grow more risk-averse in 2024, private markets investors should find opportunities to enter funding partnerships on favourable terms.

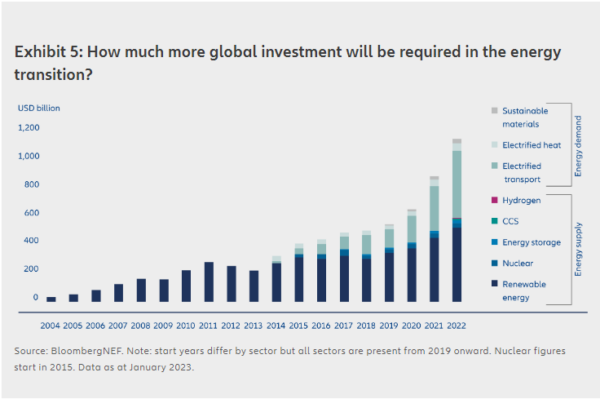

Another big potential opportunity is in infrastructure, which beyond its inflation-resistant qualities can also help to provide diversified returns and stable cashflows. The huge demand for infrastructure investment today is being driven by a seismic shift in the energy industry, among other factors. The green transition, energy security and the de-risking of supply chains for technologies such as electrolysers for the production of hydrogen or electric car batteries all need financing. The size of the USD 437 billion US Inflation Reduction Act is one example of the firepower governments are willing to commit, but the energy transition will also require a huge mobilisation of private capital (see Exhibit 5) – particularly in an era when governments’ fiscal headroom is likely to remain squeezed. Also known as “real” assets, infrastructure projects such as power grids and transport networks are typically funded through long-term contracts which can help insulate them from the economic cycle and broader market volatility.

Long-term value

The uncertain economic outlook will have many investors in wait-and-see mode. However, the ongoing disruption of higher rates and the presence of durable global trends such as the energy transition should present investors with a window of opportunity to enter some sectors of the private markets on attractive terms. In our view, 2024 should be one vintage of private markets transactions that investors will want to see in their portfolios in the coming years.

Download our 2024 Outlook >

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable, but it has not been independently verified; its accuracy or completeness is not guaranteed and no liability is assumed for any direct or consequential losses arising from its use, unless caused by gross negligence or wilful misconduct. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. This is a marketing communication issued by Allianz Global Investors UK Limited, an investment company, incorporated in the United Kingdom, with its registered office at 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk. Allianz Global Investors UK Limited, company number 11516839, is authorised and regulated by the Financial Conduct Authority. Details about the extent of our regulation are available from us on request and on the Financial Conduct Authority’s website (www.fca.org.uk). The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors UK Limited.

Alternative investments Commentary » Alternative investments Latest » Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.