Nov

2024

With US elections in the rearview mirror, what’s driving the markets now?

DIY Investor

19 November 2024

Investors should beware short-term noise generated by the recent US elections and think about the sectors that supposedly benefit from a Trump presidency, says Gestión Patrimonial of MAPFRE:

“If we look at the overall balance of [Trump’s] first presidency, the sectors that reacted better initially were among those that accumulated the lowest profitability over the next four years. If this is not enough to distrust short-term narratives, we can add that the current macroeconomic situation is very different: public debt represents 100% of GDP compared to 75% in 2016, the deficit is 7% compared to 3% in eight years ago, and interest rates are around 4% compared to 0% at that time. Let’s stick to what is important, not just what is interesting.”

Meantime, the key factors for longer term profitability for investors remain: “growth, business profits, and inflation”.

The market and media noise of recent weeks have been very focused on secondary issues (in our opinion), such as the US presidential elections and recent interest rate developments. The uncertainty generated by this electoral process, as well as the future evolution of monetary policy, has influenced the price of assets, but not so much in terms of their value.

If we move away from short-term noise, we see that growth, business profits, and inflation are the main catalysts for the profitability of a long-term investment, which is what the market has not paid much attention to in its analysis for the time being. Perhaps that’s why the market’s reaction on post-election day was practically the same as on November 9, 2016, when Donald Trump was elected President of the United States for the first time: small-cap stocks outperformed their larger counterparts, the value factor did better than the growth factor, and the dollar rose sharply. By sectors, it was the financial, industrial, and energy companies that performed the best while utilities, basic consumption, and real estate ended up with losses.

At that time, and just as is happening now, the market narrative was that these sectors/assets would benefit most from the Trump administration, but if we look at the overall balance of its first presidency, the sectors that reacted better initially were among those that accumulated the lowest profitability over the next four years. If this is not enough to distrust short-term narratives, we can add that the current macroeconomic situation is very different: public debt represents 100% of GDP compared to 75% in 2016, the deficit is 7% compared to 3% in eight years ago, and interest rates are around 4% compared to 0% at that time. Let’s stick to what is important, not just what is interesting.

First factor: growth

Growth forecasts continue with the same trend in recent months, although perhaps accentuated following the US presidential elections. Trump’s election as President of the United States is viewed and considered by the market to be very positive for growth, as his commitment to business deregulation and greater fiscal expansion on the side of less taxes are undoubtedly perfect ingredients to expect greater growth in the future, as the market discounts.

The counterweight to this possible increase in growth could be due to its tariff policy, given that protectionism rarely raises a country’s GDP, but it should be noted that the trend towards protectionism is global and is being implemented to a greater or lesser extent by governments of all political colors. Furthermore, many of the tariffs announced in 2016 were not implemented or were made to a much lesser extent.

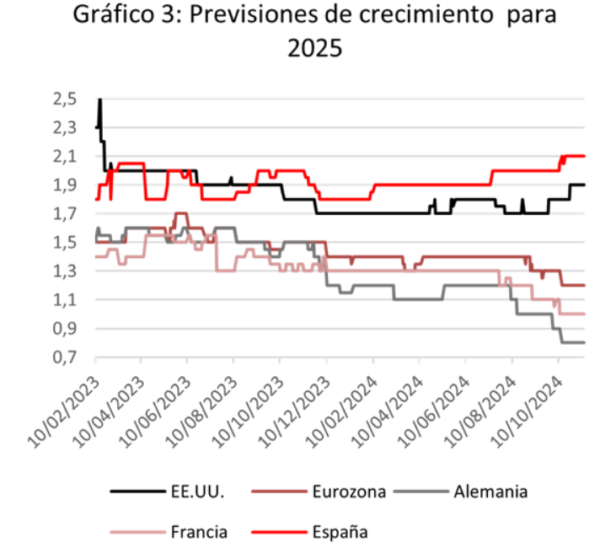

For Europe, growth forecasts continue to fall (less in the case of Spain), greatly weighed down by the situation already mentioned in our last month’s report from Germany and France. Although GDP data for the third quarter surprises the Eurozone as a whole (France 0.4% vs 93% expected; Germany 0.2% vs -0.1% expected; Spain 0.8% vs 0.6% expected) and allowed the macro surprise index to move to positive territory, the expected structural growth for the old continent is quite weak.

With regard to Asia, greater growth in the United States has always been positive for Asia, in general, and China in particular, due to the multiplicative effect of liquidity and the strength of the dollar, which also favours the Japanese export industry.

Second factor: inflation

As we mentioned above, the election of the Republican candidate is viewed by the market as positive for growth, but we cannot say the same for inflation. The three pillars on which Trump has based his campaign in economic terms (fiscal spending, tariffs, and lower immigration) have an inflationary effect. Only deregulation could curb rising prices, which could alter the plans of Federal Reserve (Fed) in order to continue with its more lax monetary policy.

In fact, the market has already started to react with a sharp decrease in the expected interest rate cuts for 2025 as a whole and a significant increase in expected inflation. In its latest meeting, the Fed decided to lower interest rates again by 25 basis points, bringing them to the 4.5%-4.75% range. According to its chairman, Jerome Powell, this level remains quite restrictive, despite the fact that the economy is growing above its potential, unemployment is at record lows, and inflation is above the 2% target.

So, we think there are few reasons to sharply reduce interest rates in 2025 given the uncertainty about the inflationary policies that the elected president may implement and a neutral rate (the one that neither cools down nor heats up the economy) that is difficult to place in the current economic cycle.

Monetary policy in Europe seems clearer with a European Central Bank (ECB) aware of the weakness of growth in the region and the inconvenience of public accounts in some important countries, having to finance larger deficits. We therefore expect the ECB to continue lowering rates in the first half of 2025 with an eye on the evolution of the exchange rate against the dollar, even if it is not among its mandates.

Third factor: liquidity

We have always described the liquidity of the financial system as the oil that drives both the financial and real economy. The greater liquidity available to lend and/or invest in capital markets, the greater the growth of the real economy due to its multiplicative effect. And this liquidity can be generated endogenous (through the contribution made by central banks printing money) or exogenously through the granting of loans and financing of business projects.

While the primary source of liquidity (endogenous) has been declining since 2022 due to the tightening of monetary policy by central banks, it has become more neutral in 2024, which is very positive for growth and asset values, as it helps prevent a financial accident. Exogenous liquidity, for its part, has been greatly favoureded since the beginning of 2023, especially due to the increasingly diminishing probability of a recession. This encourages appetite for both lenders and borrowers to grant and request financing to undertake their investments. With a trend of rate reductions and higher growth, we do not foresee a significant decline in this key factor, which often goes unnoticed.

Fourth factor: business profits

Where we can better see the effect of the three factors above (growth, inflation, and liquidity) is on companies’ results. If economies grow, it’s because corporate profits are rising; if inflation increases, it’s because companies are able to pass on higher costs to their customers; and if there is liquidity in the system, they will be able to invest in capital (both human and physical) that allows them to continue growing. It is the virtuous circle of the free market economy. Given the situation of growth, inflation, and liquidity, we are not surprised to see the divergence in the expected profits for 2025 of European companies compared to US companies.

Conclusion: cautious optimism

Beyond the uncertainty generated before the US elections, the macro scenario is good for markets in general and in particular for equity. It is true that the recent euphoria after knowing the results could lead to a profit taking before the end of the year, although the last quarter is usually quite positive for risk assets. Inflation remains a risk (especially if some measures are approved), but for now it is time to wait and see.

Leave a Reply

You must be logged in to post a comment.