Sep

2022

Searches for ‘how to invest’ rise 186% amid mortgage chaos and market turbulence

DIY Investor

28 September 2022

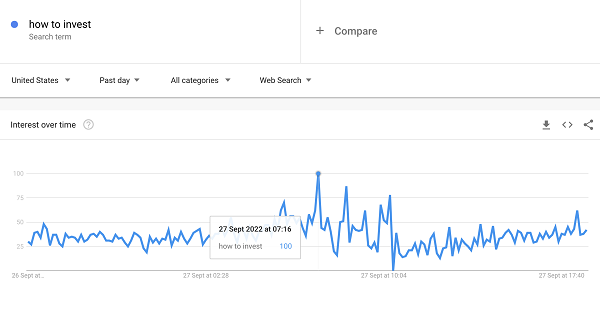

Analysis of Google search data reveals that searches for ‘how to invest’ skyrocketed 186% in the United Kingdom as of 27th of September 2022. The end of September sees some mortgage lenders halt their deals for new customers amid market turmoil as well as the Great British Pound crashing, likely leading to a rise in interest rates and worsening inflation.

The analysis, by Investing Reviews reveals that searches for ‘how to invest’ exploded to almost double the average volume within the past week, an unprecedented increase in Brits seeking information how to start investing their money, according to Google search data analysis. The data also reveals that searches for ‘investing for beginners’ have exploded an overwhelming 522% in the past week.

A spokesperson from Investing Reviews commented: “As the market grows increasingly volatile, leading to a likely rise in interest rates and inflation, it is unsurprising that Brits are looking for new ways to save their money.

However, the latest market news has now caused a rapid increase in online interest for those looking to begin investing their money, highlighting the massive impact the cost-of-living crisis is having on the public. Investing money can be a vital way to not only save your money but see profitable returns, however, it is strongly advised to research any investment opportunities thoroughly before making any concrete decisions. It will be fascinating to see whether these searches translate into investments and what it is that Brits will choose to invest in.”

Who is making these searches?

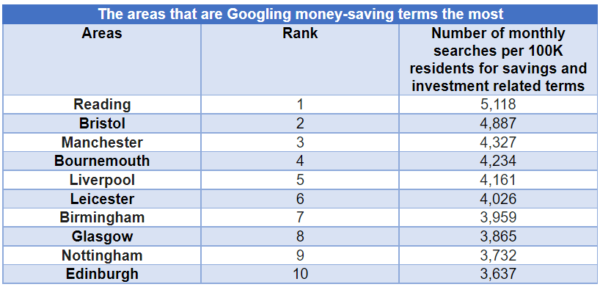

Research by Investing Reviews analysed keyword data through Google Ads to discover the average monthly search volume for keywords related to savings and investments across the most populated places in the UK.

The area most interested in saving and investing is Reading. There are 5,118 searches per month for savings and investment related terms per 100,000 residents in Reading. The most popular term is ‘premium bonds’ with an average of 1,300 average monthly searches per month within Reading. This is followed by ‘cryptocurrency’ with 720 average monthly searches and ‘credit card’ with 480 average monthly searches.

Bristol is the area that is second most interested saving and investments. There are an average of 4,887 searches related to saving and investing per 100K residents. This comes as a result of 465,866 residents in Bristol and a total search monthly combined search volume of 22,770 across all the terms. The most searched term related to investing and savings was ‘loan’ with 2,400 average monthly searches being made in Bristol.

Manchester residents are the third most interested in savings and investments. Each month, there are an average of 4,327 searches per 100K residents for searches related to saving money. Similar to Bristol, Mancunians are searching for the term ‘loan’ the most out of any search term.

In fourth is Bournemouth with 4,234 searches per 100K residents each month. This is due to a population of 187,503 and a total average of 7,940 searches for money saving and investment terms. The most popular terms being Googled by Bournemouth residents are ‘loan’, ‘premium bonds’ and ‘cryptocurrency’.

Liverpool rounds out the top five with an average of 4,161 monthly searches for money saving terms per 100K residents. There are a total of 19,380 searches made each month by Liverpudlians for money saving terms out of a population of 465,000.

The study was conducted by Investing Reviews, an independent comparison review site that was set up to help people make smarter decisions about investing.

Leave a Reply

You must be logged in to post a comment.