Sep

2020

Who Do You Trust in a Financial Crisis?

DIY Investor

23 September 2020

A previous article on DIY Investor posited that the changing world increased the need for people to take personal control of their financial future – The New Rule of Financial Self Reliance

That was put into sharp relief by the COVID-19 crisis where many of those that have have lost their jobs, or seen their livlihood disappear overnight, have been plunged into financial hardship.

‘new accounts in record numbers and trading volumes more than double what would be expected’

However eye-catching the headlines, the promised government support took a long time to reach those that need it most; however freakish, this crisis is for real – more than one third of the world was locked down, and the global economy is likely to be damaged for decades to come.

As ever, the least advantaged countries and individuals will be hit the hardest; whilst their businesses may suffer, the well-heeled are unlikely to experience any significant long term damage, whereas those at the other end of the economic spectrum are facing a hideous existential crisis.

For financial middlings, it appears to have delivered a short, sharp shock, as online brokers and investment platforms reported applications for new accounts in record numbers and trading volumes more than double what would be expected in normal market conditions – Coronavirus Lockdown Fuels Spike in DIY Investing

‘What had been a drift towards financial self-reliance has become a charge’

What had been a drift towards financial self-reliance has become a charge; even a modest nest egg could tide-over the self employed until state support arrived.

Significantly, investment platforms are reporting activity is at its greatest among younger generations – those with the ability to invest over a long time-horizon have the best chance of improving their financial outcomes.

This is not only because of pressures on the ever stretched state, it is also a dawning mistrust in the big, ‘safe’, financial institutions which for a very long time have promised professional management of our finances and the security to hold our assets.

A striking image in 2008 was a queue outside a branch of the British bank Northern Rock. The line, which had formed long before opening, stretched along the street and round the corner.

A striking image in 2008 was a queue outside a branch of the British bank Northern Rock. The line, which had formed long before opening, stretched along the street and round the corner.

Each and every one of those who had politely assembled wanted one thing: to withdraw their cash for fear that Northern Rock would collapse, taking their savings with it.

The BBC, of course, with Business Editor Robert Peston in tow, was there to whip up panic. The extent of the fear was personified by one middle aged woman who told the reporter that she had £700,000 in the bank and that she was going to withdraw every penny.

‘there was two thirds of a million Pounds stashed under the bed’

This was someone who felt more secure announcing on television that somewhere in North London there was two thirds of a million Pounds stashed under the bed, than leaving it with a well known and regulated high street bank.

It was not only the banking crisis which eroded this trust. Corporate scandals, miss-selling and pension mismanagement each played their part. Running alongside this has been the demise in defined benefit pensions and a drop in annuity rates, reflecting great changes in demographics.

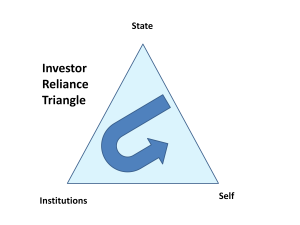

It might be possible to plot this shifting reliance from state to institutions to self; the chances are it would not be such a smooth trend as that illustrated in the Investor Reliance Triangle shown below.

Big financial institutions might have gradually played a greater role in our financial health as the limits to welfare provision meant demand for additional products, services and expertise.

But the state continues to offer a safety net not simply in terms of welfare and public services, but also more crucially in terms of stability of global markets and economics; until of course it is replaced by instability, if not the collapse of global markets and economics.

When the banks imploded, it was after all, the long shunned state which was turned to in order that millions were bailed out of near catastrophe.

But that was to be short lived. As markets reasserted their authority in recovery, it became clearer than at any point since the Second World War that the state could not be relied upon to finance our futures.

‘the state could not be relied upon to finance our futures’

This idea of investor reliance, is crucial in thinking about the extent of our required self sufficiency. After all, without thoughtful financial planning it will still be possible to retire, to make career decisions or to send ones children to university.

The difference comes down to certainty and control. Plotting recent decades in this way, would result in a trend broadly in the direction of that shown with perhaps a more recent, though short-lived, return of the state.

Issues of sustainable public finances combined with great demographic shifts have meant that governments have looked very hard at welfare provision, universality and retirement age.

For most people, even those that expressed anger on the streets of  Paris or Athens, the retirement age moving from 55 through 60, even 65, 67 and perhaps beyond, is surely no surprise to anyone who has spent even a few moments glancing at the facts.

Paris or Athens, the retirement age moving from 55 through 60, even 65, 67 and perhaps beyond, is surely no surprise to anyone who has spent even a few moments glancing at the facts.

Funding of Higher Education for more than an elite few has been the subject of debate for years. Again, it comes as little surprise that UK and European students like their American counterparts will be expected to contribute ever more towards the (expensive) cost of their university education.

While cost is seemingly the only issue debated, the real problem for most people is the uncertainty. The best laid of plans put into doubt because of the vagaries of public policy.

As government gradually shifts the goal posts, our financial destiny becomes doubtful; that something as catastrophic as a global pandemic should lead to fear if not panic, is entirely understandable.

By embarking upon their journey to financial independence, the younger generation are making a very clear statement that they do not want to experience such uncertainty and fear – they are trusting themselves and DIY Investor will be there to help them on their journey.

Leave a Reply

You must be logged in to post a comment.