Oct

2021

The fund I’m buying while markets are faltering

DIY Investor

20 October 2021

Saltydog Investor has spotted an opportunity in a fund sector that’s been in a rich vein of form and that continued to deliver during the recent market volatility.

A couple of weeks ago, our Ocean Liner portfolio bought the TB Guinness Global Energy fund. It is already up 3.3% and last week we added to our holding. Our more cautious Tugboat portfolio has also made a small investment in this fund.

It has been a testing few weeks for investors and when we looked at our sector analysis last week, nearly all sectors were showing losses over the previous four weeks. Our combined North America and North American Smaller Companies sector was up 0.02%, and that was just about the best of the bunch.

The only other opportunities have been in funds from the ‘Specialist’ sector or the new ‘India/India Subcontinent’ or ‘Natural Resources and Commodities’ sectors.

To be honest, it should not come as too much of a shock that markets have faltered in recent weeks. Since the Covid-19 market-sell off in the first quarter of last year, stock markets have rebounded strongly, and that was during the worst of the pandemic when most of the world was in lockdown. It was probably naive to think that we could get back to life after Covid without any hiccups.

In the last few weeks, the shortage of various commodities has become all too obvious. While you cannot always believe everything that you hear in the media, there is no doubt that in recent weeks there have been some genuine supply issues. We have seen petrol stations running out of fuel and the supermarket shelves are definitely not as heavily laden as usual, although for some reason there seems to be an ample supply of mince pies and Christmas puddings.

I do not know whether the recent fuel crisis could have been averted if people had not been panic buying, but the fact that it seems to have resolved itself relatively quickly would suggest that it is at least a possibility. However, there are some underlying issues. Oil and gas are globally traded commodities and prices have been soaring in recent weeks, that would suggest that there is currently an imbalance between supply and demand.

It is not just oil. Gas is as bad, if not worse, and there are issues with labour, timber, coffee, semiconductor chips, even carbon dioxide (and there was me thinking that we produce too much of the stuff).

The oil companies had a particularly tough time in 2020. The global lockdown drastically reduced the demand for energy, and this had a direct impact on the bottom line of these businesses. At one point last year, a barrel of Brent oil was trading for less than $10 and, for slightly obscure technical reasons, the price of WTI (Western Texas Intermediate) briefly went negative. To put things in context, at the beginning of last year Brent Crude was trading at around $70 and it’s now $85. A decade ago, it was more than $100.

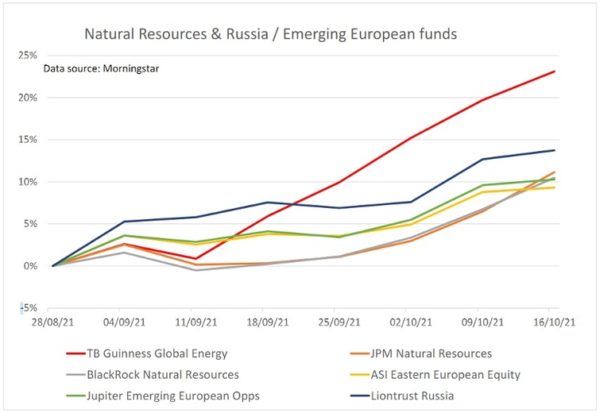

There are several funds that invest directly into energy companies and commodities, such as TB Guinness Global Energy, BlackRock Natural Resources, and JPM Natural Resources. Other funds, investing in Russia and Emerging Europe, are also very sensitive to oil and gas prices.

Here is a graph showing how a number of them have performed since the beginning of 2020.

As you can see, they all went down in March 2020. They then picked up, but fell back again later in the year when the second wave of Covid-19 forced countries around the world back into lockdown. Since then, they have recovered with a strong upturn in the last few weeks. This can be seen more clearly on a graph just showing the performance of the funds since the end of August.

Although the TB Guinness fund suffered the most last year, it is currently catching up at a rate of knots.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.