Jul

2024

Passion Investing – Vintage Guitars

DIY Investor

24 July 2024

There has been a definite shift towards investing in tangible assets over recent years and items such as classic cars, luxury watches, fine wine, whiskey, antiques, works of art and vintage guitars have all proved to be popular choices with investors looking at alternatives to more traditional investments – by Phil Bourne

The pandemic saw a marked increase in demand for tangible assets partly fuelled by some degree of volatility and uncertainty in traditional markets, and the vintage guitar market saw a substantial increase in demand and a significant rise in values of vintage American guitars across the board.

The beginnings of what is now considered the vintage guitar market can be traced back to the mid 1960’s when Eric Clapton started using a 1959 sunburst Gibson Les Paul Standard while playing in John Mayall & The Bluesbreakers. The sound that he coaxed from this guitar on the legendary 1966 ‘Beano’ album was to kickstart a demand for this discontinued model amongst other prominent players of the era on both sides of the Altantic.

Influential players such as Jimmy Page, Jeff Beck, Peter Green, Paul Kossoff, Mike Bloomfield and Duane Allman were to all seek out this particular model for its distinctive tone. The original 1958-1960 sunburst Gibson Les Paul Standards didn’t sell well at the time of their original release and Gibson discontinued the model in 1960 due to poor demand. Fast forward a few years later and the guitar was in favour and the relative scarcity of these original instruments fuelled a big demand in the market which saw prices soar.

At the time of course no one referred to these instruments as vintage guitars, they were just second-hand guitars that were no longer being manufactured, but players knew that these were superior instruments and thus the vintage guitar market was born.

So what constitutes a vintage guitar in the early 21st Century?

Technically any instrument over 30 years of age could possibly be called ‘vintage’ but it’s not quite that straight forward when it comes to which guitars are desirable and collectable and likely to appreciate significantly. The market is dominated by the big 5 American guitar makers – Fender, Gibson, Gretsch, Martin and Rickenbacker. Out of these 5 makers Fender and Gibson are by far the most sought after (with the exception of some pre-war Martins) and most valuable and form the cornerstone of the vintage guitar market.

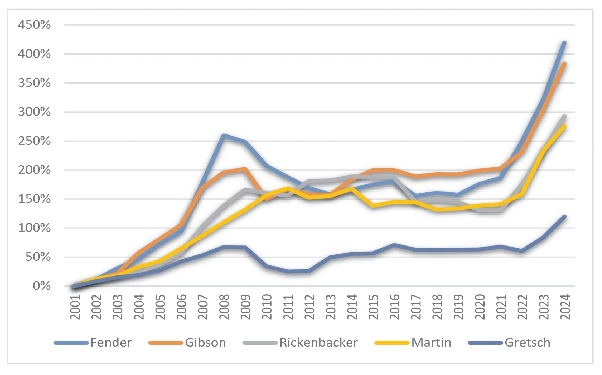

The following chart from Vintage Guitar magazine illustrates the appreciation from 2001 onwards of vintage guitars from the big 5 American guitar manufacturers.

Credit: Ram W Tuli, Vintage Guitar magazine

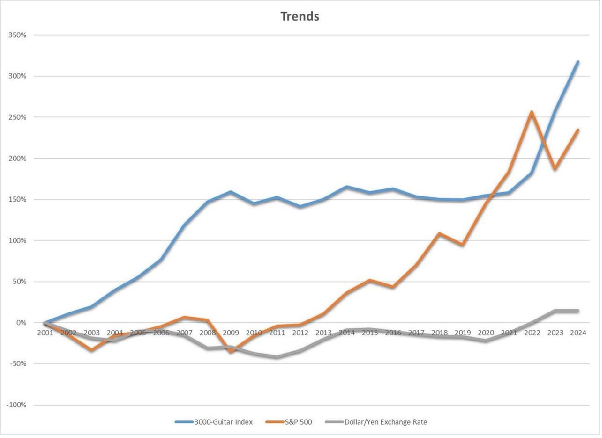

As can be seen the last 3 years have seen a big jump in vintage guitar values across the board with some models more than doubling their value during this period. Looking at the longer term the vintage guitar market as a whole has consistently outperformed the S&P 500 as illustrated in the following chart from Vintage Guitar magazine.

Credit: Ram W Tuli, Vintage Guitar magazine

If you are thinking of investing in a vintage guitar what should you be looking for?

The first rule of thumb is not to buy a guitar purely on what you think will show the greatest return based on historic figures but to buy an instrument that you feel some connection with and can enjoy over time. That being said there are certain models that will always be sought-after and perform well, as well as some models that are currently undervalued and likely to show above average appreciation in the coming years.

The ’blue chip’ guitars include instruments that are historically significant or scarce such as 1950 Fender Broadcasters (the first commercially available solid body electric guitar), early Fender Telecasters and Stratocasters, any 1950’s Gibson Les Paul Standard but particularly the 1958-1960 sunburst Les Paul Standards, late 50’s Gibson Flying Vs and Explorers, 1958-1962 Gibson ES-335s, certain custom colour pre-CBS (pre ’65) Fender Stratocasters and Telecasters and pre-war Martin acoustics.

The next tier includes other models primarily from Fender and Gibson that were manufactured before 1965 as well as some 1950’s and early 1960’s models from Rickenbacker and some 1950’s Gretsch guitars.

Historically 1965 is a milestone year in the history (and desirability) of both Fender and Gibson guitars. Due to the guitar boom of the early 1960’s Fender and Gibson, as well as the other top 5 makers, found themselves struggling to keep up with demand. In the case of Fender this meant selling the company to the CBS Corporation in order to scale up, and in the case of Gibson it meant changing some of the specs to speed up production as well as using less exotic woods and other materials. In both cases there was a slight but noticeable slip in quality compared the pre-1965 models. This drop in standards continued during the remainder of the 1960’s and arguably reached its nadir in the mid to late 1970’s for both companies.

So it is the pre-1965 models from both Fender and Gibson, some 1950’s and early 1960’s models from Gretsch and Rickenbacker, and 1950’s and earlier models from Martin that have come to represent the most desirable, and by definition valuable vintage guitars.

The substantial appreciation of these guitars in recent years has also had the knock on effect of bringing up the collectability and value of the previously less favoured 1965-75 Fenders and Gibsons.

What are the potential pitfalls when considering investing in a vintage guitar?

Authenticity and originality are key to making a sound investment. As the value of certain vintage guitars has reached stratospheric levels there has been a number of fakes that have appeared on the market.

Taking the 1958-1960 sunburst Gibson Les Paul Standard (or Burst as they are known by collectors) as a case in point, the value of original examples is now anywhere from £200-£400K depending on the year, the overall condition and the amount of figure on the maple top. There is a famous quote that ‘there were originally 1500 ’58-60 sunburst Les Paul Standards manufactured but there are now over 15000 in circulation’. So when investing in something this valuable sourcing a fully authenticated example with solid provenance from a trusted dealer is paramount.

The other thing to look out for is originality. Things such as changed parts, repairs or refinishes greatly affect the value of a guitar. 100% original, excellent to near mint condition examples are the gold standard that will show the greatest ROI, and if you are looking purely in investment terms these are what you should be looking at. That said, some small changes such as a replacement set of tuners, or a refret will only affect the value to a relatively small degree and these guitars (especially if they are otherwise sought-after models) are still a good investment.

Then there are the ‘player grade’ vintage guitars. These are guitars that have typically either had a repair or a refinish, or both, and may have also had a replaced part or two. Generally these are best avoided as an investment but can represent good value as a player guitar that will still appreciate marginally over time depending on the model. Again finding a trusted, knowledgeable dealer who is completely transparent about any non-original parts or repairs, and will also provide a written authentication certificate is important.

Not all vintage guitars are as valuable as a 1958-60 Les Paul Standard and there are plenty of models with values between £5-20K that represent a good way into the market and will show solid appreciation over time. There are still quite a few models that are undervalued and are definitely worth considering if you are looking to enter the market. For example, a pre-CBS (pre-1965) Fender Jazzmaster was one such undervalued guitar 3 years ago. This particular model has skyrocketed and more or less doubled in value in the last 3 years.

There are a good number of highly knowledgeable vintage guitar dealers worldwide who are a great source of information as to what to consider as an investment, and what the next undervalued models likely to see a bigger than average appreciation in the coming years could to be.

If you are a guitar player then investing in a good vintage guitar is something of a no brainer, as it is a living, breathing instrument you can enjoy owning and playing while showing a good level of appreciation over time. If you don’t play but appreciate fine objects and modern cultural history, then vintage guitars represent a particularly strong connection with 20th Century cultural history and you can own an iconic artefact of rock n roll history.

About the writer:

About the writer:

Phil Bourne is a vintage guitar enthusiast and the founder of 20th Century Toys, a business specialising in vintage American guitars and reissues.

Alternative investments Commentary » Alternative investments Latest » Brokers Commentary » Commentary » Latest

Leave a Reply

You must be logged in to post a comment.