Jun

2023

With cash earning 5%, why risk money on the stock market?

DIY Investor

14 June 2023

Savings rates have trebled in 12 months, and UK savers can earn over 5% on one-year deposits. So doesn’t it make sense to cut risk and stick to the safety of cash? By Duncan Lamont

Cash savers are benefiting from the highest returns in almost two decades, with some popular accounts like cash ISAs currently paying over 5%. The rise in returns has been rapid, with rates today many times higher than a year ago. Unsurprisingly savers are committing more to cash ISAs than at any point in the past five years*.

After a long spell in which nominal returns on cash were virtually zero, investors are now rethinking the role deposits should play in wider portfolios. Schroders’ May 2023 survey of financial advisers – coming as the Bank of England raised interest rates for the 12th time since the start of 2022 – found nine in ten advisers were “having conversations with clients about long-term investing versus cash deposits”.

Aren’t investors right to reconsider cash?

All savers’ circumstances are different, and some may have excellent reasons to be holding cash. But just because savings rates are rising does not mean cash is keeping pace with inflation.

Popular UK savings rates vs inflation

|

Cash ISAs |

Jan 2022 |

June 2022 |

Jan 2023 |

30 April 2023 |

|

Variable rate |

0.3% |

0.6% |

1.7% |

2.3% |

|

2-year fixed rate |

0.5% |

1.6% |

3.9% |

4.1% |

|

Inflation |

5.5% |

9.4% |

10.1% |

8.7% |

Source: Bank of England; ONS, June 2023

As shown, cash returns after inflation – or “real” returns – remain negative, even though rates have risen strongly. Negative returns mean losses. And the jump in inflation since early 2022 means that the value of cash is now eroding at a faster pace than for most of the previous decade, even if the cash earns today’s top available rates.

So for many the key question of where to make long-term investments remains as relevant as ever. In fact it is even more important.

Cash or equities: what are the chances of beating inflation?

The certainty offered by cash lies only in its nominal value. £100 today will still be £100 in future years. There is no certainty its spending power will hold up, however. Low inflation will see the money retain its spending power to some degree, but high inflation will erode it quickly.

Time is the critical factor. Over short periods cash is likely to fare better against inflation. Over long periods, cash fares worse, even where inflation is relatively low.

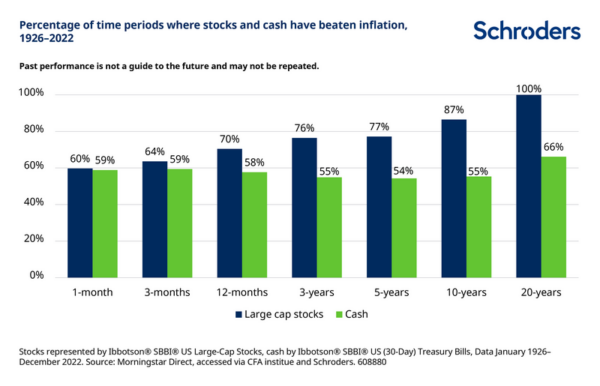

The chart below crunches historic returns on cash and stock market investments over a range of timeframes extracted from 96 years’ data. It then sets these against inflation over the same timeframes.

The results are stark. The chart shows that over very short periods – three months or less – there has not been much difference in the likelihood of cash or shares beating inflation. But for longer periods the gap widens conclusively.

- The likelihood of cash savings beating inflation has been about 60:40 for the majority of all timeframes.

- The likelihood of stock market investments beating inflation has reached 100% where the investments are held for 20 years.

In other words, for every 20-year timeframe in the past 96 years, equities delivered inflation-beating returns.

So while stock market investments may be risky in the short run, when viewed against inflation they have offered far more certainty in the long run.

The stock market has delivered strong long-term returns through very different conditions

The recent era of ultra-low interest rates, from which we’re now emerging, has meant that cash has been unattractive for investors. That is despite the fact that inflation until recently has been low.

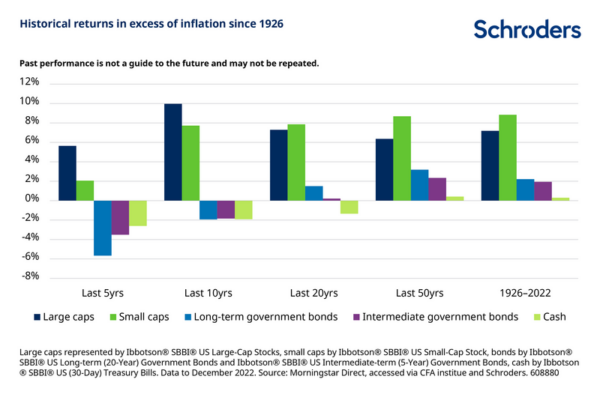

In the past five, ten and 20 years, cash savings have failed to keep up with price rises and so depositors would be worse off.

Over very long periods – during which inflation and interest rates have gone through both highs and lows – cash has retained its spending power, but only just.

By contrast, stock market investments have delivered inflation-beating returns over all periods highlighted in the chart.

So it’s a no-brainer: stock market investments are a better bet for long-term real returns?

There are lots of reasons to hold cash, and savers’ individual timeframes will differ.

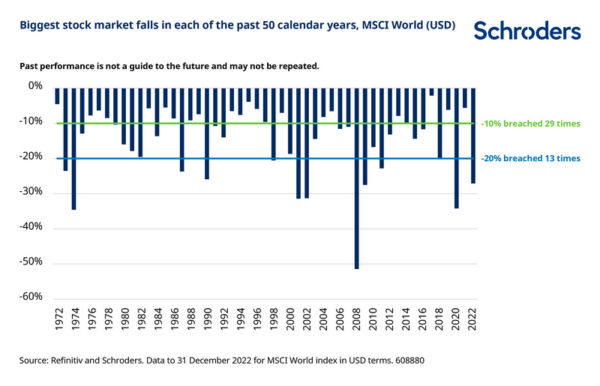

While long-term historic data strongly suggests stock market investments stand a better chance of beating inflation than other investments, they are also volatile.

So investors who opt for stock markets over cash need to be prepared for a bumpy ride.

- In approximately half of the past 50 years markets fell by at least 10%.

- In a quarter of the past 50 years markets fell by at least 20%.

In conclusion, different risks attach to both cash and stocks and shares. Cash is far from a risk-free asset: even at today’s best available savings rates, deposits are likely to lose real value. And, as our data shows, cash can deliver real losses over longer periods too, including the past two decades. But shares also carry risk, especially when held for shorter periods.

*Source: Bank of England, two-year fixed rate cash ISA, change from 30 April 2022 (1.19%) to 30 April 2023 (4.12%). ISA deposits from BoE Money & Credit tables. Data issued June 2023.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Alternative investments Commentary » Alternative investments Latest » Brokers Commentary » Commentary » Investment trusts Commentary » Latest

Leave a Reply

You must be logged in to post a comment.