Oct

2020

The New Emerging Markets Landscape

DIY Investor

6 October 2020

Economies across the globe have begun to emerge from various stages of COVID-19 lockdowns and look toward recovering economic growth. Franklin Templeton’s Emerging Markets Equity team considers three new realities they see in the emerging markets today—some of which may help certain countries weather the crisis.

Economies across the globe have begun to emerge from various stages of COVID-19 lockdowns and look toward recovering economic growth. Franklin Templeton’s Emerging Markets Equity team considers three new realities they see in the emerging markets today—some of which may help certain countries weather the crisis.

Our emerging markets equity team has found that outdated misconceptions of the asset class still exist. We believe it’s worth dispelling some of these myths and highlighting the new realities we see. This first post in a three-part series examines how policy improvements in emerging markets could increase resilience in times of stress.

New reality #1: Policy improvements should contribute to increased resilience during times of stress

In decades past, many emerging markets had large external imbalances, current account deficits and large fiscal deficits.

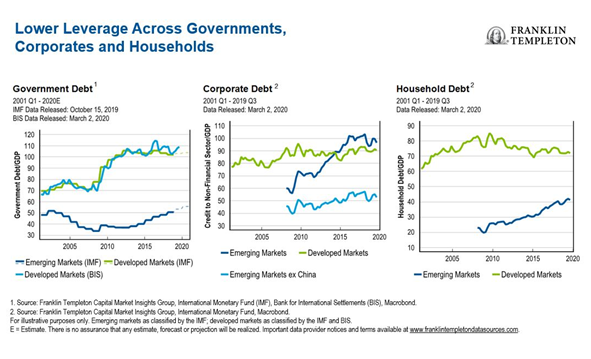

However, many emerging markets have learned lessons from prior crises to strengthen and reposition their economies. Today, many emerging markets have less debt in comparison with developed markets across governments, corporates and households.

Debt to gross domestic product (GDP) is approximately 50% across emerging markets, roughly half that of developed markets overall.1 The chart below also shows that not only is public debt generally lower, but household debt is also lower across emerging markets, and when excluding China, corporate debt is also lower.

We believe less debt across an economy means governments are more likely to loosen their purse strings if necessary during periods of stress without creating a fiscal crisis—and businesses and households can better survive economic downturns.

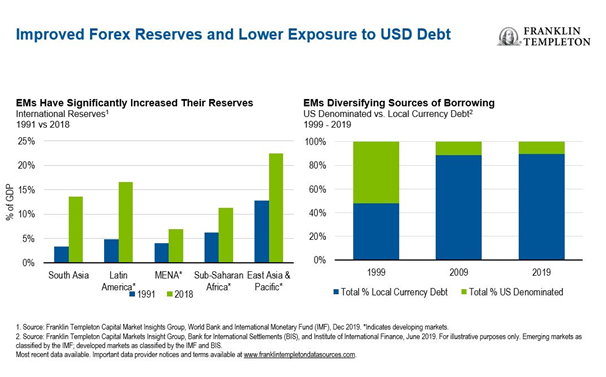

Over the past two decades, we’ve seen signs emerging market economies have been able to increase foreign exchange reserves, in addition to steering borrowing away from US-denominated debt. This signals to us that emerging markets are less likely to be vulnerable in periods when the US dollar strengthens against the local currency

Emerging markets have made continuous improvements with more effective banking sector oversight and supervision. Going into this COVID-19 crisis, the high levels of oversight, regulation and capitalization mean that banks across most emerging markets should be able to weather this crisis. It would take a significant level of economic pain to impair bank balance sheets, in our view.

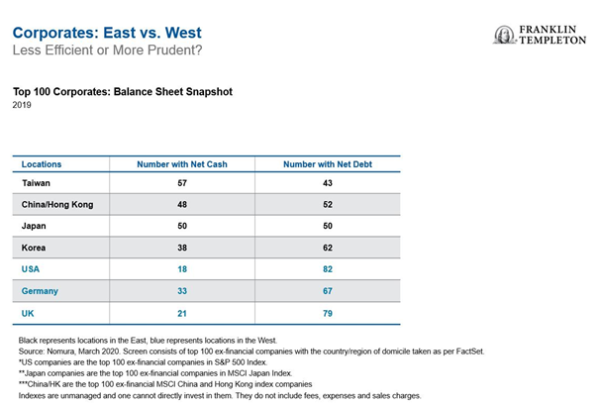

Identifying resilience

Examining corporate balance sheets can help identify the resilient companies during this crisis—and potential winners from an investment standpoint. The chart below highlights how emerging-market corporates in select areas have more cash on hand and less debt than corporates in Germany, the United States or United Kingdom.

The massive piles of cash some companies today are sitting on could provide a vital buffer against the dour economic climate. Companies without such reserves, whether in Asia or the United States and United Kingdom, could suffer in comparison.

Andrew Ness, Franklin Templeton Emerging Markets Equity, May 18, 2020.

While the coronavirus outbreak has tested the resilience of emerging markets, we think some of the changes that have taken place in these economies over the past few decades should help them weather the COVID-19 pandemic. In our view, lower levels of debt, higher levels of foreign exchange reserves, improved banking systems and stronger corporate balance sheets are indicators that emerging markets have come a long way from times past

The new emerging market landscape: The single commodity focus has shifted

As emerging markets cope with the COVID-19 epidemic, Franklin Templeton’s Emerging Markets Equity team considers three new realities they see in the emerging markets today. This second post in a three-part series examines how emerging markets have diversified their economies.

In our first post in this series, we explored how emerging markets have learned from past crises to strengthen their economies and become more resilient. Part of this resilience comes from a shift in the growth drivers for many countries, which have diversified into services, technology and domestic consumption.

New reality #2: Emerging market economies have diversified, with consumption and technology providing secular growth drivers.

Compared with 30 years ago, emerging market economies are quite different.

While some emerging economies certainly have challenged fundamentals that perhaps skew overall perceptions during crisis periods, we believe fundamentals in emerging markets remain in good shape as a whole.

Emerging economies have been through a transformation. While many investors once considered emerging markets as tied to commodity ups and downs, the asset class has become much more diversified. Today, rising domestic consumption and technology are greater drivers of economic growth for many emerging countries than commodity exports.

Economic diversification

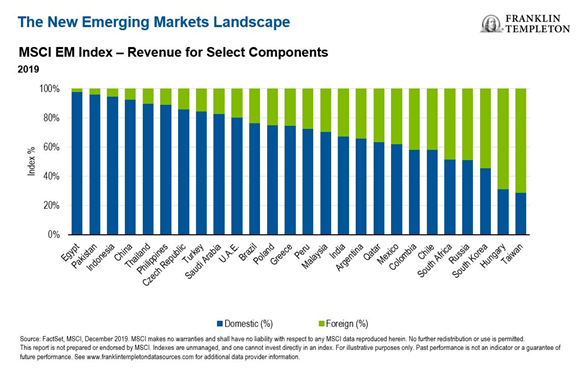

In the past, emerging market economies were broadly reliant on cheap exports of natural resources to developed markets. Today they benefit from both internal and external growth drivers.

Many emerging markets are primarily domestically driven, including large economies such as China and Brazil. A significant portion of exports are also intra-emerging market trades, versus exporting to developed markets.

The single commodity focus has shifted to the emerging market consumer

The emerging market story has shifted from a commodity play to one centred around domestic growth drivers and consumption. For example, China has been re-balancing its economy; domestic consumption is now the key driver of economic growth, representing 76% of gross domestic product in 2018, up from 44% a decade ago.1

Consumption has played a significant role in propelling emerging economies. We see a trend of penetration, the increased consumption of goods and services, as well as premiumization, which represents the rising demand for higher-quality goods and services amid a growing middle class. While COVID-19 could dampen discretionary spending in the short term, the secular factors such as favourable demographics, rising income and urbanization remain very much intact.

In our view, emerging economies could also eventually come out of the current crisis stronger as new technologies are adopted during the crisis and remain vital after.

In times of crisis, businesses tend to adapt accordingly, and embrace technology much more quickly. This is what we have witnessed in recent months, with many businesses moving from offline to online. Education is a good example of that; schools have embraced the use of online technologies to provide a learning platform for students. E-commerce, internet and software companies are also benefiting from an increase in online activities. Acceleration in internet usage and penetration will continue driving growth in cloud and other network architecture, increasing demand for servers and other memory intensive devices.

Franklin Templeton Emerging Markets Equity, May 12, 2020

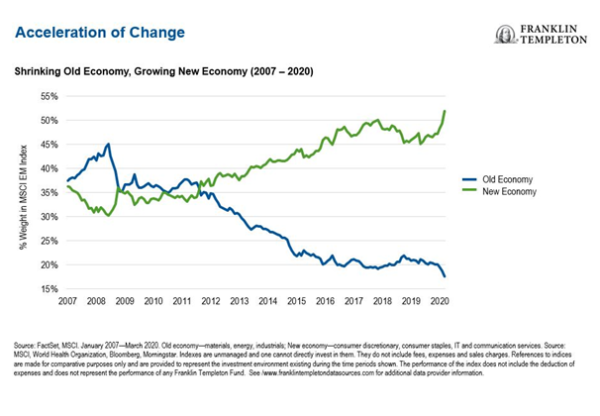

The chart below illustrates how “new economy” stocks—which include consumer staples, discretionary, information technology and communications—have a greater percentage weighting within the MSCI Emerging Markets Index than “old economy” stocks—which include industrials, materials and energy.

Moving up the value chain

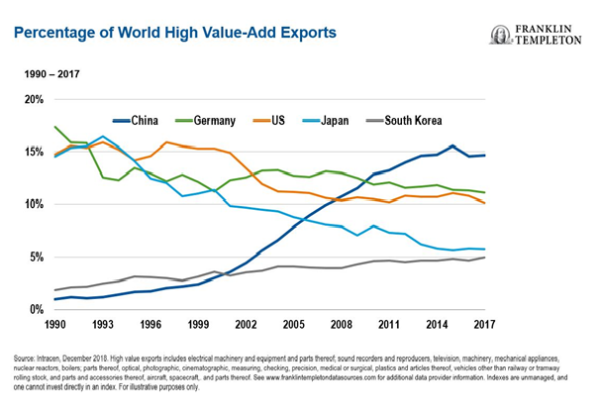

The continued technological development we see is an additional domestic-growth driver, and indeed a global growth driver. We’ve seen evidence of the emerging-market share of global high value-add exports has risen dramatically since the start of the 21st century, with China and South Korea as leading examples.

Emerging markets, which initially found economic success in producing low-value goods, have now set their sights further up the value chain. Many emerging markets today are established players and integral to global supply chains, given competitive labour costs and continued investments in research and development. Samsung Electronics, which evolved into the world’s largest memory chip maker, is just one example.

In our view, the coronavirus pandemic will likely change the way businesses consider supply chain logistics going forward. We think emerging economies could benefit from greater supply chain diversification.

A lot of consumers and corporates will have to ask themselves to what greater degree will they be willing to pay a premium for security of supply of key goods. And, that means companies will be looking to diversify their supply chains, not just looking at where it’s the cheapest, where they can ensure security of supply.

Manraj Sekhon, Franklin Templeton Emerging Markets Equity, April 23, 2020

Emerging markets take technology leadership

In the final post of our three-part series, the Franklin Templeton Emerging Markets Equity Team explains how emerging market companies are innovating.

New reality #3: Emerging market companies have leapfrogged established models through innovation and technology

Emerging market economies won’t necessarily follow the same evolutionary pattern as developed markets—but that can be a good thing, in our view. For example, emerging market governments and companies may not have had legacy physical or technology infrastructure that would need to be upgraded. Instead, in many cases they can move straight in next-generation infrastructure, which can enable new innovations and business models. For example, private banks in India have used digital capabilities to gain customers living in rural areas with little or no access to banking services.

As we continue to shift towards a knowledge-based global economy, we are seeing a rise in the importance of intangible assets. In fact, several emerging markets are now leading in terms of innovation and leapfrogging the West in areas such as e-commerce, digital payment and the aforementioned mobile banking. We think this trend is likely to continue.

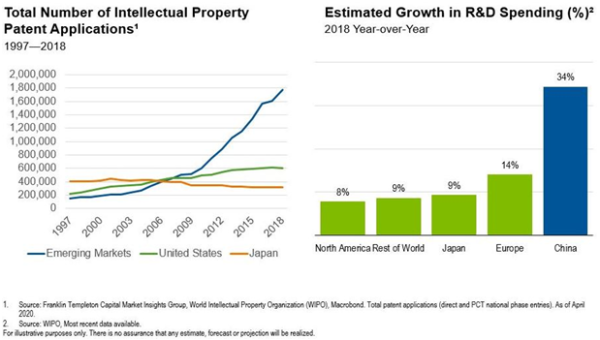

Emerging markets have overtaken the United States and Japan in terms of patent applications, as shown in the chart below. Likewise, the chart shows how growth in China’s spending on research and development (R&D) has recently largely exceeded that of developed economies. Extending this edge, the costs of building and maintaining technology software tend to be lower in emerging markets. Many lenders have also constructed nimble digital platforms from the ground up, while their developed market peers struggle with migrating from legacy systems. Local access to strong expertise in artificial intelligence has also helped lenders develop their own capabilities in digitally booming countries.

Emerging market companies have leapfrogged established models

Becoming global leaders

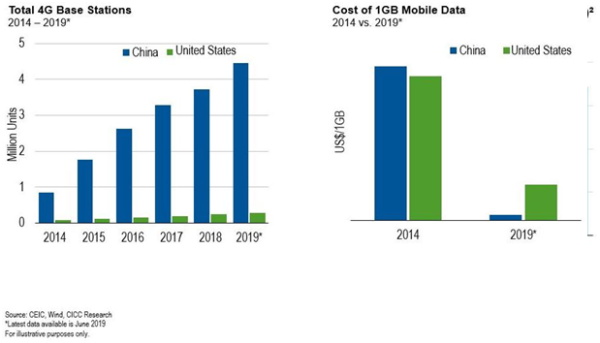

China has over four million fourth-generation (4G) base stations, which is over half of the total number of 4G base stations globally and 15 times more than in the United States.1 As a result, mobile phone signal coverage in China ranks high among major economies. And, China is also leading the way in the rollout of 5G technology.

In addition, data in China comes at a fraction of the cost in the West, so technology is embraced by a broader proportion of the population.

Amid the COVID-19 epidemic, such technology is being viewed as essential as more people have to work and study from home.

China: New economy infrastructure

Cheaper and Superior Network Coverage Supports Internet Companies

China will be a frontrunner in the 5G arena and is expected to have some 600 million 5G subscribers by 2025, or about 40% of the forecasted 1.6 billion subscribers globally. Together with artificial intelligence (AI) and robotics, this will help drive growth in China’s new economy as it strives to become less reliant on the United States.

Manraj Sekhon, Franklin Templeton Emerging Markets Equity, December 18, 2019

Demand for greater technology is likely going to have a knock-on effect within the semiconductor industry in South Korea and Taiwan, which have become two of the world largest semiconductor manufacturers in the world.

South Korea-based Samsung Electronics, for example, evolved from producing televisions in the 1970s to gaining global dominance in memory chips. Meanwhile, some of the most sophisticated chips powering a range of devices such as smartphones and servers come from Taiwan Semiconductor Manufacturing Company (TSMC).

Moving online in Covid times

In times of crisis, businesses often need to quickly adapt, which can lead to the adoption of new technologies. For example, when the coronavirus outbreak first occurred in China, New Oriental, one of the country’s leading after-school tutoring companies, was able to convert every single learning course they offered in physical learning centers across 100 cities to an online platform.

Effectively, that meant two million students had been transitioned—and this is just one example. We expect further acceleration in the penetration of online tutoring in China in the medium to long run.

The Alibaba group, commonly known for its e-commerce platform, has diversified its business and expanded into new sectors over the years. During lockdown, Alibaba gave free access to its communication app which allowed 600,000 teachers to teach remotely.

The company also increased the number of live-streaming sessions on its e-commerce platforms while millions of people were confined to their homes in lockdown. Live-streaming hosts offered a range of rewards, discounts and games to interact with potential consumers in a modern-day teleshopping experience. In the West, streaming platforms are generally focused on games and entertainment. In China, live streaming has become a key option for Chinese consumers looking for new products and discounts. For merchants, live streaming has become a key tool to not only offset the decline in offline business but also to encourage creativity in marketing and customer relationship development.

We have seen the COVID-19 pandemic accelerate technological developments across the globe—perhaps changing how we shop, learn and receive health care services permanently. Companies in emerging markets appeared to be relatively solid going into this crisis, and we believe that their ability to deal with this crisis is a lot greater than in similar crisis periods.

Commentary » Equities » Equities Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.