Sep

2024

QD View: Ahead of the Vanguard (LifeStrategy)

DIY Investor

21 September 2024

The board of Alliance Trust (ATST) announced on 12 September that the forthcoming vote on its merger with Witan will be held on 1 October – By David Johnson

This will undoubtedly be a pivotal event, as their combination could be the catalyst for ATST’s entry into the FTSE 100. We believe investors should vote in favour of the merger, given the many benefits of increased scale (we outlined our views in more detail when the merger was first announced – click here to see our coverage of this – and we have also explored it in more detail in our recently-published note, which you can read here). Given ATST’s diversified approach to global equity investing, this announcement has prompted me to revisit an article we recently published: It’s a wonderful (Vanguard) Life.

In that article, we identified several trusts that could serve as potential alternatives to the monolithic Vanguard LifeStrategy funds. These funds are five passive (index-tracking) investment strategies that blend global equity and global bond index funds in varying proportions to offer solutions for investors with different risk tolerances and our aim was to find one trust to replace each equivalent Vanguard LifeStrategy fund. However, in practice, there is no need to limit oneself to a single fund when seeking diversification. The various equity-bond splits of the Vanguard LifeStrategy funds can be easily approximated by holding comparable assets in the same proportions.

Diversification strategies can be complex, and determining both the number of holdings and their optimal blend can require significant computational power. Nevertheless, for this article, we have chosen to demonstrate how blending two trusts, which are viable proxies for the global equity and bond markets, can still achieve superior outcomes compared to the Vanguard LifeStrategy funds, based on their five-year NAV returns. For the avoidance of doubt, we are not suggesting that other comparable equity and fixed income funds could not be blended in a similar way, but we like both funds as standalone investments in their own spaces and think this is a good place to start.

Alliance Trust (ATST) was an obvious choice for the global equity portion – its multi-manager approach has preserved the alpha potential of active management. Thanks to Willis Towers Watson’s oversight, it exhibits minimal style deviations relative to global equities. These factors, combined with its long-term outperformance of the MSCI All Countries World Index (a default global equity index for many), make it a straightforward replacement for a passive 100% equity portfolio. ATST’s strong discount control and high liquidity further justify its inclusion, as ease of trading is one of the key attractions of ETFs.

Replacing the bond portfolio is a bit more challenging, as the number of global bond-focused investment companies has been declining. However, one standout option is the CQS New City High Yield Fund (NCYF). NCYF aims to provide a high yield through a blend of various fixed income assets, ranging from loan stocks to government bonds, investing in issuers across the globe. While it may lack ATST’s level of diversification, it still holds a sufficiently broad array of fixed income assets to capture the diversification benefits of the bond markets. NCYF is one of the best-performing trusts in the loans and bonds sector (based on its five-year NAV returns), as well as being the second largest in that sector.

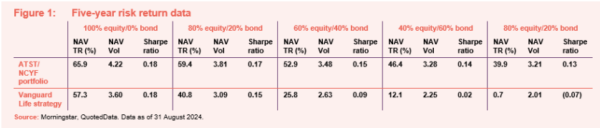

As can be seen in Figure 1, the equivalent blend of ATST and NCYF would have generated a superior risk-return profile to the relevant Vanguard LifeStrategy fund over the last five years, although this is achieved with higher volatility. While this can be a consequence of active management decisions, it is also explained by the fact that both of these trusts use gearing, which amplifies their exposure to the market and thus their volatility, and by extension also increases their beta.

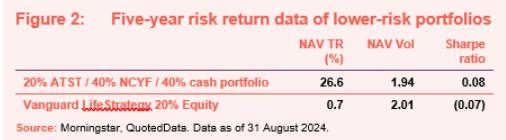

Yet because the risk-return profile of these trusts is so superior, investors are still able to achieve superior returns even if they are the most cautious of investors. We illustrate this point in Figure 2, which shows the results of blending a 20% investment in ATST with a 40% investment in NCYF and hold the remaining 40% in cash (which has no volatility or return in this example). The resulting portfolio has a lower volatility than the Vanguard LifeStrategy 20% Equity Fund while still delivering a far superior NAV return.

As noted above, similar results could likely be achieved with other investment trusts although we have chosen not to explore that here as it could lead to a bewildering array of combinations. Nonetheless, the fact that two straightforward, shareholder friendly global investment strategies can easily surpass their passive equivalent should hopefully convince investors that there are benefits to be achieved from active management, particularly within an investment trust structure.

Published by our friends at:

![]()

Leave a Reply

You must be logged in to post a comment.