Nov

2024

The stocks and sectors that are outperforming the Magnificent-7 – and why passive investors should be concerned

DIY Investor

3 November 2024

Despite technology stocks dominating returns in 2023, the market has now broadened out and investors could be missing out on other, overlooked opportunities – by Duncan Lamont

Several times in 2023, I commented that the Magnificent-7 of Nvidia, Apple, Microsoft, Alphabet (Google), Amazon, Meta Platforms (Facebook), and Tesla were dominating global stock market performance. Some people are still pushing that narrative today. They couldn’t be more wrong.

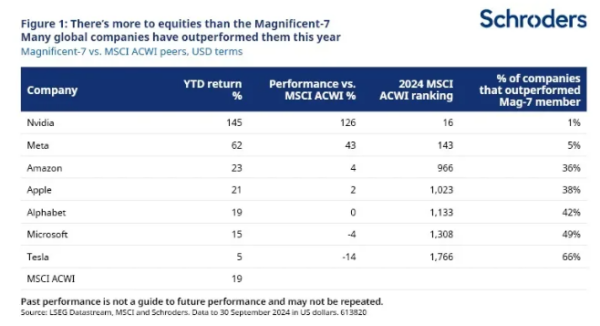

This year, a significant proportion of global companies have outperformed most of the Magnificent-7. This isn’t just down to China’s recent revival. A remarkably similar proportion have also outperformed them in the US.

Don’t get me wrong, many of the Magnificent-7 are fantastic companies. Some have compounded returns for so long, even as they’ve grown ever larger, that naysayers have been forced to eat humble pie on a regular basis.

The point I want to emphasise here is not that they are bad investments, just that it is short-sighted to suggest they are the only good investments. As Figure 1 shows, with the exception of Tesla, they’ve all delivered strong returns this year. It’s just that others have done even better.

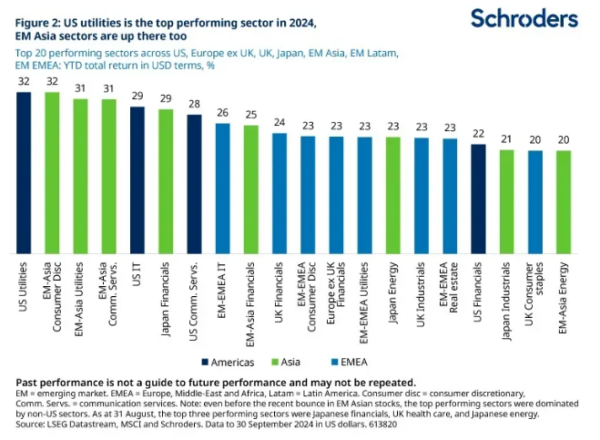

There’s a similar trend when we look at the sector level. Across the major markets, the top performer this year has been the, normally considered boring, US utilities sector, with an impressive 32% gain. Financials have also performed well in many parts of the world. Even Japanese and UK industrials have done so. EM-Asia features strongly. There’s more to markets than tech stocks.

The theme here is one of broadening out. Whereas last year, returns outside of the Magnificent-7 were mediocre in comparison, this year there has been a wealth of, often overlooked, opportunities.

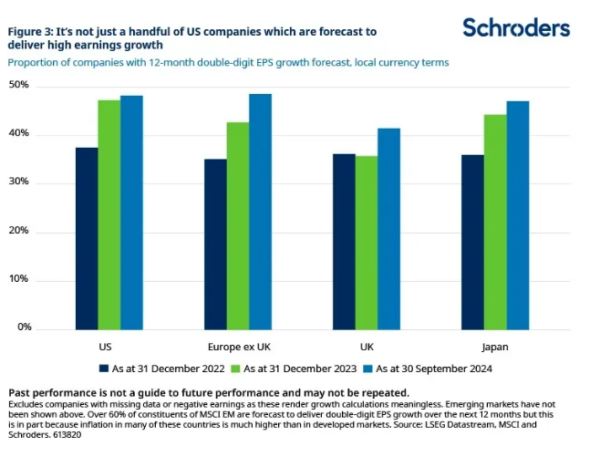

This goes beyond share price movements. When we look 12 months ahead, nearly half of listed companies in Europe and Japan are forecast to deliver double-digit earnings per share growth in local currency terms. This is on a par with the much-celebrated US. The UK is not far behind. Figures for EM are even higher (more than 60% are forecast to deliver double-digit growth) but this is because these are nominal figures and inflation is much higher in many emerging markets.

The problem for equity investors is that, although performance is broadening out, their portfolios are not.

The six largest US companies (Magnificent-7 excluding Tesla) make up more of the global stock market than the combined weight of the next six biggest countries combined: Japan, UK, Canada, France, China, and Switzerland. Six stocks, six countries. Their 18.1% weight is the same as the 2,000 smallest companies in the global market combined.

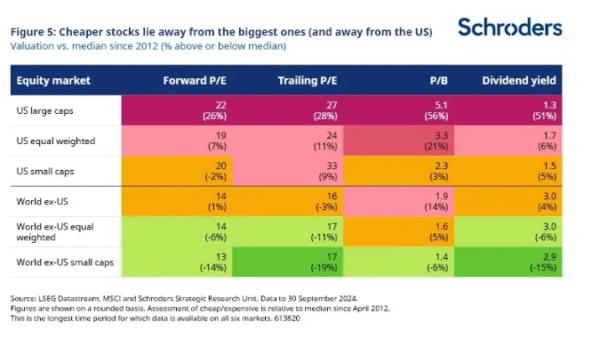

This concentration means a lot of risk in barely a handful of stocks with scant exposure to the broader opportunity set. And these other companies are much cheaper in valuation terms, both within the US and globally. The equal-weighted version of the stock market, a measure of the average large cap company (as opposed to being influenced by their relative size), highlights this valuation opportunity. Figure 5 also highlights that small cap stocks are also cheap vs history.

The broadening out of performance away from the Magnificent-7 should not be a surprise. It is rare for a company that is a top 10 or even top 100 performer to stay among the top for consecutive years. Prices get bid up too high, baking in overly optimistic expectations for growth. Others get neglected, their share prices languishing, baking in overly downbeat expectations. This can go on for a period as more investors get sucked into the hype-cycle until, eventually, the elastic snaps back. The past-winners are overtaken by the neglected and fall down the performance rankings (Figure 6).

Historically, periods of high index concentration (where a small number of companies have come to dominate) have foreshadowed periods when the bigger companies went on to underperform the average company. The equal-weighted version of the stock market outperformed the typical market cap weighted version (Figure 7). There are opportunities away from the mega caps but portfolios have a shrinking allocation to them.

My worry

The proportion of assets managed passively around the world has never been higher. The reasons for this are well known and understandable. But it is worth investors at least pausing to reflect on what that really means in today’s market. Six stocks, six countries. Six stocks, 2,000 stocks. There are tremendous opportunities across global stock markets today but passive portfolios have rarely had so little exposure to them. Individual decisions may be understandable but I do worry that the precise timing of the influx may be inopportune. Time will tell whether I am right.

The pros and cons of stock market valuation measures

When considering stock market valuations, there are many different measures that investors can turn to. Each tells a different story. They all have their benefits and shortcomings so a rounded approach which takes into account their often-conflicting messages is the most likely to bear fruit.

Forward P/E

A common valuation measure is the forward price-to-earnings multiple or forward P/E. We divide a stock market’s value or price by the earnings per share of all the companies over the next 12 months. A low number represents better value.

An obvious drawback of this measure is that it is based on forecasts and no one knows what companies will earn in future. Analysts try to estimate this but frequently get it wrong, largely overestimating and making shares seem cheaper than they really are.

Trailing P/E

This is perhaps an even more common measure. It works similarly to forward P/E but takes the past 12 months’ earnings instead. In contrast to the forward P/E this involves no forecasting. However, the past 12 months may also give a misleading picture.

Price-to-book

The price-to-book multiple compares the price with the book value or net asset value of the stock market. A high value means a company is expensive relative to the value of assets expressed in its accounts. This could be because higher growth is expected in future.

A low value suggests that the market is valuing it at little more (or possibly even less, if the number is below one) than its accounting value. This link with the underlying asset value of the business is one reason why this approach has been popular with investors most focused on valuation, known as value investors.

However, for technology companies or companies in the services sector, which have little in the way of physical assets, it is largely meaningless. Also, differences in accounting standards can lead to significant variations around the world.

Dividend yield

The dividend yield, the income paid to investors as a percentage of the price, has been a useful tool to predict future returns. A low yield has been associated with poorer future returns.

However, while this measure still has some use, it has come unstuck over recent decades.

One reason is that “share buybacks” have become an increasingly popular means for companies to return cash to shareholders, as opposed to paying dividends (buying back shares helps push up the share price).

This trend has been most obvious in the US but has also been seen elsewhere. In addition, it fails to account for the large number of high-growth companies that either pay no dividend or a low dividend, instead preferring to re-invest surplus cash in the business to finance future growth.

A few general rules

Investors should beware the temptation to simply compare a valuation metric for one region with that of another. Differences in accounting standards and the makeup of different stock markets mean that some always trade on more expensive valuations than others.

For example, technology stocks are more expensive than some other sectors because of their relatively high growth prospects. A market with sizeable exposure to the technology sector, such as the US, will therefore trade on a more expensive valuation than somewhere like Europe. When assessing value across markets, we need to set a level playing field to overcome this issue.

One way to do this is to assess if each market is more expensive or cheaper than it has been historically.

We have done this in the table above for the valuation metrics set out above, however this information is not to be relied upon and should not be taken as a recommendation to buy/and or sell If you are unsure as to your investments speak to a financial adviser.

Finally, investors should always be mindful that past performance and historic market patterns are not a reliable guide to the future and that your money is at risk, as is this case with any investment.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Past Performance is not a guide to future performance and may not be repeated.

Subscribe to our Insights

Visit our preference centre, where you can choose which Schroders Insights you would like to receive.

Please remember that the value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

This marketing material is for professional clients or advisers only. This site is not suitable for retail clients.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England.

For illustrative purposes only and does not constitute a recommendation to invest in the above-mentioned security / sector / country.

Schroder Unit Trusts Limited is an authorised corporate director, authorised unit trust manager and an ISA plan manager, and is authorised and regulated by the Financial Conduct Authority.

On 17 September 2018 our remaining dual priced funds converted to single pricing and a list of the funds affected can be found in our Changes to Funds. To view historic dual prices from the launch date to 14 September 2018 click on Historic prices.

Leave a Reply

You must be logged in to post a comment.