Oct

2022

The fund making money as markets fall

DIY Investor

25 October 2022

Saltydog Investor invests in the ‘absolute return’ sector, where funds are designed to rise in all market conditions.

As any private investor will know, 2022 has been a challenging year. If you have nerves of steel, an appetite for risk, a good understanding of derivatives and alternative investments, and are willing to lose everything, then you would have done very well shorting most of the developed markets, and the Nasdaq in particular. But that is not for the faint-hearted. A crystal ball would also have been very useful.

At Saltydog Investor, we are trying to help more mainstream investors. We do provide data on ETFs that do the opposite of what the markets do, and even report on some leveraged products, but that is not our main focus.

What we are really looking for is some slow and steady funds, where we are confident that our members can make a reasonable return on a relatively large part of their portfolio, and then highlight a few sectors where greater returns are available but potentially come with more risk.

But what do we do when even that is a challenge?

Our first port of call is cash. It is not very exciting, especially when inflation is running at 10%, but it is better than losing money.

When we looked at our fund analysis last week, fewer than 3% of the funds that we monitor had gone up in the last four weeks. I accept that we are looking over a very small timescale, but it is indicative of what is happening in the markets at the moment. If you look over 26 weeks (six months), things are not much better, with fewer than 6% of funds increasing in value. So, things are not great, and it looks as though they are getting worse.

Last week, I mentioned that our demonstration portfolios had invested in the Royal London Short Term Money Market fund, and it has already made a gain. Not a lot, but if it continues at the same rate that it has over the last four weeks, then it would give an annual return of 1.9%.

When most funds falling, money market funds start to look a bit more appealing. Last week, there were five funds in our latest reports that we highlighted to our members because they had made gains over four, 12 and 26 weeks.

Safe Haven

| Fund | Sector | 4-week return | 12-week return | 26-week return |

| Royal London Short Term Money Market | Short Term Money Market | 0.15% | 0.41% | 0.66% |

| abrdn Sterling Money Market | Standard Money Market | 0.15% | 0.38% | 0.66% |

| BlackRock Cash | Short Term Money Market | 0.13% | 0.33% | 0.54% |

| L&G Cash Trust | Short Term Money Market | 0.12% | 0.32% | 0.56% |

| Premier Miton UK Money Market | Standard Money Market | 0.09% | 0.26% | 0.41% |

Data source: Morningstar

These funds will never make you rich, but they can provide better returns than holding cash.

When we do our weekly fund analysis, we group funds based on what sectors they are in and how volatile they have been in the past. The money market funds are in our “Safe Haven” Group: very low volatility but very low returns.

The next group up the risk ladder is “Slow Ahead”. The funds in these sectors have historically been towards the lower end of the volatility spectrum, but in better times have made reasonable gains. The sectors in this group are the £ High Yield Bond, £ Strategic Bond, £ Corporate Bond, Mixed Investment 0-35% Shares, Mixed Investment 20-60% Shares, Mixed Investment 40-85% Shares, and Targeted Absolute Returns.

They have not had a great 2022. After the first nine months of the year, the Investment Association (IA) reported that £ High Yield Bond sector was down 13.5%, £ Strategic Bond was down 15.2%, £ Corporate Bond was down 20.8%, Mixed Investment 0-35% Shares was down 12.3%, Mixed Investment 20-60% Shares was down 12.4%, and Mixed Investment 40-85% Shares was down 12.8%. The IA does not calculate an average return for the Targeted Absolute Return sector because the ‘funds are not considered homogenous, and the investment strategies can vary widely’.

We include the “Targeted Absolute Return” funds in our “Slow Ahead” Group, because when you calculate the average standard deviation for the funds, that is where it sits, but I am a little sceptical. Their aim is to “deliver positive returns in any market conditions”, but the returns are not guaranteed. We’ve had mixed experiences with funds from this sector over the years.

The VT Argonaut Absolute Return fund, which is at the top of the table, often appears in our numbers but can fall as quickly as it can rise. It’s currently showing a 12-week return of 6.5%, but has lost 6.3% over 26 weeks. It’s worth remembering that most of the funds in this sector have lost money over the last six months. The Baillie Gifford Multi Asset fund, for example, is down 6.6% in four weeks, 5.3% in 12 weeks, and 13.9% in 26 weeks.

I’m also cautious because the fund managers have more leeway than in other sectors. Asset selection is at their discretion, and they often use derivatives in their investment process.

However, in last week’s analysis only five funds from our “Slow Ahead” group rose. Four were from the Targeted Absolute Return sector (and the other one probably could be if the name is anything to go by).

Slow Ahead

| Fund | Sector | 4-week return | 12-week return | 26-week return |

| VT Argonaut Absolute Return | Targeted Absolute Return | 3.3% | 6.5% | -6.3% |

| BlackRock European Absolute Alpha | Targeted Absolute Return | 2.6% | 1.8% | 1.2% |

| LF Ruffer Total Return | Mixed Investment 20-60% Shares | 1.0% | 1.9% | -4.4% |

| TM Tellworth UK Select | Targeted Absolute Return | 0.8% | 2.6% | 5.7% |

| Aegon UK Equity Absolute | Targeted Absolute Return | 0.2% | 1.3% | 1.9% |

Data source: Morningstar

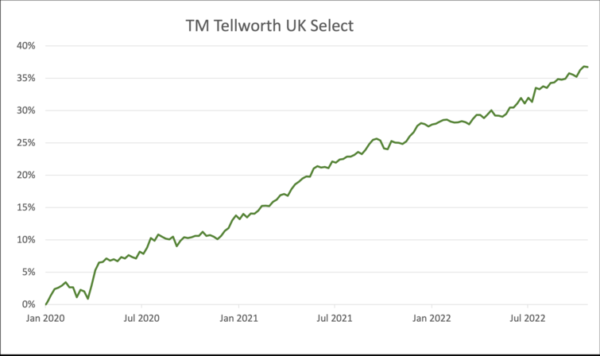

In spite of my concerns, there is one fund that has a good track record over the last couple of years, TM Tellworth UK Select, which is currently up 0.8% over four weeks, 2.6% over 12 weeks and 5.7% over 26 weeks. It has been going up relatively steadily since April 2020, but that doesn’t mean that it never goes down. Our demonstration portfolios have recently invested in this fund.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Alternative investments Commentary » Commentary » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.